Millennial Home-Buying and Homeownership Statistics

KEY POINTS

- MILLENNIAL HOMEOWNERSHIP RISES: Over 50% of millennials are now homeowners, marking a significant increase despite economic and pandemic challenges.

- DOWN PAYMENT STRUGGLES: Saving for a down payment is the toughest part of the home-buying process for young millennials, reflecting high home prices.

- PANDEMIC SAVINGS BOOST: Despite financial hardships, 59% of millennials who saved money during the pandemic plan to use it for a down payment on a home.

Millennial homeownership trends

Millennials have burst onto the housing scene over the last decade. Over 50% of millennials are now homeowners. But that milestone took longer to reach for millennials than generations before them, and for the first time since 2014, millennials do not make up the largest share of home buyers.

Unprecedented challenges, including the COVID-19 pandemic, record-high home prices, rising interest rates, and economic challenges have placed millennial home buyers in a uniquely difficult position. A growing share of millennials that are not homeowners are pessimistic that they will ever be able to buy a home.

Read on for a deeper dive into millennial home-buying statistics, including what challenges the generation faces and how they have navigated the housing market.

52% of millennials are now homeowners

Fifty-two percent of millennials are now homeowners, crossing the 50% mark for the first time in 2022.

That's up from 49% in 2021 and 48% in 2020, according to Apartment List.

| Generation | Percent That Are Homeowners, 2022 |

|---|---|

| Millennials | 52% |

| Gen X | 70% |

| Baby boomers | 78% |

| Silent | 77% |

Millennials reaching the 50% homeownership milestone doesn't tell the whole story, however.

It took millennials longer than previous generations to hit that mark. One way of measuring this is to look at the percentage of each generation that were homeowners at 30 years of age.

Just 42% of millennials at age 30 were homeowners, compared to 48% of Gen X and 51% of baby boomers when they were the same age, according to data compiled by Apartment List.

| Generation | Percent homeowners at age 30 |

|---|---|

| Millennials | 42% |

| Gen X | 48% |

| Baby boomers | 51% |

Millennials slip to second place in home buying behind boomers

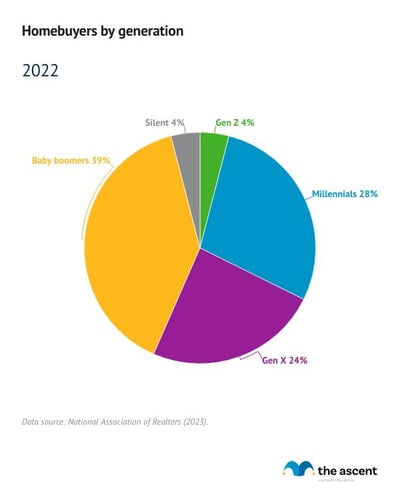

Millennials accounted for 28% of home buyers in 2022, making them the second-largest home-buying generation in the market. 2022 was the first year since 2013 that millennials did not account for the largest share of home buyers, according to data from the National Realtors Association.

Older millennials were responsible for 16% of home purchases in 2022 while younger millennials were responsible for 12%, suggesting that there's still plenty of room for additional home buying from millennials as they reach the traditional peak home-buying years of their mid-30s.

Baby boomers have long dominated the housing market and played a leading role in 2022, accounting for 39% of all home buyers.

Gen X accounted for 24% of home buyers. Sandwiched between millennials and baby boomers, Gen Xers still play an important role in the housing market. They are in their peak earning years, have the highest median income of any generation, and have more kids at home than other generations.

Percent of home buyers by generation

| Generation | 2022 | 2021 | 2020 |

|---|---|---|---|

| Gen Z | 4% | 2% | 2% |

| Millennials | 28% | 43% | 37% |

| Gen X | 24% | 22% | 24% |

| Baby boomers | 39% | 29% | 32% |

| Silent | 4% | 4% | 5% |

Nearly half of older millennials are buying homes worth $300,000 or more, catching up to older generations

Older millennials are spending close to what Gen Xers are on a house, and more than baby boomers.

