The Homeowners Insurance Discounts That Save You the Most, Ranked

Homeowners insurance is among the most important financial products you can get -- and one that has plenty of discounts available.

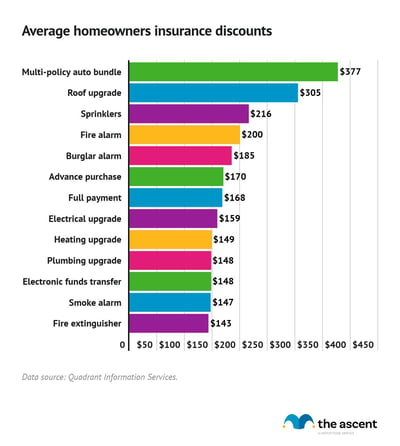

The Ascent, a Motley Fool service, compiled data on a dozen homeowners insurance discounts to rank which provide the most savings.

We found that bundling home insurance with auto insurance provides the largest discount on home insurance, with an average savings of $377 dollars.

Roof upgrades, installing sprinklers, having a fire alarm, and having a burglar alarm also offer significant savings.

Keep reading for a full breakdown of the home insurance discounts that save you the most.

Key findings

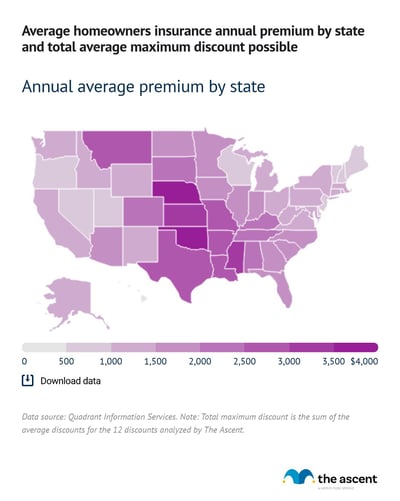

- The national average homeowners insurance premium is $1,725.

- Nebraska has the highest average homeowners insurance premium at $4,043. Hawaii has the lowest at $392.

- Bundling home and auto insurance provides the largest homeowners insurance discount and results in an average savings of $377.

- Roof upgrades, sprinklers, a fire alarm, and a burglar alarm each provide savings of over 10% off the national average.

- Some of the largest homeowners insurance discounts can be found in Oklahoma, Alabama, Kansas, and Mississippi, but those states have among the highest homeowners insurance premiums, as well.

Largest homeowners insurance discounts: bundling policies, roof upgrades, sprinklers, fire alarms, burglar alarms

Bundling home and auto insurance, upgrading to an impact-resistant roof, adding fire sprinklers, installing a fire alarm, and owning a burglar alarm offer the largest homeowners insurance discounts.

Bundling auto and homeowners insurance alone saves an average of $377 on homeowners insurance.

Upgrading your roof, while expensive, provides an average annual discount of $305 -- well worth the cost, especially if your home is in an area that experiences extreme weather.

Having fire sprinklers in your home reduces annual homeowners insurance premiums by $216, while a fire alarm provides an average discount of $200.

A burglar alarm provides an average discount of $185 in addition to peace of mind that comes with home security.

Considering that the national average annual homeowners insurance premium is $1,725, these discounts alone provide significant savings.

| Homeowners insurance discount | National average annual discount |

|---|---|

| Multi-policy auto bundle | $377 |

| Roof upgrade | $305 |

| Sprinklers | $216 |

| Fire alarm | $200 |

| Burglar alarm | $185 |

Homeowners insurance discounts ranked

Here’s a full list of average annual home insurance discounts available to consumers:

| Homeowners insurance discount | National average annual discount |

|---|---|

| Multi-policy auto bundle | $377 |

| Roof upgrade | $305 |

| Sprinklers | $216 |

| Fire alarm | $200 |

| Burglar alarm | $185 |

| Advance purchase | $170 |

| Full payment | $168 |

| Electrical upgrade | $159 |

| Heating upgrade | $149 |

| Plumbing upgrade | $148 |

| Electronic funds transfer | $148 |

| Smoke alarm | $147 |

| Fire extinguisher | $143 |

Homeowners in Oklahoma, Alabama, Kansas, and Mississippi receive the largest discounts

Homeowners insurance premiums vary by state. The largest discounts can be found in Oklahoma, Alabama, Kansas, and Mississippi.

