Average Down Payment on a House 2021: $27,850

While mortgage rates have hit historic lows over the past year, home prices have soared, causing bidding wars and leading buyers to pay well above listed sales prices.

High demand and low supply have fueled a red-hot housing market -- home prices in March 2021 were 13.2% higher than they were in March 2020, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index.

How has this housing market affected the average down payment on a home? The Ascent, a Motley Fool service, dug into the data to find out. When it comes to the real cost of owning a home, the down payment can be the largest and most consequential factor.

We found that the median down payment for a home purchased in early June 2021 was $27,850. Read on for more down payment insights.

Key findings

- The average (median) down payment for a home purchased in early June 2021 was $27,850. The mean was $75,716.

- Average down payments widely varied by state. Rhode Island; Washington, D.C.; and Hawaii saw the highest average down payments -- at least $35,000 more than Montana, West Virginia, and Vermont, where the lowest average down payments were made.

- Between July 2019 and June 2020, the average down payment for a home amounted to 12% of the home value.

- In the first three months of 2021, 48% of home buyers made a down payment of at least 20% of the home value.

- 21% of home buyers in that same period made an all-cash purchase.

The average down payment for a home in early June 2021 was $27,850

The median down payment for a home purchased in early June 2021 was $27,850, according to mortgage data from market-leading data provider Optimal Blue.

The mean down payment was $75,716 -- significantly higher than the median, indicating that some very high down payments skew the mean. We'll see later that the mean down payments in ten states and Washington, D.C. are over $100,000 -- this has a big impact on the difference between mean and median down payments.

The median loan amount was $283,550 and the median loan-to-value ratio (the percent of the home’s value the loan is worth) was 90%, indicating that a 10% down payment was about average in early June 2021.

The mean loan amount was $333,317, again suggesting that expensive homes moved the average higher.

Down payments are important for a few reasons. A larger down payment means a smaller loan and less interest to pay off over time, resulting in savings over the long run. A bigger down payment also immediately gives you more equity in your home, which you can borrow against if you need to.

The average down payment for a single-family home in early June 2021 was $28,300

The median down payment for a single-family home in early June was $28,300. The mean was $74,403.

This nearly $50,000 gap between median and mean down payments was seen in single-family homes, condos, and planned unit development homes. Manufactured double-wide homes, however, only saw a $10,000 gap.

This discrepancy can be explained by the fact that the value of the former group of property types covers a much wider range -- millions of dollars -- than manufactured double-wide homes, which tend to run from just under $100,000 to a few hundred thousand dollars.

Rhode Island; Washington, D.C.; and Hawaii have the largest average down payments

Rhode Island ($65,817); Washington, D.C. ($63,537); and Hawaii ($51,499) were the states with the largest median down payments in early June 2021.

The lowest median down payments were made in Montana ($15,525), West Virginia ($13,297), and Vermont ($11,538).

| State | Median down payment on a house, early June 2021 |

|---|---|

| Rhode Island | $65,817 |

| District of Columbia | $63,537 |

| Hawaii | $51,499 |

| Kentucky | $44,250 |

| Maryland | $43,500 |

| Alaska | $36,738 |

| Delaware | $36,500 |

| New York | $34,998 |

| Tennessee | $34,975 |

| California | $34,500 |

| Arizona | $34,488 |

| Oklahoma | $33,525 |

| Indiana | $32,900 |

| Pennsylvania | $32,136 |

| Massachusetts | $30,025 |

| Kansas | $30,004 |

| Minnesota | $29,999 |

| New Jersey | $29,500 |

| Missouri | $28,963 |

| North Dakota | $28,900 |

| New Hampshire | $28,760 |

| Colorado | $28,750 |

| Ohio | $28,750 |

| Washington | $28,600 |

| Oregon | $28,001 |

| Texas | $27,500 |

| Florida | $27,450 |

| Idaho | $26,195 |

| Maine | $26,150 |

| Michigan | $26,088 |

| Connecticut | $24,500 |

| Alabama | $24,225 |

| North Carolina | $24,000 |

| Georgia | $23,750 |

| Nevada | $23,670 |

| Iowa | $23,600 |

| Louisiana | $23,575 |

| Virginia | $23,125 |

| South Carolina | $23,064 |

| Utah | $23,050 |

| Wisconsin | $21,930 |

| Arkansas | $20,525 |

| South Dakota | $20,502 |

| Illinois | $20,500 |

| Nebraska | $20,390 |

| New Mexico | $20,250 |

| Mississippi | $18,375 |

| Wyoming | $17,500 |

| Montana | $15,525 |

| West Virginia | $13,297 |

| Vermont | $11,538 |

In 31 states, the median down payment was between $20,000 and $30,000. Only five states saw median down payments below $20,000: Mississippi, Wyoming, Montana, West Virginia, and Vermont.

West Virginia also had the country’s lowest median home value in 2020. Mississippi, which registered the fourth lowest median down payment in June, had the second-lowest median home value in 2020.

There's less overlap among states with the highest median home value and highest median down payment.

Kentucky, which saw the fourth highest median down payment in June, had the fifth lowest median home value in 2020.

California, Hawaii, and Washington, D.C. saw the highest mean down payments, all coming in over $150,000. Ten states and the District of Columbia had average down payments of over $100,000.

