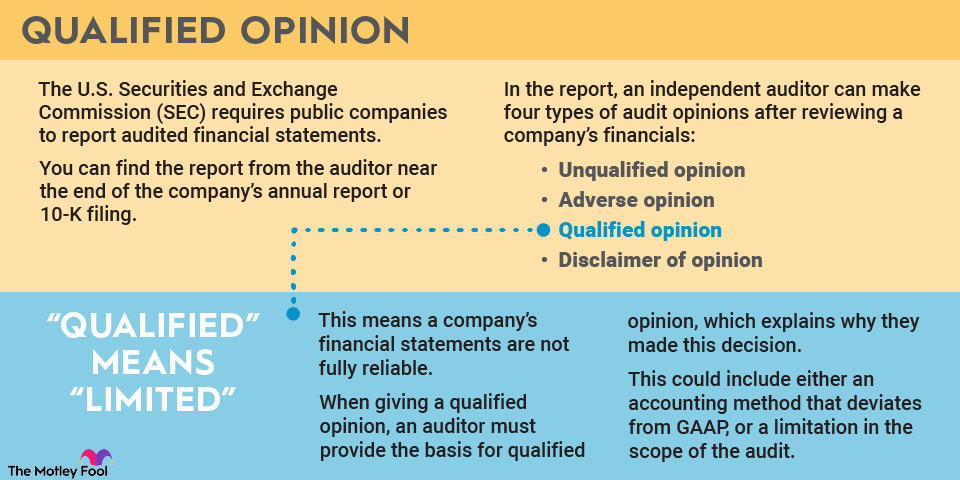

A qualified opinion is an auditor's declaration that there is an area of uncertainty in a company's financial statements. Except for that uncertainty, the financial statements otherwise generally represent the company's performance.

Here's a closer look at qualified opinions, including reasons why an auditor might issue one, how an auditor might explain a qualified opinion, and why a qualified opinion matters to you as an investor.

How does a qualified opinion work?

A qualified opinion is one of four types of statements an auditor can make after reviewing a company's financials. The four options are:

- Unqualified opinion: The financials fairly represent the company's performance and financial position.

- Qualified opinion: The financials generally represent the company's performance and position, with one or more exceptions.

- Adverse opinion: The financial statements are misleading or do not follow generally accepted accounting principles (GAAP).

- Disclaimer of opinion: The auditor refrains from publishing an opinion on the quality of the financial statements. This may happen when the statements violate basic accounting principles or if the auditor did not have access to financial data.

Investors and lenders feel most comfortable with unqualified opinions. A qualified opinion is less desirable because it means the financial statements are not as reliable as they could be. However, adverse opinions and disclaimers of opinion are far more negative than a qualified opinion.

There are two common reasons why auditors issue qualified opinions.

- Departure from GAAP: The company didn't follow accepted accounting practices when recording certain transactions. An example would be not applying overhead costs correctly to the value of inventory. As a result, the company's inventory on the balance sheet and cost of goods sold on the income statement would be incorrect. Note that some companies will choose to report non-GAAP metrics alongside their GAAP reporting. The intention is usually to share metrics that better reflect ongoing operations. This would not warrant a qualified opinion.

- Scope limitation: A scope limitation means the auditor could not verify certain financial transactions. This can happen if supporting documentation is destroyed or unavailable.

Notably, qualified opinions result from GAAP departures and scope limitations that are material but not pervasive. To clarify these terms:

- Materiality: A material issue is significant enough to influence investor and stakeholder decisions.

- Pervasiveness: A pervasive issue affects all or most of the financial reporting. Qualified opinions arise from non-pervasive concerns, meaning only a limited area of the financials is affected.

How a qualified opinion is given

Under SEC rules, public companies must provide audited, GAAP-compliant financial statements. You can find the report from the auditor near the end of the company's annual report or 10-K filing. The auditor opinion -- whether unqualified, qualified, adverse, or disclaimed -- is part of that report.

A report with a qualified opinion will often include these components:

- Report title: This might state, "Report of Independent Registered Public Accounting Firm."

- The auditor's report is usually addressed to shareholders and company directors.

- Scope statement: Here, the auditor defines what the report covers. The statement often begins with, "We have audited ..." and then lists specific financial statements and timeframes covered by the audit.

- Basis for qualified opinion: This section explains the GAAP departure or scope limitation that led to the qualified opinion.

- A qualified opinion will communicate that the financial statements represent the company's position fairly except for the issues explained in the basis for qualified opinion.

- Critical audit matters: The report may also provide more detail on complex or significant accounting issues. The purpose of this section is to explain how the auditor handled them. As an example, the unqualified auditor statement in Southwest Airlines' (LUV +0.35%) 2020 annual report identifies and defines two critical matters: non-redeemed Rapid Rewards points and the valuation of derivative financial instruments.

Why does a qualified opinion matter?

A qualified opinion can be challenging to interpret. The other auditor opinions are clear-cut: An unqualified opinion is ideal, and an adverse opinion is a giant red flag. The qualified opinion is between those two extremes. It tells you there is a problem with the company's reporting, and that the problem has limited consequences.

Your job is to decide how influential those consequences should be to your decision-making. Some questions to think about are:

- Does the basis for the qualified opinion affect comparisons with peer companies? It's problematic if you can't trust numbers you'd normally compare to peers.

- Does the issue affect the reliability of the company's reporting in general? A qualified opinion states that the financials are reliable except for specific concerns. Still, a material departure from GAAP could signal a larger problem with the quality of reporting.

- How did the company respond to the qualified opinion? Ideally, the company will take action to prevent the issue going forward. Management could retain an external consultant or implement better internal controls, for example.

- Is the basis for the qualified opinion a one-off issue? The qualified opinion may be less significant if it stemmed from a single transaction instead of ongoing business practices.

- Can a peer company with a clean (unqualified) audit report better meet your investment goals? To be clear, the qualified opinion doesn't mean the company is not performing or that the financial statements are wholly unreliable. Still, there is an opportunity cost associated with every investment decision. Another company may be able to provide the exposure and return you want without the uncertainty related to the reporting.

Related Investing Topics

A yellow flag

A qualified opinion in an auditor's report is a yellow flag. Whether you respond to that yellow flag depends on the issue itself and your investing needs. For example, you might accept a qualified opinion on a company whose stock you own if the issue looks to be a one-time event with no long-term consequences.

On the other hand, you might respond differently if the issue affects your ability to compare the company's finances with peers or signals a lack of internal controls around reporting. You might also sell the stock of the company in question if there's another stock from a company with a clean audit that can fill a similar role in your portfolio.