If you hang around financial circles long, you're bound to hear about some company's CEO who ended up having to take their golden parachute out the door. But what is a golden parachute, and what are they good for?

Definition

What is a golden parachute?

A golden parachute is a sizable benefits package offered to the top brass at a large corporation. These packages include a list of monetary benefits, which can include cash, stock options, company shares, insurance benefits, continued enrollment in pension plans, immediate vesting in things like 401(k) retirement plans, compensation for legal fees, and other perks.

The first golden parachute was put in place in 1961 to protect Charles C. Tillinghast, Jr., president and CEO of Trans World Airlines. The company was trying to free itself of Howard Hughes' leadership, but if he regained control, the golden parachute would provide Tillinghast with significant compensation.

Golden vs. silver parachute

Golden parachute vs. silver parachute

Of course, golden parachutes aren't the only severance packages. We hear a lot more about them because they're often so substantial that the average person could never dream of making as much money. But there are other types of parachutes, too.

- Golden parachutes are only available to the top executives at a company, offering remarkable compensation in the case of termination.

- Silver parachutes can be applied to more employees but are still limited to management. They offer smaller benefits than golden parachutes but are still considered to be soft landings if these people lose their jobs unexpectedly.

- Tin parachutes are sometimes available to regular, long-term employees who may lose their jobs within three years of a corporate change-over. These employees may receive a year's salary plus additional compensation based on how long they were employed.

Why they're used

Why are golden parachutes used?

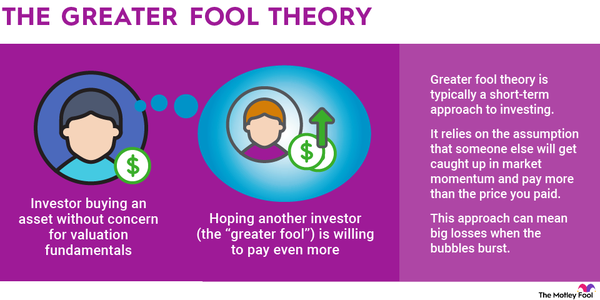

Golden parachutes were originally designed to help protect high-level employees in the case of a merger or acquisition when employees are often let go. They also work as deterrents when one company is considering a hostile takeover since the acquiring company will have to honor the golden parachute clause if they wish to bring in their own leadership. It can be an incredibly costly endeavor that has to be figured into the cost of acquisition.

Because golden parachutes are a type of protection for high-level executives, they can also attract these people to a corporation. You might think of them as a type of benefit that the company can offer besides basics like salary, retirement, and so forth. If you had two job offers and one guaranteed you a certain amount of pay and things like ongoing access to health insurance -- even if you were terminated -- you would certainly be tempted to take that offer over one that didn't, regardless of the rest of the package.

Related investing topics

Why investors care

Why do golden parachutes matter to investors?

Golden parachutes matter to investors in big ways because they involve funds that will disappear into an executive's account if the company is purchased and the executive is let go or if the executive is terminated for specific reasons. They have to be considered as a company debt. Even though golden parachutes don't show up on balance sheets, they can seriously affect the bottom line.

We're not talking about a few bucks; these are often hundreds of millions of dollars. Take the social media platform formerly known as Twitter, for example. When Elon Musk bought the company, he immediately fired three top executives who had golden parachutes that were estimated to be worth a total of about $122 million in cash and $65 million in shares -- a big chunk of money added to the cost of acquisition that any investor would want to consider.

When there's a merger on the horizon, a good investor will look into these golden parachutes to see what its potential effects on the company. If they think it's going to cause a major hit and high-level people will be terminated en masse, it might be time to sell; if they think the golden parachutes won't be a problem, but enough other investors are worried and the stock drops, it might be time to buy.