Unless you're a teacher or an employee of a tax-exempt organization, you may not be familiar with the 403(b). Named after the section of the tax code that describes it, a 403(b) is a special type of retirement savings plan that's similar to a 401(k) in many ways but with a few key differences.

Here's a brief overview of 403(b) retirement plans, including their pros, cons, and contribution limits, to help you make the most of this account.

What is a 403(b) plan?

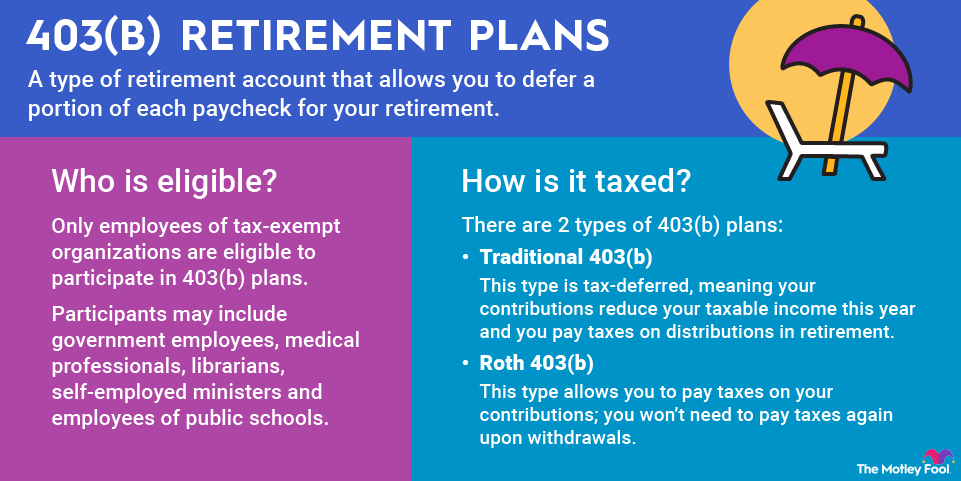

A 403(b) plan is a type of retirement account available to individuals who work in public education and employees of certain 501(c)(3) tax-exempt organizations. It's similar to the more commonly known 401(k) account, which is more often offered by employers in the private sector.

A 403(b) is frequently used by:

- Government employees

- Medical professionals

- Librarians

- Self-employed ministers

- Employees of public schools, such as teachers and administrators

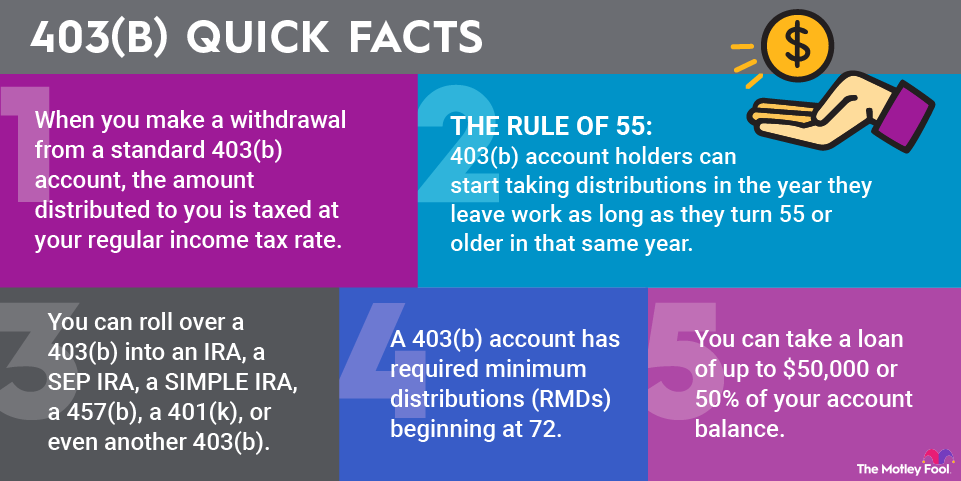

Like a 401(k), a 403(b) account enables you to defer a portion of each paycheck for your retirement, and your employer may match some of your contributions if it chooses. A 403(b) may be either tax-deferred, meaning your contributions reduce your taxable income this year and you pay taxes on distributions in retirement, or a Roth 403(b), meaning you pay taxes on your contributions this year and your money grows tax-free afterward.