Forty-two percent of home buyers aged 32 to 41 paid $350,000 or more for a home in 2021, and the median home purchase price for that cohort was $315,000.

Older millennials purchasing homes priced at what older generations can afford shows that they are a driving force in the housing market, despite the challenges they face.

Younger millennials, meanwhile, are the most frugal group. In fact, 73% purchased homes for under $350,000 and their median home purchase price was $250,000. Many in that group are just starting their careers and not making close to the upper limit of their potential salary, so it's not surprising they are spending $65,000 less on a home than their older millennial counterparts.

| All Buyers | 23 to 31 | 32 to 41 | 42 to 56 | 57 to 66 | 67 to 75 | 76 to 96 | |

|---|---|---|---|---|---|---|---|

| <$75,000 to $174,999 | 16% | 26% | 16% | 16% | 19% | 16% | 21% |

| $175,000 to $349,999 | 42% | 47% | 41% | 40% | 41% | 46% | 47% |

| $350,000 to $499,999 | 22% | 18% | 23% | 22% | 21% | 21% | 21% |

| >$500,000 | 20% | 10% | 19% | 22% | 18% | 18% | 13% |

| Median price | $305,000 | $250,000 | $315,000 | $320,000 | $301,000 | $295,000 | $296,000 |

Around 40% of millennials didn't cite a specific reason for the timing of their home purchase, instead just saying it was "just the right time" and that they were "ready to buy a home."

That is surprising, given that mortgage rates have shot up since 2021. Still, over 10% of millennials said their home purchase in 2022 was done because of the mortgage financing options they had.

| Reasons for Buying | All Buyers | 18 to 23 | 24 to 32 | 33 to 42 | 43 to 57 | 58 to 67 | 68 to 76 | 77 to 97 |

|---|---|---|---|---|---|---|---|---|

| It was just the right time, was ready to buy a home | 38% | 45% | 41% | 38% | 33% | 41% | 38% | 30% |

| Did not have much choice, had to purchase | 24% | 13% | 23% | 28% | 35% | 16% | 16% | 19% |

| It was the best time because of mortgage financing options available | 12% | 13% | 18% | 13% | 11% | 9% | 12% | 3% |

| It was the best time because of availability of homes for sale | 11% | 11% | 6% | 7% | 9% | 12% | 17% | 21% |

| It was the best time because of affordability of homes | 4% | 11% | 3% | 4% | 2% | 5% | 5% | 13% |

| The buyer wished they had waited | 2% | 1% | 1% | 2% | 2% | 2% | 2% | 3% |

| Other | 10% | 6% | 7% | 9% | 8% | 15% | 10% | 11% |

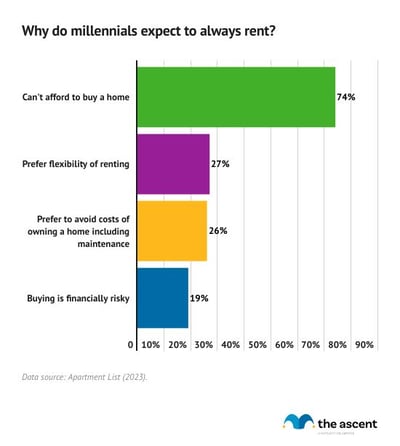

18% of millennials expect to always rent a home, up from 11% in 2018

Overall, millennials are more pessimistic about their prospects for owning a home than in previous years -- 18% of millennials in 2020 said they expect to always rent, up from 12% in 2019 and 11% in 2018.

