General obligation bonds, or GO bonds, are municipal bonds that aren’t directly connected to a specific revenue-producing project. While revenue bonds are attached to a project, such as a utility, an airport, or a toll road that generates revenue to pay back bondholders, general obligation bonds are typically used for infrastructure projects that don’t directly generate revenue.

Instead of direct revenue, the municipality’s ability to tax is used to secure GO bonds. Sometimes a community might raise property taxes or local income or sales taxes in order to pay back bondholders.

In the article below, we’ll discuss how local governments raise money for GO bonds, the different kinds of general obligation bonds, and answer commonly asked questions about this type of bond.

Understanding general obligation bonds

General obligation bonds are debt instruments issued by state and city governments to cover a wide range of municipal infrastructure projects. They are a commonly used financing tool when local governments choose to finance a project rather than pay for it out of treasury funds. Examples of projects GO bonds fund include:

- Street improvements

- Flood and erosion control

- Parks and beautification

- Improving or building schools

- Building and improving facilities, such as libraries, police stations, and fire stations

- Adding sidewalks or bike lanes

General obligation bonds make up 27% of the overall municipal bond market. That percentage is divided about evenly between state and local GOs. Revenue bonds make up the vast majority of the remainder in the municipal bond market.

Historically, GO bonds were considered more secure than revenue bonds. Because they were considered less risky, they offered lower yields. But that changed after Detroit’s bankruptcy in 2013, when the city argued that its general obligation bondholders were “unsecured” creditors. That went against investors’ belief that GO bonds came with “secured” creditor status, which carries higher priority if the issuer defaults.

Bankruptcies in state and local governments are rare, but they’re still a risk that general obligation investors should be aware of. After all, that risk is the reason GO bonds pay higher interest rates than Treasury securities.

Types of general obligation bonds

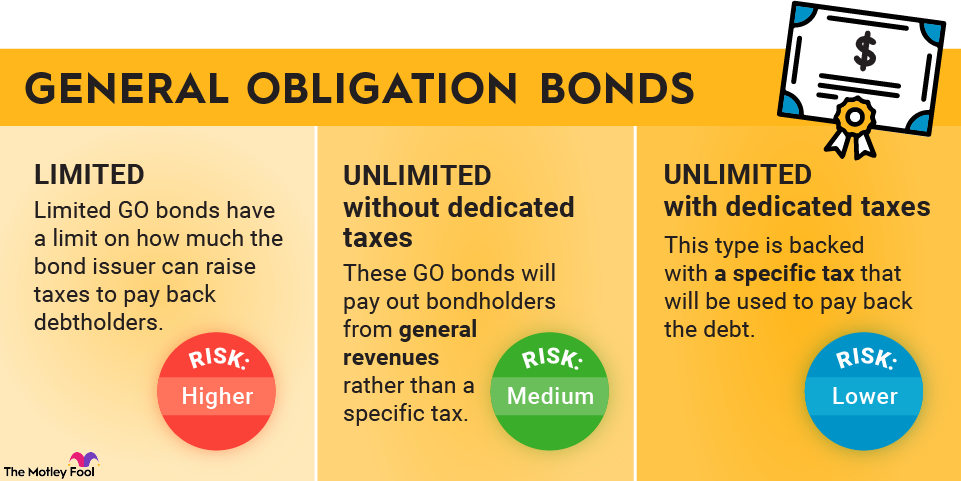

There are two primary classifications of general obligation bonds: limited GO bonds and unlimited GO bonds. Limited and unlimited general obligation bonds are both backed by the general revenues of the issuing municipality, but they differ in their ability to levy taxes in order to pay bondholders.

Limited GO bonds

Limited GO bonds have a limit on how much the bond issuer can raise taxes to pay back debtholders. Those limits vary and are generally detailed in the bond offering statement. As you would expect, the limit on the ability to raise taxes makes limited GO bonds riskier than unlimited ones.

Unlimited GO bonds

Unlimited GO bonds come in two varieties. One comes with dedicated taxes, while the other does not.

An unlimited GO bond with dedicated taxes means that it’s backed with a specific tax, usually a property tax, that will be used to pay back the debt. With these kinds of GO bonds, the municipality also typically pledges to use other available funds or to raise taxes if they are unable to pay back the bond with the taxes earmarked for it. Because this bond comes with taxes specifically set aside for it, it’s considered the strongest, most secure GO bond.

An unlimited GO bond without dedicated taxes will pay out bondholders from general revenues rather than a specific tax connected to the project. In this case, if the local or state government does not have sufficient funds to pay back the bond, they must raise taxes to cover the difference. Unlimited GO bonds without dedicated taxes are less secure than ones with dedicated taxes, but they are still safer than limited GO bonds.

Related investing topics

The bottom line on GO bonds

Investors tend to seek out municipal bonds for their safety, reliability, and tax advantages. General obligation bonds are a great option for fixed income investors, especially as yields have risen in relation to revenue bonds.

Over the past 20 years, the average interest rate on a 20-year, AA-rated general obligation bond has been 4.37%, making it a solid option for investors looking for a combination of safety and yield.

Reports of bankruptcies in Detroit and Puerto Rico may have spooked investors away from general obligation bonds. But the reality is that local and state government defaults are rare. Similarly, stories of the pandemic squeezing local budgets may have also made some investors wary of investing in municipal bonds. However, federal stimulus dollars have helped replenish state and local coffers, and many have healthy surpluses today.

In fact, there have only been a handful of GO defaults in modern history. If you’re interested in owning general obligation bonds, it’s worth checking with your brokerage to see what your options are. You can also invest directly into municipal bond exchange-traded funds (ETFs) and mutual funds.