Survey: Car Insurance Shopping Preferences and Trends

KEY POINTS

- LOYALTY VS. SAVINGS: Three-quarters of respondents don't shop for new auto insurance annually, missing potential savings.

- MILLENNIALS LEAD CHANGE: Forty-two percent of millennial respondents compare auto insurance prices yearly, the highest among all age groups.

- PRIORITIES IN SHOPPING: Cost and coverage options are the top factors for drivers when selecting auto insurance, with two-thirds prioritizing premium costs.

The cost of car insurance has risen considerably in recent years, but has that driven drivers to shop more frequently for car insurance or does loyalty to their current insurance provider win out? And when drivers do shop for auto insurance, what factors are most important to them?

To find out how drivers are approaching auto insurance as rates continue to climb, the Motley Fool Ascent surveyed 2,000 Americans on their auto insurance shopping habits and preferences. Read on for the full survey results.

3 out of 4 don't shop for new auto insurance annually

Three out of four respondents to the Motley Fool Ascent's 2024 Auto Insurance Preferences and Trends Survey don't shop for auto insurance annually.

Shopping for a new auto insurance policy is one of the top ways to find savings on auto insurance. The Motley Fool Ascent recommends that drivers compare auto insurance quotes at least once a year.

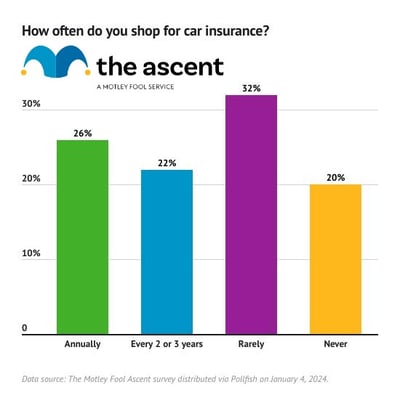

Here's how frequently respondents compare auto insurance quotes:

- Every year: 26%

- Every two or three years: 22%

- Rarely: 32%

- Never: 20%

Millennial respondents were far more likely than any other generation to scour the auto insurance market annually. Forty-two percent of millennial respondents compare prices each year compared to 19% of Gen Z, 24% of Gen X, and 19% of baby boomers.

Just 13% of millennial respondents say they never shop for car insurance, the smallest percentage of any generation.

| How often do you shop for a new auto insurance policy? | Gen Z | Millennials | Gen X | Baby boomers | All respondents |

|---|---|---|---|---|---|

| Annually | 19% | 42% | 24% | 19% | 26% |

| Every 2 or 3 years | 24% | 21% | 20% | 21% | 22% |

| Rarely | 28% | 25% | 36% | 40% | 32% |

| Never | 29% | 13% | 20% | 20% | 20% |

Drivers responded to rising auto insurance costs by shopping for auto insurance and switching insurers at a higher rate in the first half of 2023, according to J.D. Power Insurance Intelligence. Shopping and switching rates fell in the second half of 2023, which J.D. Power interpreted as drivers accepting higher auto insurance premiums.

43% have never switched car insurance providers

Forty-three percent of respondents to the Motley Fool Ascent's 2024 Auto Insurance Preferences and Trends Survey have never switched auto insurance providers.

While some auto insurance companies may offer loyalty discounts after a number of years, it's still worth comparing that discounted rate to others available on the market. Some auto insurance providers may also offer a one-time discount for switching to them as well.

Gen Z and baby boomer respondents were least likely to have ever switched auto insurance companies, although over 50% of those generations reported having done so. By comparison, 60% of Gen X and 63% of millennial respondents said they have switched auto insurance providers at least once to get a better rate.

Have you ever switched auto insurance providers to get a better rate?

| Gen Z | 52% |

| Millennials | 63% |

| Gen X | 60% |

| Baby boomers | 55% |

| All respondents | 57% |

Cost and coverage options are the most important factors for auto insurance shoppers

The most commonly cited top two most important factors when shopping for car insurance are premium cost and coverage options, according to the Motley Fool Ascent's 2024 Auto Insurance Preferences and Trends Survey.

