I don’t think organization maven Marie Kondo was talking about business records here, but it certainly applies: “To put things in order means to put your past in order, too.”

Business records prove business transactions and activities. Growing a successful business requires organization on all levels, including your business records.

An effective records management system doesn’t take much time to maintain and streamlines bookkeeping, tax preparation, and financial audits.

Follow these tips to create a record-keeping system that keeps your blood pressure down during tax filing season.

1. Implement a document management system

All business transactions should be documented, whether on paper or electronically. As your business grows, so does the pile of paper and files your business needs to store.

First, go paperless so all your records are easily accessible. Then, implement a digital document management system that organizes your business documents. Then add a document control system that outlines how often to review and update documents.

2. Check for record retention mandates

Record-keeping isn’t just about putting a smile on your tax preparer’s face. It’s also to comply with document retention mandates.

IRS and Department of Labor (DOL) record retention mandates vary between two and six years, depending on the document. Regardless, maintain all business records for at least seven years.

Some business records, like a nonprofit’s tax-exempt certificates or a business tax ID, never become irrelevant, so always keep them close at hand.

IRS record retention rules apply to records that helped you calculate or justify business income, tax deductions, or tax credits. The DOL requires that you keep any documents that help you do payroll.

The IRS can audit your business’s financial records up to seven years in the past and even further back when you don’t file a tax return or are suspected of fraud. Most CPAs tell you to keep all business documents for at least seven years after they’re no longer relevant.

The most common business records include:

- Employee names, addresses, and contact information

- Employee timesheets

- Employee pay stubs

- All tax forms submitted to the IRS

- Bank statements

- Insurance documents

- Contracts, including loans and mortgages

- Purchase receipts

- Customer invoices

- Tax returns

- Financial statements

- Depreciation schedules

- Business registration documents

- Board of Directors meeting minutes

- Legal files

- Emails

States can further specify document retention rules, so check your state treasury department’s website for more detailed information.

3. Choose accounting and payroll software that generate records

Let software lead in creating small business accounting records, like customer invoices and payroll tax forms.

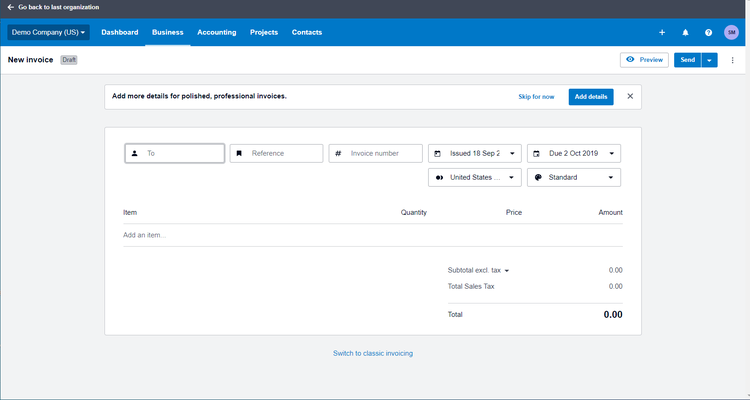

Most accounting software can generate customer invoices. The software should also automatically help you with the bookkeeping basics, like recording accounts receivable when you bill a customer.

Most accounting software can generate customer invoices. Image source: Author

Your payroll software should take care of creating payroll tax records, such as:

- Forms W-2

- Forms W-3

- Forms 1099-MISC

- Forms 1099-NEC, new in 2020

- Forms 941

Payroll software generates and files these forms with the appropriate authority, be it the IRS, Social Security Administration (SSA), or both. You can easily search for these forms in your payroll software whenever you need them.

4. Match records to transactions during bank reconciliations

Bookkeeping 101 teaches us to have documentation for all business transactions. Master the accounting basics by making record-keeping part of your small business bookkeeping.

Bank reconciliations help small businesses catch errors and understand their financial position. It’s also the ideal time to make sure you have records for all business transactions.

During your monthly bank reconciliation, match every transaction in your accounting software to a record. As you comb through your business transactions, make sure you have a matching invoice, receipt, or contract.

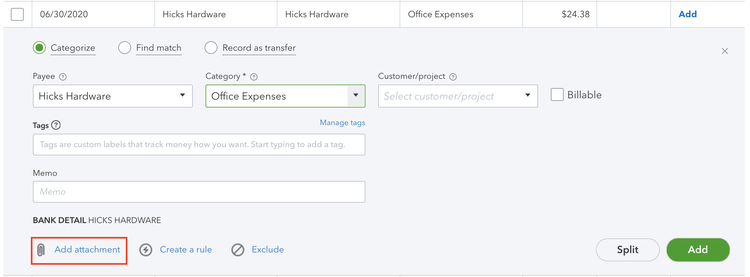

If your software allows it, store your business records in your accounting software. Intuit QuickBooks Online lets users attach documents to each transaction, so anyone who opens your books can view the associated record.

Attach records directly to business transactions in your accounting software. Image source: Author

5. Back up and secure your records

We live in a time where data breaches and natural disasters are rampant. Take time to back up and secure your records to avoid catastrophe.

Records stored on paper or on a hard drive should be backed up to at least one other location. Digitize all documents to preserve information that could be lost, stolen, or destroyed.

Storing records on cloud-based software lowers the risk of losing them, but it raises the risk of theft. Your business records include sensitive information, like employee Social Security numbers (SSNs).

When storing business records online, secure your account with a unique and strong password, and enable two-factor authentication.

FAQs

-

If you ever doubt whether a business record is worth keeping, save it. Ask a tax professional or attorney when you’re unsure if a record is important.

The IRS usually audits less than 1% of individual and corporate returns submitted, so don’t live in fear of an IRS audit. But if your business is chosen, they’ll require proof for all income, deductions, and credits you report on your taxes.

Without the proper documentation, you may face an increased tax liability and a negligence penalty equal to 20% of your underpayment.

-

When records are lost or stolen, your first reaction should be to inform anyone whose sensitive information may be at risk. For example, if payroll records have gone missing, inform your employees that their SSN might have been exposed.

If your records are unrecoverable, you should do your best to reconstruct all records that justify business tax deductions. Contact your vendors and financial institutions, who should have copies of your business documents.

If the IRS audits your company, you’re still responsible for proving business expenses claimed on your taxes.

-

It may seem logical to keep records for as long as you have the storage, but you may delete records that haven’t been relevant to your business for more than seven years.

By downsizing your pile of records, you’re making it easier to search for and review documents you actually need. Consult a legal professional before erasing swaths of business documents.

Put the needle on the record-keeping system

Accounting can be a challenge for a small business, but an organized record management system can make it easier. When you follow these best practices, you’re setting yourself up for a smooth tax season.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.