Those states also have some of the highest average homeowners insurance rates.

Top five most expensive states for homeowners insurance

| State | Average annual homeowners insurance rate |

|---|---|

| Nebraska | $4,043 |

| Oklahoma | $3,883 |

| Mississippi | $3,045 |

| Kansas | $3,012 |

| Arkansas | $2,983 |

Average homeowners insurance rate by state

| State | Average annual homeowners insurance rate | Total average maximum discount* |

|---|---|---|

| Alabama | $2,364 | $4,220 |

| Alaska | $1,241 | $1,847 |

| Arizona | $1,644 | $2,483 |

| Arkansas | $2,983 | $4,013 |

| California | $1,252 | $1,600 |

| Colorado | $2,179 | $2,889 |

| Connecticut | $1,287 | $2,000 |

| Delaware | $826 | $1,262 |

| District of Columbia | $989 | $1,426 |

| Florida | $1,958 | $2,554 |

| Georgia | $1,732 | $2,766 |

| Hawaii | $392 | $869 |

| Idaho | $1,056 | $1,558 |

| Illinois | $1,869 | $2,787 |

| Indiana | $1,837 | $2,211 |

| Iowa | $1,713 | $2,652 |

| Kansas | $3,012 | $4,647 |

| Kentucky | $2,269 | $3,667 |

| Louisiana | $2,643 | $3,399 |

| Maine | $955 | $1,783 |

| Maryland | $1,411 | $1,759 |

| Massachusetts | $1,379 | $1,961 |

| Michigan | $1,452 | $2,139 |

| Minnesota | $1,636 | $2,905 |

| Mississippi | $3,045 | $4,251 |

| Missouri | $2,542 | $3,786 |

| Montana | $2,547 | $2,834 |

| Nebraska | $4,043 | $4,752 |

| Nevada | $934 | $1,447 |

| New Hampshire | $884 | $1,503 |

| New Jersey | $822 | $1,476 |

| New Mexico | $1,402 | $2,077 |

| New York | $1,013 | $1,590 |

| North Carolina | $1,640 | $2,424 |

| North Dakota | $1,719 | $2,029 |

| Ohio | $1,429 | $2,086 |

| Oklahoma | $3,883 | $4,814 |

| Oregon | $814 | $1,300 |

| Pennsylvania | $1,047 | $1,546 |

| Rhode Island | $1,214 | $1,815 |

| South Carolina | $1,766 | $2,718 |

| South Dakota | $2,403 | $3,028 |

| Tennessee | $2,194 | $3,424 |

| Texas | $2,646 | $3,605 |

| Utah | $817 | $1,263 |

| Vermont | $857 | $1,321 |

| Virgina | $1,209 | $1,992 |

| Washington | $1,009 | $1,428 |

| West Virginia | $1,339 | $2,077 |

| Wisconsin | $993 | $1,425 |

| Wyoming | $1,314 | $2,185 |

States that offer the largest homeowners insurance discounts, ranked

Here are the top five states that offer the largest homeowners insurance discounts broken down by specific discounts.

Burglar alarm discount

Adding security features like a burglar alarm can lead homeowners insurance lenders to offer significant discounts, often large enough to recoup the cost of installing a new home security system after a couple of years.

| State | Burglar alarm annual discount |

|---|---|

| Alabama | $401 |

| Oklahoma | $400 |

| Kansas | $339 |

| Louisiana | $290 |

| Mississippi | $269 |

Fire alarm discount

Fire alarms are considered by homeowners insurance lenders to be a home safety feature and can lead to savings on your policy.

| State | Fire alarm annual discount |

|---|---|

| Alabama | $422 |

| Oklahoma | $413 |

| Kansas | $351 |

| Mississippi | $327 |

| Louisiana | $297 |

Smoke alarm discount

Smoke alarms are another home safety feature that can score you a discount on your homeowners insurance.

| State | Smoke alarm annual discount |

|---|---|

| Kansas | $279 |

| Oklahoma | $277 |

| Alabama | $246 |

| Mississippi | $242 |

| Nebraska | $231 |

Fire extinguisher discount

Another home safety feature, having a fire extinguisher in your home can net you a discount.

