What is the current Fed interest rate?

| FED RATE DECISION DATE | FEDERAL RESERVE INTEREST RATE |

|---|---|

| May 1, 2024 | 5.25%-5.50% |

The Federal Reserve interest rate, known as the federal funds rate, fed funds rate, or FOMC rate, is the interest rate at which banks and credit unions borrow from and lend to each other, and is the benchmark for nearly all interest rates. It's determined by the Federal Reserve and can be changed at any time.

Interest rates hold steady following April 30-May 1 Federal Reserve meeting

The Federal Reserve has opted to hold interest rates steady for the sixth meeting in a row. The target range for the federal funds rate will remain 5.25% to 5.5%.

Economists had anticipated a pause in interest rate hikes due to a number of factors, including cooling inflation. At the same time, March's higher-than-expected inflation reading made an interest rate cut unlikely at this juncture. The Fed's decision is therefore not very surprising.

Analysis of Fed April 30 - May 1, 2024 meeting

The Federal Reserve made the decision to keep its benchmark interest rate unchanged at its most recent policy meeting, and rates haven't moved since the start of 2024 following 11 rate hikes in 2022 and 2023.

The Fed has long been committed to an annual inflation rate of 2% in the long run. It's this rate, the central bank feels, that's most conducive to economic stability.

In March, the Consumer Price Index, which measures changes in the cost of consumer goods and services, rose 3.5% on an annual basis.

The Fed noted in its meeting statement that "inflation has eased over the past year but remains elevated." The central bank also said, "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective."

The Fed needs to strike a balance between bringing inflation back down to 2% and potentially upending the economy by driving up the cost of consumer borrowing to an unreasonable degree. Given the narrowing gap between inflation and its 2% target, this sixth pause in rate hikes seems reasonable. However, since inflation hasn't edged closer to 2%, it's also easy to see why a rate cut is not appropriate at this time.

The Fed had previously signaled that three rate cuts could be coming this year. But for that to happen, inflation will need to continue cooling. At this point, it's too soon to write off rate cuts, but whether three of them happen in the course of 2024 is yet to be determined.

Changes to the federal funds rate impact consumers because they can influence the interest rates on credit cards, loans, and savings accounts to varying degrees.

When is the next Fed rate hike?

The Federal Reserve's next meeting is scheduled for June 11-12. The Fed is likely done raising interest rates at this point. At its next meeting, the central bank will have to decide whether it's ready to start cutting interest rates.

How high will U.S. interest rates get?

Interest rates are unlikely to rise in 2024 from where they are today. If anything, they're likely to fall.

High-yield savings account comparison

We recommend comparing high-yield savings account options to ensure the account you're selecting is the best fit for you. To make your search easier, here's a short list of standout accounts.

When is the next Fed meeting?

The next Federal Reserve meeting of 2024 is scheduled for June 11-12, 2024. The FOMC meeting spans two days so Federal Reserve committee members can discuss the economic impacts of adjustments to the Federal interest rate.

See the 2024 tentative remaining FOMC meeting schedules»

What changes are expected at the next Fed meeting?

The Federal Reserve is committed to its goal of 2% inflation. At its next meeting, the Fed is likely to either hold rates steady again or potentially introduce its first rate cut of 2024, depending on how inflation trends.

When are Federal interest rates expected to drop?

Based on the Fed’s previous economic projections, it believes the federal funds rate will fall to 5.1% by the end of 2024, and 3.9% by the end of 2025. Rate cuts are likely later on in 2024 as inflation continues to cool.

Economic impacts to Fed rate hikes & lowered Fed rates

Here's everything you need to know about Federal Reserve interest rates and how they impact your wallet.

- The Federal Reserve exists to promote a safe and strong economy, which includes maintaining healthy employment rates, stable prices, and reasonable interest rates.

- The Federal Reserve manages the economy by strategically adjusting interest rates.

- To stimulate the economy in times of recession, the Fed lowers interest rates.

- Conversely, when the economy is performing well, it raises interest rates to maintain stability by keeping businesses and consumers in check, and preventing excessive inflation.

- The federal funds rate is an important tool used by the Fed. This rate can be adjusted to help make economic changes less extreme, like reducing the effects of recessions, stopping prices from getting too high, and preventing market crashes.

- By raising rates, the Fed hopes to cool off demand by making it more expensive to borrow money.

- The goal for the Fed is to stop high inflation without potentially plunging the economy into a recession.

