Social Security forms a critical part of most seniors' retirement strategy, so it's natural that people have questions about it, like how much do Social Security benefits increase after age 62? The answer depends on several factors, including when you were born and when you sign up for Social Security. We'll explore this in greater detail below to help you choose your best age for claiming benefits.

Understanding age and Social Security

Understanding age and Social Security

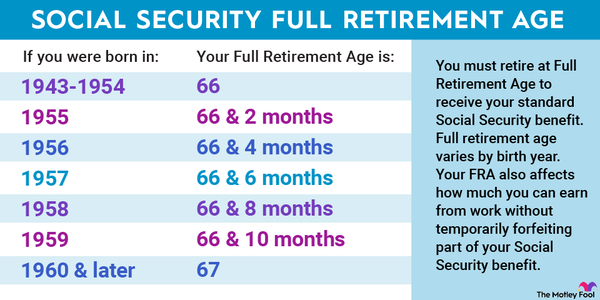

The government assigns everyone a full retirement age (FRA) based on their birth year. This is the age at which you become eligible for your full Social Security benefit based on your work history. For people born in 1960 or later, FRA is 67, although you don't have to sign up for benefits then.

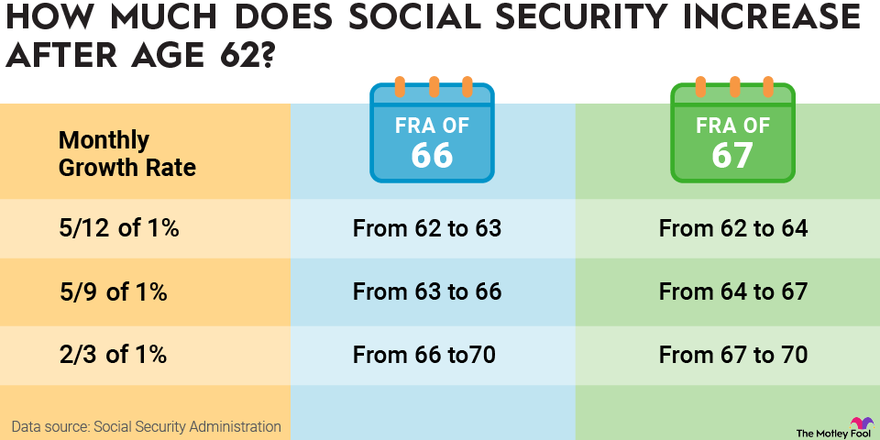

You can claim Social Security as early as age 62, but doing so will shrink your checks as much as 30%. Delaying benefits increases your checks a little each month, as outlined in the table below, until you reach your maximum benefit at 70 years old.

To give you some idea of the effect this could have, let's say you have an FRA of 67 and qualify for a $2,000 benefit at 62. Delaying benefits until you turned 70 would net you about $3,543 per month. And you don't have to wait that long to see substantial changes to your checks.

Delaying benefits by one year could increase the size of your benefit by 5% to 8%, depending on your age at the time. But that doesn't mean it's the right decision for everyone.

Benefits of claiming Social Security at 62

Benefits of claiming Social Security at 62

Claiming Social Security at 62 means more years of benefits. This is why it remains one of the most popular ages to apply. Seniors who wish to retire in their early 60s but cannot afford to do so on their own can supplement their personal savings with Social Security to help them cover their expenses.

Signing up early can also be advantageous if you don't expect to live long. You'll likely get a larger lifetime benefit this way. If you try to delay benefits, there's a chance you could wait too long and miss out on Social Security altogether.

Benefits of working past 62

Benefits of working past 62

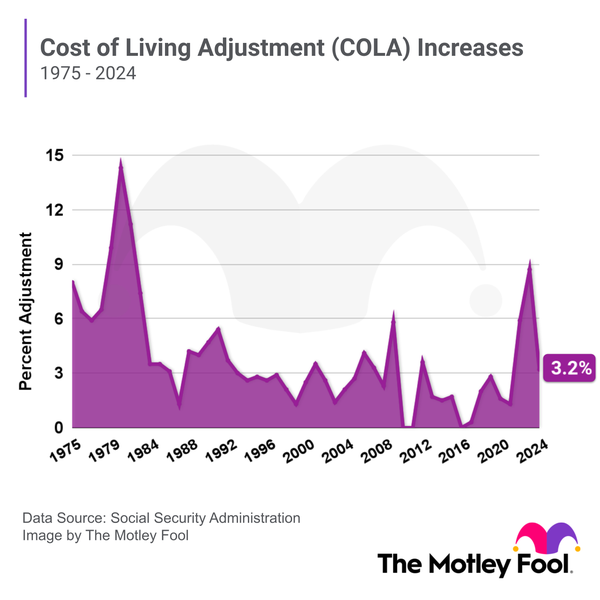

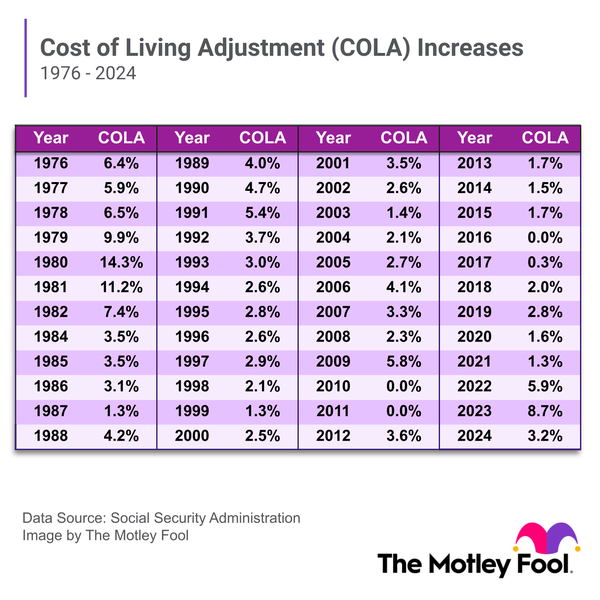

Delaying Social Security allows you to increase your monthly checks as discussed above. This could lead to a larger lifetime benefit for those who live into their mid-80s or beyond. Larger monthly checks also mean larger cost-of-living adjustments (COLAs). These are annual Social Security increases that all beneficiaries receive to help their checks keep pace with inflation.

When you delay Social Security until your FRA or beyond, you also don't have to worry about the earnings test. Those who work while claiming Social Security under their FRA could lose a portion of their benefits if their annual income is too high. But the money isn't gone forever. When you reach your FRA, the government recalculates your benefit to account for the amount previously withheld and your new checks will be larger. For some, however, this is a hassle they'd rather not deal with.

Should you claim Social Security at 62?

Should you claim Social Security at 62?

When you start Social Security is a personal decision. You must look at your financial situation and your life expectancy to decide the best move for you. If you plan to delay benefits, you'll need to be sure you can cover all your expenses on your own until you're ready to sign up. You might do this with a job or by relying on your personal savings.

It's a good idea to have a plan for when you'll claim even if you're far from retirement. Knowing when you'll apply can help you estimate how much you'll get from the program, and you can use that information to estimate how much you need to save for retirement on your own. But you have to be willing to adapt as the situation demands it.

Social Security's trust funds are expected to run out within the next decade or so. If this happens, the government won't be able to pay out all scheduled benefits unless it takes steps before then to address the shortfall. We can't guess what will happen right now, so we have to do our best to save on our own and adjust our Social Security strategy as needed over time.

Whatever claiming age you choose, be sure you understand the implications of your decision. It's difficult to change your mind once you've already applied, so it's best to wait until you're confident that you're ready.