Annual share of millennial renters who plan to "always rent" instead of buy

| 2018 | 13.30% |

| 2019 | 14.90% |

| 2020 | 21.30% |

| 2021 | 21.60% |

| 2022 | 24.70% |

Finances were the primary concern of those that said they expect to always rent. That's not surprising, given that housing prices have been at record levels and mortgage rates have increased.

| Why do you always expect to rent | 2018 | 2022 |

|---|---|---|

| Can't afford to buy a home | 69% | 74% |

| Like the flexibility renting provides | 42% | 27% |

| Prefer to avoid home maintenance and other costs | 36% | 26% |

| Buying a home is financially risky | 29% | 19% |

A whopping 74% cited the inability to afford a home, 26% said they wanted to avoid maintenance and other costs that come with owning a home, and 19% said that buying a home is a financial risk. Just 27% said they like the flexibility of renting.

Saving for a down payment was the most difficult part of the home-buying process for 28% of home buyers between 24 and 32

Twenty-eight percent of young millennial home buyers said that saving for a down payment was the hardest part of the home-buying process, per the National Association of Realtors.

Young millennials were more likely to struggle with a down payment than any other age group, a reflection of high home prices and not being in their peak earning years.

Putting together a down payment on a home is typically a multi-year exercise in disciplined saving -- not an easy feat in usual times and made tougher by the pandemic and sky-high home prices.

| All Home Buyers | 24 to 32 | 33 to 42 | 43 to 57 | 58 to 67 | 68 to 76 | 77 to 97 | |

|---|---|---|---|---|---|---|---|

| Saving for a down payment was most difficult task in buying process | 13% | 28% | 19% | 21% | 2% | 2% | * |

The most difficult part of the home-buying process across all ages is finding the right property. Over 50% of all Americans struggled most to locate their dream home.

Paperwork and understanding the home-buying process were more common challenges among younger home buyers. Older Americans were more likely to say that there were no difficult steps in their home-buying process.

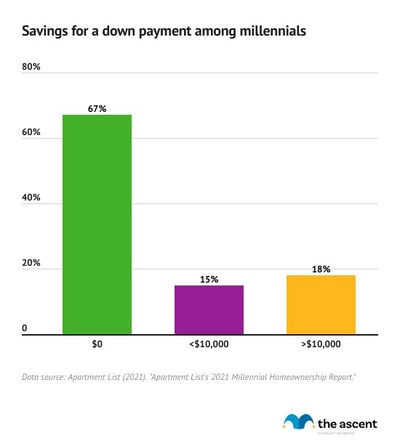

67% of millennials have no savings for a home down payment

Despite millennials accounting for 28% home buyers, 67% of the generation have not begun to save for a home down payment, a survey from Apartment List reveals.

While a down payment isn't necessary to buy a home, it does come with important benefits. A larger down payment increases the chances a mortgage lender offers a better rate. Making a down payment of at least 20% is usually required to avoid mortgage insurance, a cost that's tacked onto mortgages and insures lenders against the borrower defaulting.

Saving for a down payment can seem like a monumental task, but it's never too late to start. Figuring out how much you need to save, where to put your savings, and establishing a timeline can form the foundation of a budget that will make the home-buying journey manageable.

Among millennials, how much money have you saved for a down payment?

| Amount saved | Percent of millennials that have saved |

|---|---|

| $0 | 67% |

| <$10,000 | 15% |

| >$10,000 | 18% |

Older millennials put 11% down on average when buying a home

Older millennial home buyers -- those between 33 and 42 years old -- made an average down payment of 11% in 2022. Younger millennials put down 8% -- the lowest of any age group and well below the 20% threshold that is encouraged.

| Home buyers | Median percent financed |

|---|---|

| All | 14% |

| 24 to 32 | 8% |

| 33 to 42 | 11% |

| 43 to 57 | 10% |

| 58 to 67 | 20% |

| 68 to 76 | 21% |

| 77 to 97 | 27% |

Millennials are making a smaller down payment than the overall average for first-time home buyers, 14%.

Only Americans over 58 years old are making the recommended 20% down payment, on average.

