What Is IRS Form W-3? How to Fill It Out and File It

No, that’s not a typo. We’re not talking about Forms W-2 or W-4 here.

The little-known IRS Form W-3 accompanies Form W-2, which is one of the most famous tax forms -- if that adjective can be applied to a tax form.

Overview: What is IRS Form W-3?

IRS Form W-3 summarizes your employees’ earnings and tax withholdings. You file Form W-3 with the Social Security Administration (SSA), which uses it to verify that you’re correctly withholding payroll taxes from your employees’ checks.

Each employee receives a Form W-2 in January showing his or her earnings and tax withholdings from the previous calendar year. Your payroll software can send out these documents on your behalf to each employee and the SSA.

The Form W-3 acts as a cover sheet to the W-2s, adding the wages and tax withholdings found on each W-2. Form W-3’s official name is “Transmittal of Wage and Tax Statements.”

If you do payroll manually, you have to file Forms W-3 and W-2 yourself. Use a small business tax preparation checklist each January so you don’t miss a filing.

Form W-3 comes in handy with small business taxes because it puts all of your employee-paid payroll taxes in one place. Have it out when filing your business tax return.

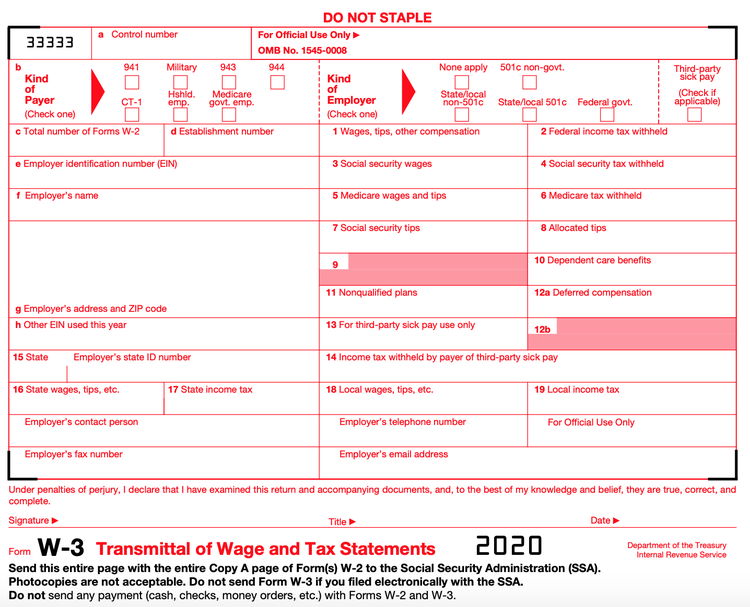

Form W-3 summarizes all employee earnings and tax withholdings. Image source: Author

Where can employers get Form W-3?

Form W-3 must be printed with special red ink, so you can’t copy or print it at home from the IRS website. You can order Form W-3 from the IRS online ordering site or wherever you got your paper copies of Form W-2.

If you submit Form W-3 with noncompliant ink, you may face a penalty.

How to fill out and file Form W-3 for your small business

Step 1: Fill out your W-2s

Before you fill out Form W-3, you need to finish filling out a Form W-2 for each of your employees. The information on each W-2 gets added up to fill out Form W-3.

Independent contractors don’t get W-2s; they receive Form 1099-NEC. As a rule, only employees who filled out a Form W-4 during the onboarding process should receive a W-2.

Step 2: Read the instructions

Filling out Form W-3 is not like building a dresser. You actually need to read the instructions.

Chief among them is you only have to worry about Form W-3 when you’re filing your employees’ Forms W-2 by mail. When you file electronically, the SSA Business Services Online automatically generates your W-3.

The number of employees you have -- really, the number of W-2s you file -- determines whether you can file your W-3 by mail.

You can find the W-3 instructions here on the IRS website. A few callouts:

- You must file Form W-3 online when you have more than 250 employees. The IRS and Treasury Department have the authority to reduce that employee count, but they have yet to do so. When you file electronically, the SSA automatically creates your Forms W-3.

- You can use one Form W-3 for up to 50 employees. Businesses with between 50 and 250 employees fill out multiple W-3s.

If you file your employees’ W-2s by mail, keep reading.

Step 3: Enter your business information (Boxes A-H)

The lettered boxes on Form W-3 help the SSA identify your business.

Box A. Control Number: You can ignore this box. If you have more than 50 employees and file more than one W-3, you can use this box to organize your internal records. There’s a space on Form W-2 to fill in a matching control number.

Box B. Kind of Payer: Most employers will choose “941,” referencing IRS Form 941, the quarterly federal tax return most businesses file. Small businesses that owe less than $1,000 in annual payroll taxes and file Form 944 can choose “944.”