Two-thirds of respondents cited premium costs as one of two most important auto insurance factors when shopping and 60% cited coverage options. Customer service reputation was selected as a top factor by 31% of respondents, discount availability was picked by 24%, and claims processing speed was chosen by 20%.

It's no surprise that cost and coverage options are the most important factors to auto insurance shoppers. Car insurance costs have risen in recent years and can be considered a required monthly payment for drivers. Having coverage optionality allows drivers to personalize their policy, provides cost flexibility, better risk management, and more.

The percentage of respondents that cited premium cost as one of two most important auto insurance factors rose with age: 78% of baby boomers selected it as a top factor compared to 49% of Gen Z and 64% of millennials.

The opposite is true for claims processing speed. A higher percentage of respondents from younger generations picked it as a top factor, compared to older generations.

| What two factors do you consider to be most important when choosing an auto insurance policy? | Premium cost | Coverage options | Customer service reputation | Claims processing speed | Discount availability |

|---|---|---|---|---|---|

| Gen Z | 49% | 61% | 34% | 26% | 30% |

| Millennials | 64% | 56% | 34% | 27% | 20% |

| Gen X | 72% | 65% | 23% | 14% | 25% |

| Baby boomers | 78% | 57% | 28% | 12% | 25% |

| All respondents | 66% | 60% | 31% | 20% | 24% |

31% say they understand their auto insurance policy "very well"

Thirty-one percent of respondents to The Motley Fool Ascent's 2024 Auto Insurance Preferences and Trends Survey say they understand their auto insurance policy "very well." Thirty-five percent say they understand their policy moderately well and 21% say they understand it somewhat well.

Seven percent of respondents say they understand their policy not very well and 5% say they don't understand their car insurance policy at all.

Gen Z had the highest share of respondents that either understand their car insurance policy not very well (13%) or not at all (8%).

| How well do you understand your auto insurance policy? | Very well | Moderately well | Somewhat well | Not very well | Not at all |

|---|---|---|---|---|---|

| Gen Z | 24% | 33% | 22% | 13% | 8% |

| Millennials | 46% | 30% | 14% | 5% | 6% |

| Gen X | 28% | 36% | 24% | 7% | 4% |

| Baby boomers | 24% | 41% | 26% | 5% | 4% |

| All respondents | 31% | 35% | 21% | 7% | 5% |

Having a good understanding of your auto insurance policy is important if you get in an accident, but also before and after one as well.

Understanding your coverage is necessary to ensure you meet your state's legal coverage requirements, how much you may owe in the event of an accident before your coverage kicks in (known as your deductible), and whether you are over- or under-insured.

Knowledge of your policy will also guide your response in the event of an accident, including when to file a claim and how to make the most of your benefits.

Car insurance shopping tips

With car insurance costs on the rise and auto insurance being a must-have for drivers, it's important to seek out savings. Here are three tips that can help you save on auto insurance.

- Shop around and compare quotes: Companies differ in how they assess risk and price auto insurance policies, so shopping around and comparing quotes may yield a more affordable policy.

- Maximize discounts: A good credit history can help drivers get lower rates. And having a clean driving record can also yield significant savings. Bundling home and auto insurance is another common way to lower your premiums on both policies. Companies may offer other discounts as well, such as for taking a defensive driving class, parking in a garage, or having a vehicle with advanced safety features.

- Review your coverage: Make sure you aren't over- or under-insured. Check if your premium exceeds the value of your car and adjust your coverage accordingly. Increasing your deductible is another way to lower your monthly premium, but you can end up with a bigger bill in the event of an accident.

Methodology

The Motley Fool Ascent surveyed 2,000 American adults via Pollfish on Jan. 4, 2024. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling.

Sources

- J.D. Power (2024). "2023 Q4 Quarterly Shopping LIST Report."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.