Home buyers in some states saw significantly lower mean down payments, though, including the average of $14,938 in Mississippi.

| State | Mean down payment on a house, early June 2021 |

|---|---|

| California | $181,314 |

| Hawaii | $165,918 |

| District of Columbia | $156,337 |

| Idaho | $132,449 |

| Montana | $130,194 |

| Massachusetts | $119,648 |

| Colorado | $112,164 |

| Nevada | $111,022 |

| Utah | $110,971 |

| New York | $105,411 |

| Oregon | $104,398 |

| Washington | $94,059 |

| Delaware | $87,649 |

| New Jersey | $84,772 |

| Arizona | $82,818 |

| Florida | $78,478 |

| Wisconsin | $71,971 |

| Rhode Island | $70,269 |

| Connecticut | $67,027 |

| Maine | $67,016 |

| Texas | $63,826 |

| North Dakota | $62,078 |

| New Hampshire | $61,870 |

| South Carolina | $59,968 |

| Pennsylvania | $58,982 |

| Maryland | $57,591 |

| Illinois | $56,885 |

| Wyoming | $55,853 |

| North Carolina | $55,380 |

| Tennessee | $53,644 |

| Minnesota | $52,753 |

| Virginia | $52,509 |

| Kentucky | $52,072 |

| New Mexico | $50,862 |

| Georgia | $50,024 |

| Alaska | $48,735 |

| South Dakota | $48,360 |

| Louisiana | $47,912 |

| Michigan | $47,697 |

| Missouri | $42,410 |

| Alabama | $36,819 |

| Kansas | $34,223 |

| None | $33,332 |

| Oklahoma | $33,082 |

| Nebraska | $32,042 |

| Iowa | $31,576 |

| Ohio | $31,212 |

| Indiana | $31,051 |

| Vermont | $30,844 |

| Arkansas | $29,688 |

| West Virginia | $19,046 |

| Mississippi | $14,938 |

The median down payment between July 2019 and June 2020 was 12% of the home value

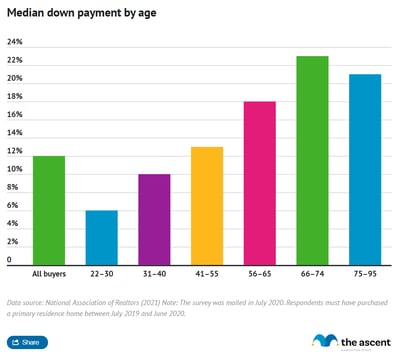

The median down payment for a home between July 2019 and June 2020 was 12% of the home’s value.

Older buyers made down payments worth a larger percentage of their home’s value. Buyers aged 66–74 made down payments worth the largest percentage of their home’s value, closely followed by those aged 75–95.

Buyers aged 22–30 made an average payment of 6% compared to 23% paid by buyers aged 66–74.

A down payment of at least 20% of your home’s value is usually necessary to avoid paying for private mortgage insurance (PMI). PMI insures your lender if you can’t make mortgage payments and can amount to 1% of your loan amount per year -- not an insignificant amount of cash if you’ve borrowed an amount similar to what the average American has.

48% of all home buyers made at least a 20% down payment in the first three months of 2021

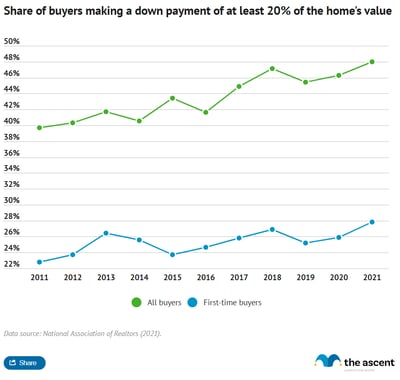

48% of all buyers and 27.8% of first-time buyers made a down payment of at least 20% in the first three months of 2021.

Those percentages are highs over the last ten years. Other than a few blips, the share of home buyers and first-time buyers that put at least 20% has grown every year since 2011.

In the first three months of 2021, 21% of buyers of existing homes made all-cash purchases

21% of home buyers that purchased existing homes made all-cash purchases in the first quarter of 2021 -- meaning they purchased their home in full, without a loan or any other type of financing.

The share of home buyers making all-cash purchases has come off highs of around 30% in the early 2010s.

6% of first-time buyers and 34% of non-first-time buyers paid all cash in April 2021. In April 2019, the number of non-first-time buyers who made an all-cash purchase was 26.3%. The first-time buyer all-cash purchase percentage has not changed since April 2018.

All-cash sales made up a quarter of all home sales in April 2021 compared to just 15% of sales in April 2020.

| All-cash sales as a percentage of sales | |

|---|---|

| April 2021 | 25% |

| March 2021 | 23% |

| April 2020 | 15% |

As home prices have risen, so has the percentage of home buyers that make at least a 20% down payment or an all-cash purchase. This could be a function of a more competitive housing market -- a 20% down payment makes it easier to obtain financing while all-cash purchases greatly increase your chances of sealing a deal.

Conclusion

Buying a home is a landmark event. With the average down payment in June nearing $30,000, prices continuing to rise, and the housing market remaining competitive, potential home buyers should make sure they’re equipped for their home buying journey. The Ascent has resources from mortgage guides to tips for first-time home buyers that will set you up for success.

Sources

- National Association of Realtors, 2021. "2021 Home Buyers and Sellers Generational Trends Report."

- National Association of Realtors, 2021. "How are Buyers Coping in a Highly Competitive Housing Market?"

- National Association of Realtors, 2021. "Realtors Confidence Index Survey, April 2021."

- S&P Dow Jones Indices (2021). "S&P/Case-Shiller U.S. National Home Price Index."

- U.S. Census Bureau and U.S. Department of Housing and Urban Development. "Median Sales Price of Houses Sold for the United States."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.