Kind of Employer: Unless you run a nonprofit, you will likely mark “None apply.” Most nonprofits choose “501c non-govt.”

Box C. Total Number of Forms W-2: Tally up the number of W-2 forms you’re filing. Remember that the number of W-2s included on one Form W-3 can’t exceed 50.

Box D. Establishment Number: Businesses filing more than 50 W-2s use box D to explain how they separated their employees. Most small businesses can ignore this box.

Box E. Employer Identification Number: A business with even one employee must have an employer identification number (EIN). You can find your EIN on Form W-2.

Box F. Employer’s Name: This is just your business’s name.

Box G. Employer’s Address and Zip Code: Your business address.

Box H. Other EIN Used this Year: If your business changed EINs this year, enter the old number here.

Step 4: Add up your W-2s

Boxes one through 19 mirror Form W-2. Box by box, total each employee’s W-2, and input the result in the corresponding box on Form W-3.

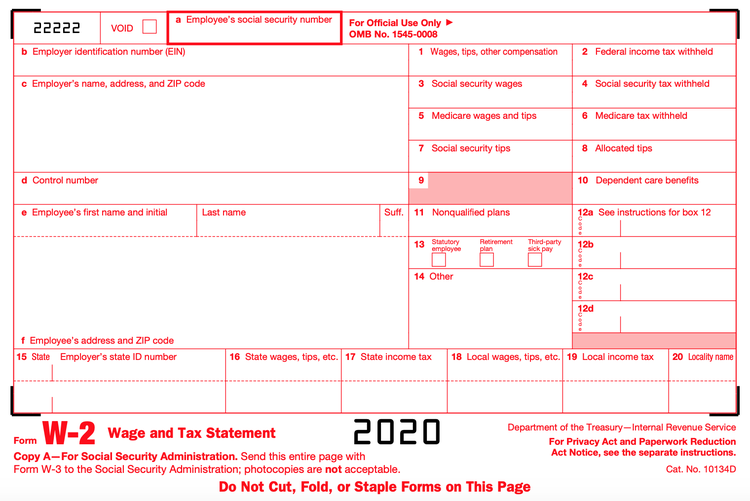

The boxes on Form W-2 match those on Form W-3. Image source: Author

Start with box one, which is gross wages. Go to each employee’s W-2 and find box one and add them all together. The sum is what you put in box one on Form W-3. Continue through box 19.

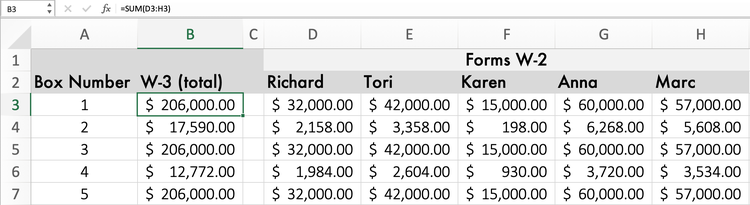

You should always keep a record of your tax calculations, including the arithmetic. Using a spreadsheet, enter the figures on each employee’s W-2 and total them to arrive at the amount for your W-3.

Use a spreadsheet to organize your employee’s Form W-2 data. Image source: Author

For example, your payroll software put $32,000 in box one on Richard’s Form W-2, $42,000 on Tori’s, and so on. Box one on your W-3 is $206,000, the sum of your employees’ gross wages.

Step 5: Check your work and other information

You’re nearly finished. Now, just check your work. Make sure your calculations are correct and that you didn’t accidentally transpose any numbers.

When you’re confident that you have an errorless W-3, fill in the bottom of the form with your contact information.

If you later find an error on your Form W-3, file Form W-3c as soon as you notice it.

Step 6: File your W-3 and W-2s together

Once you’ve filled in your Form W-3, you’re ready to file with the SSA. Form W-3 and Forms W-2 should be filed together.

If you’re still reading, you’re probably filing by mail. Send the forms here:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

If you’re filing electronically, you don’t need to fill out Form W-3 because it’s automatically filed when you submit Forms W-2. You can file online through your payroll or tax software.

What is the deadline for filing Form W-3?

You must file Forms W-3 and W-2 by January 31 of the following year. Send them off to the SSA as soon as they’re finished.

Your employees also receive a copy of their Forms W-2. Don’t share Form W-3 with employees, though.

Follow these steps, or just file electronically

You can avoid having to fill out Form W-3 and ordering special paper by filing Forms W-2 online.

Even the SSA recommends that you file Forms W-2 and W-3 electronically. When you do, the SSA automatically provides you with a digital copy of Form W-3.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles