It's an unfortunate fact of life that whenever large sums of money are flowing, there are scammers who want to take it. Social Security paid the average recipient more than $2,000 per month as of December 2025, and with tens of millions of Social Security beneficiaries in the United States, scammers see lots of opportunities to take advantage.

There are several variations of Social Security scams. Many involve scammers obtaining access to your personal information to commit identity theft. Scammers use personal information, including your Social Security number, to open fraudulent credit accounts in your name. The activity can ruin your credit history, often before you know what's happening.

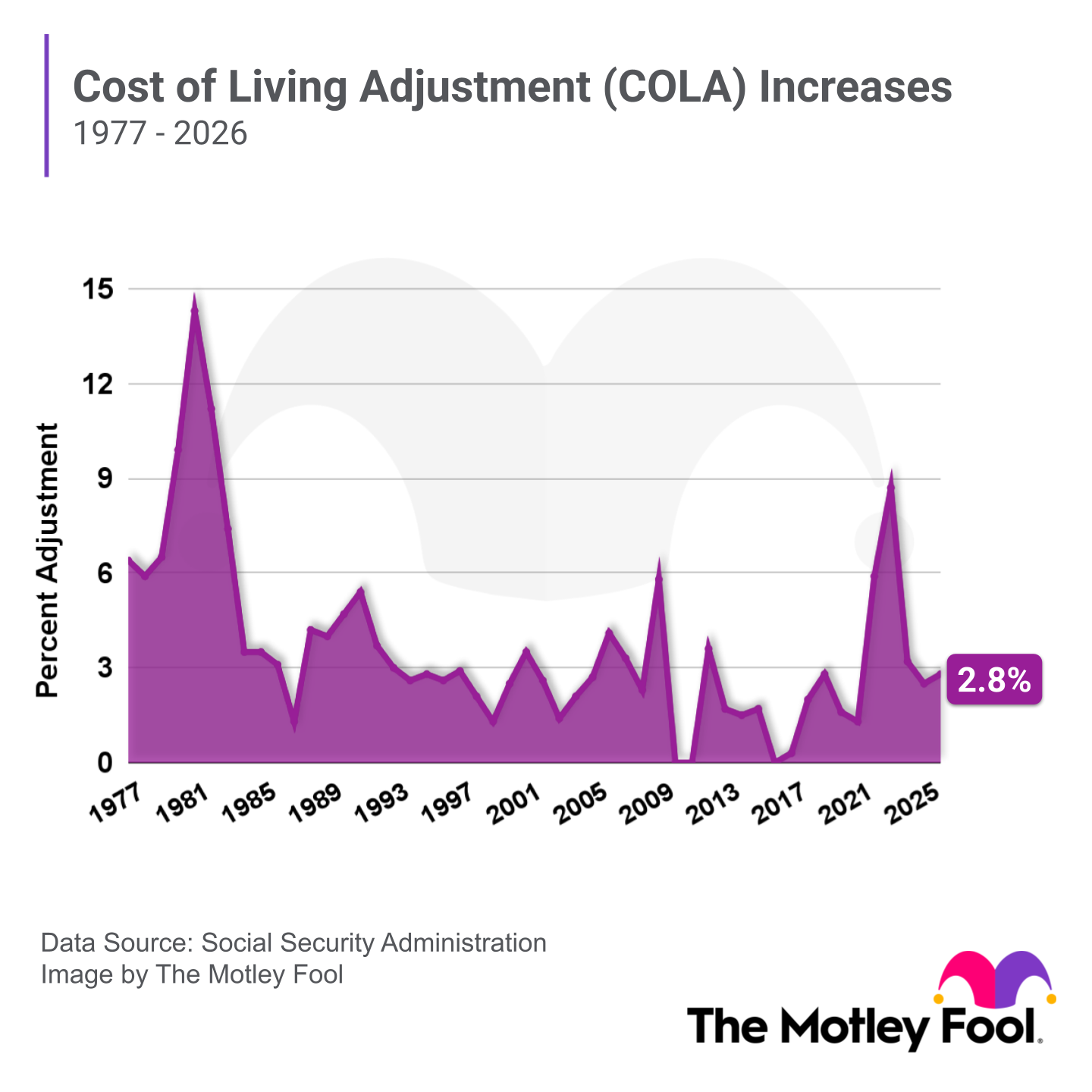

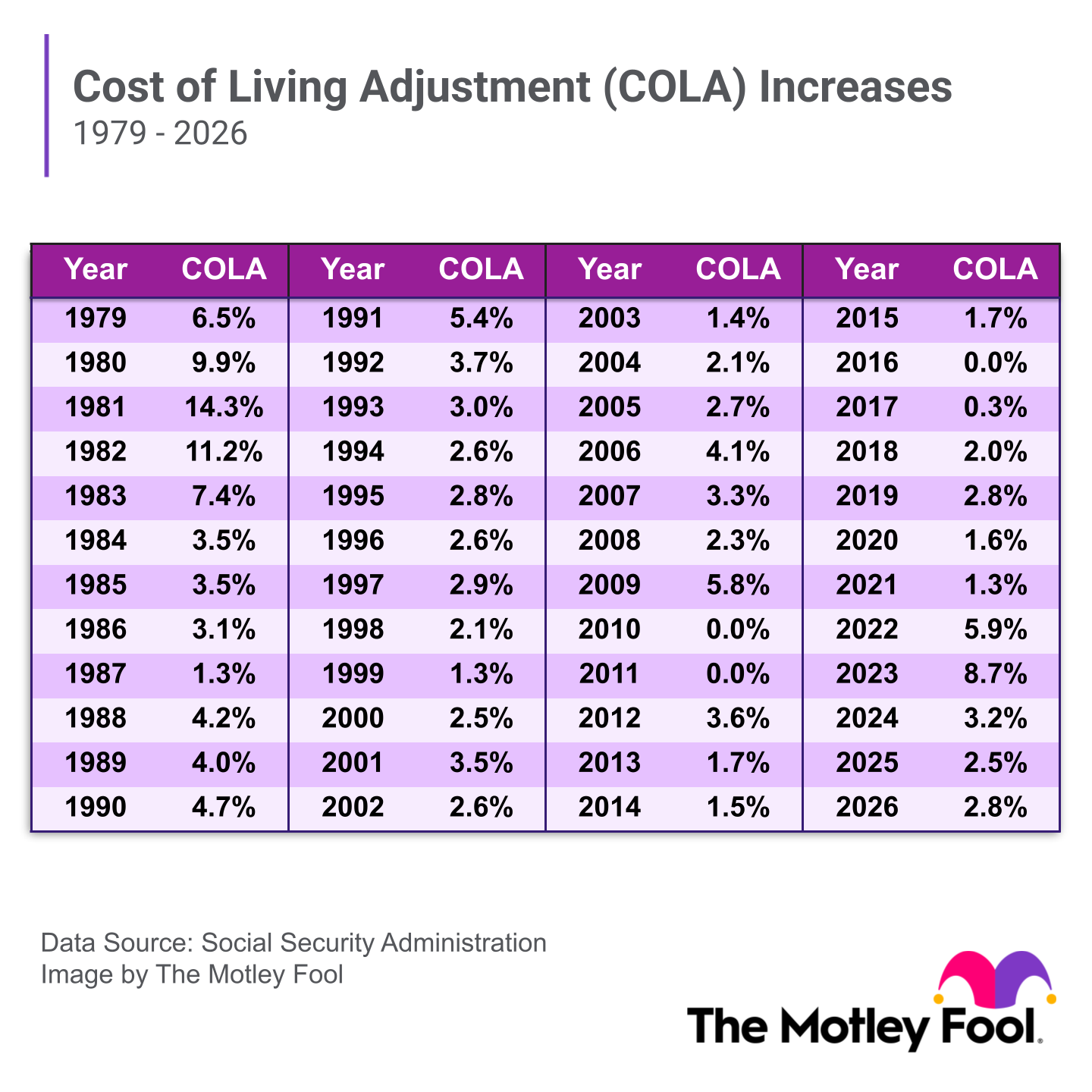

Other scams are directly related to your Social Security benefits, such as a scammer attempting to charge you money for something that happens for free (like your annual cost-of-living adjustment, or COLA).

By knowing what to look for and how to protect yourself, you'll be in a much better position to avoid Social Security scams.

Common Social Security scams

Scammers, unfortunately, can be clever and convincing. And they aren't getting any less sophisticated over time. That's why the best protective step you can take is learning some of their tricks and making yourself more likely to identify fraudulent activity before becoming a victim.

Here are some of the most common Social Security scams:

1. Impersonation scam

Fraudsters may attempt to gain your trust by posing as representatives of legitimate government agencies, such as the Social Security Administration (SSA) or the IRS. They may use credentials, like a badge or photo identification, a letter printed on agency letterhead, or an official-looking email.

Imposters will ask you for money or information -- and threaten legal action if you don’t comply.

You should know that legitimate federal law enforcement officials and government employees won't send their credentials via email, text, or mail. You can safely disregard (and report) the threats of anyone who does. Legitimate communication from these agencies can certainly come via postal mail, but will never demand money immediately without giving you a chance to appeal or ask questions.

2. There's a problem with your Social Security number

Scammers pretending to be helpful may tell you that your Social Security account has been compromised. They'll ask you to verify personal details to avoid disruption of your benefits.

Legitimate Social Security representatives will not contact you by phone or email to collect personal details.

3. You're owed a COLA

In this scam, the trickster asks you for something so you can get a benefit increase or cost-of-living adjustment (COLA). The request might be to share personal information or pay a fee. Either way, it's a trap.

What scammers don’t want you to know is that Social Security adjusts your benefits every January automatically. Under no circumstances should you ever have to pay the SSA a fee in exchange for a higher benefit.

4. You can buy essential Social Security services

Another scam involves selling services that Social Security normally provides for free. Examples are replacing lost Social Security cards, providing income records, and projecting future benefits.

Social Security doesn't sell services. Anyone who tries to charge you for services is committing fraud.

5. You need to activate Medicare

Legitimate Social Security representatives will not call you to activate your Medicare coverage. If you receive a request to enroll in Medicare, it is likely a scam.

Most people become eligible for Medicare at age 65. If you are already collecting Social Security, your Medicare enrollment is automatic. You should receive paperwork in the mail a few months before your 65th birthday.

If you are not yet receiving Social Security, you can sign up for Medicare three months before you turn 65, either online or by calling Social Security at 800-772-1213. But nobody legitimate will call you to activate your Medicare coverage, or tell you that you need to pay a fee to get signed up.

6. You have been fined or overpaid

Imposters may say you've been fined or overpaid benefits. They'll ask for money to cover the fine or repay benefits. Usually, they "require" this payment in a specific format, such as cash, prepaid debit cards, cryptocurrency, wire transfers, or retail gift cards.

Legitimate Social Security representatives won't ask for money. Period.

How to avoid Social Security scams

Protect yourself from Social Security scams by following the five practices outlined below.

1. Don’t trust your caller ID

Don't assume legitimacy based on your caller ID display. Scammers can fake phone numbers. Your phone may show an incoming call from Social Security or a local law enforcement agency, even when it's a scammer.

2. Do not react to unsolicited text messages, phone calls, or emails

According to the Office of the Inspector General, legitimate Social Security representatives will never pressure you to act immediately. If someone tells you to click on a link or pay a fee right now, it's a scam.

If you're concerned about potential issues with your benefits or want to verify the legitimacy of a call you receive, simply hang up and contact the SSA directly or visit your local Social Security office. For reference, the national 800 number for the Social Security Administration is 1-800-772-1213.

3. Do not provide personal information

Do not provide bank account or identity information to anyone who has reached out to you via phone, text, or mail. Such requests are usually fraudulent.

If you think the request might be legitimate, get the agency's name, look up the phone number independently, and call back.

4. Securely store your Social Security number

Sharing your Social Security number inadvertently can expose you to identity theft -- even if you haven't received a fraudulent phone call or text.

Memorize your Social Security number and leave the card in a safe place. Do not carry it with you. Don't write your number down or share it in public.

5. Regularly check your credit reports

If you are a victim of identity theft, you'll see new, unfamiliar credit accounts pop up on your credit report. Checking your credit activity regularly helps you catch problems early, as well as minimize the financial and legal consequences.

Related investing topics

How to report a Social Security scam

You can report suspicious activity and Social Security scams to the inspector general’s fraud hotline at 800-269-0271. You can also file a fraud report online.