| State | Fire extinguisher annual discount |

|---|---|

| Oklahoma | $264 |

| Kansas | $263 |

| Alabama | $236 |

| Mississippi | $236 |

| Nebraska | $224 |

Sprinkler discount

Homeowners insurance providers can offer significant savings for having sprinklers installed.

| State | Sprinklers annual discount |

|---|---|

| Alabama | $464 |

| Oklahoma | $416 |

| Louisiana | $346 |

| Mississippi | $338 |

| Florida | $328 |

Electrical upgrade discount

Upgrading electrical wiring can prevent fires, which homeowners insurance providers see as something worth offering a discount for.

| State | Electrical upgrade annual discount |

|---|---|

| Missouri | $402 |

| Minnesota | $384 |

| Kansas | $305 |

| Oklahoma | $265 |

| Alabama | $245 |

Heating upgrade discount

Similarly, upgrading your heating system can reduce the risk of fire, so homeowners insurance providers are willing to offer a discount if you make the investment.

| State | Heating upgrade annual discount |

|---|---|

| Kansas | $288 |

| Oklahoma | $266 |

| Alabama | $240 |

| Mississippi | $240 |

| Nebraska | $226 |

Plumbing upgrade discount

Overhauling your plumbing can make flooding in your home less likely, which homeowners insurance providers see discount worthy.

| State | Plumbing upgrade annual discount |

|---|---|

| Kansas | $278 |

| Oklahoma | $270 |

| Alabama | $242 |

| Mississippi | $237 |

| Nebraska | $229 |

Roof upgrade discount

Upgrading your roof so it can cope with extreme weather can net you a big homeowners insurance discount in some states.

| State | Roof upgrade annual discount |

|---|---|

| Nebraska | $1,221 |

| South Dakota | $691 |

| Kansas | $671 |

| Montana | $663 |

| Arkansas | $628 |

Full payment discount

Making your homeowners insurance payment in full instead of in discounts can result in a discount from some providers.

| State | Full payment annual discount |

|---|---|

| Kansas | $317 |

| Oklahoma | $305 |

| Nebraska | $272 |

| Arkansas | $264 |

| Alabama | $263 |

Electronic funds transfer discount

Paying for your homeowners insurance via an electronic funds transfer can also result in a discount.

| State | Electronic fund transfer annual discount |

|---|---|

| North Carolina | $298 |

| Kansas | $284 |

| Oklahoma | $241 |

| Mississippi | $235 |

| Nebraska | $234 |

Advance purchase discount

If you lock in a homeowners insurance policy in advance of when you need it activated, most lenders will provide a discount.

| State | Advance purchase annual discount |

|---|---|

| Oklahoma | $345 |

| Arkansas | $290 |

| Alabama | $276 |

| Mississippi | $274 |

| Kansas | $262 |

Multi-policy auto insurance bundle discount

Bundling your homeowners and auto insurance is attractive to many providers and will net you serious savings.

| State | Multi-policy auto insurance bundle annual discount |

|---|---|

| Oklahoma | $871 |

| Nebraska | $813 |

| Mississippi | $757 |

| Arkansas | $718 |

| Kansas | $675 |

How to save money on homeowners insurance by accruing discounts

Some homeowners insurance discounts are fairly easy to obtain if your provider offers them, like setting up electronic payments online or purchasing a fire extinguisher for your home.

Others are more expensive and time-consuming, like installing a new roof or overhauling your plumbing or electrical wiring.

Even if obtaining some discounts sounds daunting, remember that they’re usually a win-win proposition.

Preventing a home fire, flood from bad plumbing, or serious roof damage is worth the money and time. Those improvements can make your home more valuable and give you peace of mind. And over time the discount on your homeowners insurance can offset the cost of the improvement.

Homeowners insurance discounts can vary by provider, so don’t forget to shop around to save.

Sources

The data found on this page is a combination of publicly available quote data obtained directly from the carrier as well as insurance rate data from Quadrant Information Services. These rates were publicly sourced from the top ten (10) to fifteen (15) carrier markets, within each state, based on annual written premium and should be used for comparative purposes only -- your own quotes may be different.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.