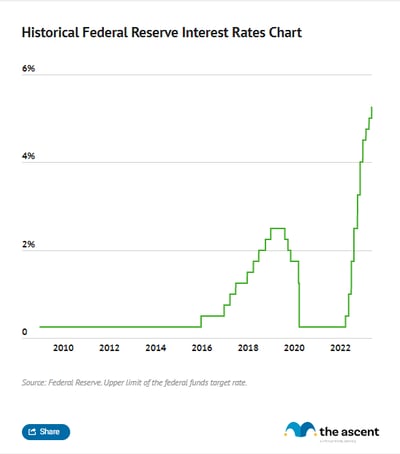

Fed interest rates chart

The Federal Reserve sets the target rate as a range, giving it the flexibility needed to achieve its goals. The chart below shows how the upper limit of the federal funds target rate has changed over time.

The federal funds target rate, set by the Federal Reserve, is the interest rate at which banks and other financial institutions borrow from each other.

It refers to the interest rate that banks charge each other for short-term loans.

When the Federal Reserve raises or lowers rates, it's changing the federal funds target rate. By adjusting this rate, the Fed can influence borrowing and lending practices throughout the economy.

The last Fed rate increase was on July 26, 2023, and has remained unchanged.

The current Federal Reserve interest rate was raised a quarter-point to 5.25% to 5.50% in July, which is at its highest level in 22 years. Following a brief pause in June, the Federal Reserve once again increased interest rates by a quarter of a percentage point in July, bringing the federal funds rate to a target range of 5.25%-5.50%, marking the highest level of benchmark borrowing costs in over 22 years.

How do current Fed interest rates affect the economy?

Interest rates can have a significant influence on the economy. Ultimately, the Federal Reserve interest rate is an important tool for maintaining a stable economy. The Federal funds rate is what banks charge each other for overnight borrowing, but it also impacts many business and consumer debt products.

Low interest rates can stimulate the economy by making it easier for people and businesses to borrow money for major purchases and investments, leading to increased economic activity. Meanwhile, high interest rates discourage spending from both consumers and businesses by increasing the cost of borrowing, leading to reduced economic activity.

How does inflation impact the federal interest rate?

One of the primary responsibilities of the Federal Reserve is ensuring price stability. This means keeping inflation consistently low and stable over the long term.

When inflation is low and stable, people can hold onto their money without having to worry about it losing its purchasing power due to high inflation. In simple terms, a dollar goes further in a low inflation environment.

Since the Fed began raising rates in 2022, the Fed has raised rates to 5.25 to 5.50%, making these hikes the fastest cycle in history.

The inflation rate in February hit 3.2% year over year. That's down from its mid-2022 peak but higher than the Fed's target of 2%.

TIP

- Look for a higher-yielding online savings account.

- Pay down your credit card debt or look at a balance transfer credit card.

- If you are shopping around for a loan, such as an auto loan or mortgage, ensure that your interest preapproval reflects current interest rates.

Historical Federal Reserve interest rates

The table below shows the Federal Reserve interest rate change history, dating back to 2015.

| DATE | FEDERAL RESERVE INTEREST RATE |

|---|---|

| May 1, 2024 | 5.25%-5.50% |

| Mar. 20, 2024 | 5.25%-5.50% |

| Jan. 31, 2024 | 5.25%-5.50% |

| Dec. 13, 2023 | 5.25%-5.50% |

| Nov. 1, 2023 | 5.25%-5.50% |

| Sept. 20, 2023 | 5.25%-5.50% |

| July 26, 2023 | 5.25%-5.50% |

| June 14, 2023 | 5.00%-5.25% |

| May 3, 2023 | 5.00%-5.25% |

| March 22, 2023 | 4.75%-5.00% |

| Feb. 2, 2023 | 4.50%-4.75% |

| Dec. 14, 2022 | 4.25%-4.50% |

| Nov. 2, 2022 | 3.75%-4.00% |

| Sept. 22, 2022 | 3.00-3.25% |

| July 28, 2022 | 2.25%-2.50% |

| June 16, 2022 | 1.50%-1.75% |

| May 5, 2022 | 0.75%-1.00% |

| March 17, 2022 | 0.25%-0.50% |

| March 16, 2020 | 0%-0.25% |

| March 3, 2020 | 1.00%-1.25% |

| Oct. 31, 2019 | 1.50%-1.75% |

| Sept.19, 2019 | 1.75%-2.00% |

| Aug. 1, 2019 | 2.00%-2.25% |

| Dec. 20, 2018 | 2.25%-2.50% |

| Sept. 27, 2018 | 2.00%-2.25% |

| June 14, 2018 | 1.75%-2.00% |

| March 22, 2018 | 1.50%-1.75% |

| Dec. 14, 2017 | 1.25%-1.50% |

| June 15, 2017 | 1.00%-1.25% |

| March 16, 2017 | 0.75%-1.00% |

| Dec.15, 2016 | 0.50%-0.75% |

| Dec. 17, 2015 | 0.25%-0.50% |

What is the federal funds rate?