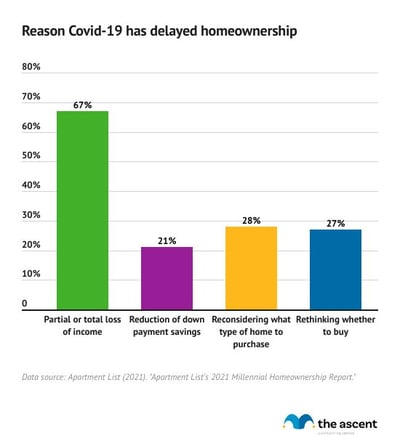

COVID-19 impacted homeownership plans for 40% of millennials and has delayed buying for 21%

The COVID-19 pandemic and its economic impact was an extraordinary challenge millennials faced as they reached their mid-30s. According to a survey in 2021 by Apartment List, 40% of the generation say the pandemic impacted their homeownership plans, with 21% saying COVID-19 has delayed home buying.

Financial hardship caused by the pandemic also dimmed homeownership prospects for some millennials.

Two-thirds of millennials who had home-buying plans delayed by COVID-19 cited loss of income as the reason. Meanwhile, 21% had to dip into money saved for a down payment for pandemic-related reasons.

The pandemic has also brought significant changes to daily life, including how people work and what neighborhood features they value. Along those lines, of millennials that delayed homeownership due to the pandemic, 28% said they reconsidered what type of home to purchase while 27% said they rethought whether to buy altogether.

COVID-19 impact on homeownership plans among millennials

| COVID-19 has had a direct impact on homeownership plans | 40% |

| Delaying homeownership | 21% |

Reason COVID-19 has delayed homeownership

| Partial or total loss of income | 67% |

| Reduction of down payment savings | 21% |

| Reconsidering what type of home to purchase | 28% |

| Rethinking whether to buy | 27% |

Of the 83% of millennials that saved cash during the pandemic, 59% said those savings would go toward a down payment on a home

While COVID-19 created financial hardship for many, 83% of Gen Zers and millennials were able to save money during the pandemic, and 59% said that they would put those savings toward a down payment on a home, according to a 2021 survey from Zillow.

What millennials will do with cash saved during pandemic

| Everyday living expenses | 64% |

| Down payment on a home | 59% |

Gen Zers and millennials that were able to save did so because the pandemic interfered with regular expenses, like childcare, and some discretionary spending, like shopping and travel.

52% of 18-to-29-year-olds were also living with their parents in July 2020 -- a record-high share -- which likely resulted in savings on housing costs for many.

Despite challenges, millennial home buyers have arrived

Millennials have overcome significant challenges to become a major player in the housing market, but they aren't out of the woods yet.

Even after the economic fallout of the COVID-19 pandemic, many millennials are still working toward overcoming barriers to homeownership, such as stubbornly high housing prices and rising mortgage rates. Plus, millennials are behind the pace of older generations for homeownership and are making below-average down payments.

But there is no question that millennials have arrived as a significant force in the housing market. And as more of the generation explores home buying and becomes homeowners, they have the potential to not only drive the market but reshape the home-buying process.

Sources

- Apartment List (2023). "Apartment List's 2023 Millennial Homeownership Report."

- Joint Center for Housing Studies of Harvard University (2021). "After a brief return, young adults quick to move out of parents homes as the pandemic continues."

- National Association of Realtors, (2023). "NAR Home Buyer and Seller Generational Trends."

- Pew Research Center (2020.) "A majority of young adults in the U.S. live with their parents for the first time since the Great Depression."

- Zillow (2020). "After Years of Decline, Household Formation Rates Were Improving Pre-Pandemic. Now What?"

- Zillow (2021). "Americans Want Digital Tools to Complement Traditional Home Shopping."

- Zillow (2022). "Buyers: Results from the Zillow Consumer Housing Trends Report 2022."

- Zillow (2021). "Young Adults Who Saved During the Pandemic Likely to Put it Toward a Down Payment."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.