Pros and cons of a 403(b)

Here's a closer look at some of the benefits and drawbacks of a 403(b) plan:

Pros | Cons |

|---|---|

Tax advantages | Few investment choices |

High contribution limits | High fees |

Employer matching | Penalties on early withdrawals |

Shorter vesting schedules | Not always subject to ERISA |

Extra catch-up contributions |

Benefits of a 403(b) plan

The advantages of contributing to a 403(b) account include:

- Tax advantages: Overall, 403(b) accounts carry the same tax advantages as 401(k)s and IRAs. Depending on whether you choose a traditional or a Roth 403(b), you can enjoy a smaller tax bill this year in exchange for paying taxes on distributions in retirement or tax-free withdrawals in retirement if you pay taxes on your contributions.

- High contribution limits: Contribution limits for 403(b) accounts, discussed below, are on par with 401(k) contribution limits and much higher than IRA contribution limits.

- Employer matching: Employers offering 403(b) plans may offer to match some of their employees' personal contributions just as companies offering a 401(k) might do. Each company has its own rules about how, when, and if it will match employee contributions. Check with your HR department for specific details about your company's matching program.

- Shorter vesting schedules: Vesting schedules determine when your employer-matched funds are yours to keep. This varies by company, but 403(b) vesting schedules are typically shorter than 401(k) vesting schedules. Some 403(b)s may offer immediate vesting, meaning you get to keep all employer-matched funds that have been made no matter when you leave that job.

- Extra catch-up contributions: In addition to the standard catch-up contributions available to adults 50 and older and the new, higher catch-up contribution for adults 60 to 63 that debuted in 2025, 403(b)s enable participants who have worked for the same employer for at least 15 years to contribute up to $3,000 in additional funds per year to their accounts.

Drawbacks of a 403(b) plan

Some of the drawbacks to remember when contributing to a 403(b) account are:

- Few investment choices: Up until recently, 403(b)s offered only variable annuities. While this is no longer the case, this type of account offers more limited investment options than a 401(k) or an IRA does.

- High fees: Some 403(b)s charge higher fees that can eat into your profits, although this isn't true of all of them. Do some research into the plan's administrative costs and any fees associated with your investments and try to keep these as low as possible to maximize your profits.

- Penalties on early withdrawals: If you withdraw funds from your tax-deferred 403(b) before age 59 1/2, you'll pay a 10% early withdrawal penalty in addition to taxes. However, the penalty is waived if you have a qualifying reason, such as a large medical expense. Note that this is also true of IRAs and 401(k)s.

- Not always subject to ERISA: The Employee Retirement Income Security Act (ERISA) institutes minimum standards for retirement plans, including reporting and fiduciary standards, to protect employees. But many 403(b)s aren't subject to ERISA. That doesn't mean they're bad plans, but you should do some more research to decide if it's the right home for your money before you begin contributing.

Related retirement topics

403(b) contribution limits

In 2025, you may contribute up to $23,500. The 403(b) contribution limit increases to $24,500 in 2026.

If you're 50 or older, the contribution limits rise to $31,000 (2025) and $32,500 (2026). Adults ages 60 to 63 can make an additional catch-up contribution, bringing the contribution limits to $34,750 (2025) and $35,750 (2026). These limits are the same as the contribution limits for a 401(k). Note that if your employer offers access to both a 401(k) and a 403(b) plan in the same year, the limit applies to your total contributions to both accounts.

You may be eligible to contribute up to $3,000 additional past standard contribution limits in a given year if you've worked for your employer for at least 15 years. There's a $15,000 lifetime maximum on this, so if you're in this situation, you'll want to keep close track of the amount of extra contributions you make.

Of course, you're not required to contribute this much annually. You may set your own savings rate and adjust it as often as necessary. Usually, you choose what percentage of each paycheck you would like to go toward your retirement, and if your company matches some of your contributions, it will also base its contribution on a percentage of your annual income.

A 403(b) can be a useful retirement savings vehicle. Stay mindful of the rules and fees to help your retirement savings grow as quickly as possible and avoid unnecessary penalties.