The federal funds rate is the interest rate that banks charge when lending money to each other from their reserve balances.

But why would a bank need to borrow money from another bank?

The federal government requires that all "depository institutions," such as banks and credit unions, keep a specific amount in funds (reserves) on hand each night so there's no risk that they'll run low. Those that don't have enough reserves borrow from other financial institutions that have more than enough on hand. The interest rate they pay to borrow the money is known as the federal funds rate.

Why does the Fed raise interest rates?

When the Federal Reserve interest rate is high, banks are discouraged from borrowing from each other, and the supply of cash in the economy decreases. This means consumers and banks are borrowing and spending less, which can cause the economy to slow down. The Federal Reserve typically raises the interest rate when the economy is strong.

It's easy to understand why the Federal Reserve would want to stimulate the economy, but it can be harder to understand why they might want to slow it down -- isn't economic growth good? Simply put, what goes up must come down, and the higher the economy climbs, the further it can fall.

When rates are low and people feel good about the economy, consumers often take on excessive debt, and lenders may even lend too much money to unqualified borrowers. This leaves people, businesses, and banks in a dangerous position when the economy inevitably slows down.

Why would the Federal Reserve lower interest rates?

When the Federal Reserve interest rate is low, there's more cash in circulation and banks are able to borrow from each other more freely. In turn, it becomes easier and more affordable for both consumers and businesses to borrow money, which boosts consumer spending and encourages businesses to expand, hire more workers, and increase wages.

Cutting interest rates stimulates the economy and drives economic growth, making it an appropriate tool to prevent and ease severe economic downturns. That's why you'll typically see the Federal Reserve start to lower the interest rate when economists are concerned about an oncoming downturn -- and then more aggressively in the midst of a downturn.

How does the Fed set interest rates?

The Federal funds rate is set eight times per year by the Federal Reserve's Federal Open Market Committee (FOMC). In addition to these eight annual meetings, the FOMC can also call emergency meetings to immediately change the rate during times of crisis.

When the FOMC sets interest rates, they set a target rate rather than the actual interest rate, as they don't have direct control over interest rates. Once the target rate is set, the Federal Reserve engages in open market operations to hit that target. This entails buying and selling government securities such as Treasury bills, bonds, and repurchase agreements to manipulate the supply of money in the economy, which in turn influences interest rates.

When the Fed buys up government securities, it injects money into the economy. Subsequently, banks have more cash on hand, and they decrease their interest rates to attract more borrowers. On the other hand, when the Fed sells government securities, they take money out of the economy. Banks then have less cash to lend, so they increase interest rates.

Federal Open Market Committee Remaining Meeting Schedules 2023-2024

Each meeting date is tentative until confirmed at the meeting immediately preceding it.

2024 FOMC meeting schedule (tentative upcoming dates)

- June 11-12 (Tuesday-Wednesday)

- July 30-31 (Tuesday-Wednesday)

- September 17-18 (Tuesday-Wednesday)

- November 6-7 (Wednesday-Thursday)

- December 17-18 (Tuesday-Wednesday)

- January 28-29, 2025 (Tuesday-Wednesday)

The Federal Open Market Committee announced its 2024 meeting schedule on June 23, 2023

How other U.S. interest rates are determined

Credit cards and savings accounts are most sensitive to changes in the Federal funds rate, followed by personal loans and auto loans, and finally, mortgage loans. The interest rates on all of these products are determined by other important factors, such as creditworthiness.

As the Federal Reserve interest rate is a short-term rate, changes in it have a stronger impact on short-term lending products. They also tend to have a bigger impact on products with variable, rather than fixed, interest rates.

Here's how banks set the interest rates on credit cards, loans, and savings accounts and how changes in the Federal funds rate might affect you.

Credit card interest rates

Most credit cards have a variable interest rate, so a change in the Fed's benchmark will directly impact a credit card's annual percentage rate (APR). This is directly tied to the prime rate, which is the interest rate for customers with prime credit, and it's pegged at 3% above the upper limit of the federal funds rate.

What's more, since credit cards are the most short-term borrowing method, the rates will change almost immediately in response to Federal funds rate changes. However, because interest rates on credit cards are relatively high, these changes -- for example, your APR going from 17.25% to 17.50% -- are often unnoticeable.

With the recent interest rate hikes, the interest rate on credit cards have hit an all-time high.

- The average credit card interest rate is 22.85% for new offers and 21.59% for existing accounts.

- The average credit card APR was at 16.17% in March 2022, before the Fed began its rate increases.

Personal loan interest rates

The interest rates on personal loans aren't directly tied to the prime rate or the Federal funds rate, but they can be influenced by it. Changes in the Federal funds rate can eventually lead to changes to personal loan rates, but those rate changes may not be as immediate as they are with credit cards.

In addition, many personal loans have fixed interest rates, meaning if you already have a personal loan, the rate will remain the same for the life of the loan -- regardless of how the Federal funds rate changes. Loans with variable interest rates can fluctuate as the Federal funds rate changes.

- The average interest rate for a 24-month personal loan has increased from 9.38% in 2021 to 12.49% in February of 2024, the latest numbers available from the Fed.

Auto loan interest rates

Like personal loans, auto loan interest rates aren't directly tied to the Federal funds rate. However, they can be influenced by it, particularly because they're somewhat short term -- typically two to five years.

The changes in auto loan rates are likely to be minimal though, as they're largely based on other factors like your credit score and the bond market.

Recent rate hikes will not affect current auto loans, but new car loans or those with variable-rate financing will likely see costs rise.

- The average interest rate on a 72-month auto loan was 8.41% as of February 2024.

Mortgage loan interest rates

Mortgage loans are typically long-term loans, so short-term interest rate changes aren't likely to affect them as much. Mortgage rates aren't directly tied to the Federal funds rate -- they're set based on a variety of economic indicators, which can include the Federal funds rate, but also include factors such as unemployment, inflation, and the bond market.

- The current 30-year fixed mortgage rate is 7.17%. Mortgage rates have been fluctuating in 2024.

While those with an existing mortgage will not be affected by the recent rate hike, those with an adjustable-rate mortgage (ARM) will likely see their costs rise.

- The average interest rate for a 15-year mortgage is 6.44%.

Savings account interest rates

Interest rates on savings accounts are fairly responsive to changes in the federal funds rate. When interest rates are cut, banks are likely to cut the APYs offered by their savings accounts fairly quickly to protect their profits.

Increases in the federal funds rate usually lead to less dramatic and immediate increases in savings account rates, but a rising rate environment is still advantageous for savers.

- The current average APY for savings accounts is now at 0.47%.

- The average money market rate is 0.66%.

- CD rates have also gone up since the Fed's rate hikes. The average rate for a 12-month CD is currently 1.81%.

The Federal Reserve interest rate is an important tool for guiding the economy. Increases in the federal funds rate can protect a strong economy, while cuts to the federal funds rate can help cushion the fall for a declining economy.

These changes can impact your wallet -- low interest rates are good for borrowers, while high interest rates are good for savers. Ultimately, though, it's your own money habits that are the main factor in determining your financial future.

-

Data research sources

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20240501a.htm

- https://www.federalreserve.gov/releases/g19/current/

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- https://www.bls.gov/news.release/cpi.nr0.htm

- https://www.usinflationcalculator.com/inflation/current-inflation-rates/

- https://www.bls.gov/cpi/

- https://www.fdic.gov/resources/bankers/national-rates/index.html

- https://www.creditcards.com/news/rate-report/

- https://fred.stlouisfed.org/series/TERMCBPER24NS

- https://cars.usnews.com/cars-trucks/advice/average-used-car-loan-interest-rates

- https://cars.usnews.com/cars-trucks/advice/average-auto-loan-interest-rates

- https://www.freddiemac.com/pmms

- https://www.fdic.gov/resources/bankers/national-rates/index.html

FAQs

-

Rates are projected to drop to 5.1% by the end of 2024 and to 3.9% at the end of 2025.

-

The key factors that influence interest rates are the supply and demand of money, inflation, the monetary policy objectives of the Federal Reserve, and government borrowing.

-

When the Fed raises interest rates, it becomes more expensive to borrow money. This reduces the amount of money in the economy. It also impacts the stock and bond markets, and interest rates for credit cards and various types of loans. It also impacts savings and checking accounts.

Our Personal Finance Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.