What Is a Business Tax Receipt?

From the moment your small business opens -- and even before -- you’re paying taxes. One of the first taxes you’ll pay gives you a green light from your local government to start operating.

Overview: What is a business tax receipt?

A business tax receipt is proof that your business is cleared by a local government to sell products and services.

We’re not talking about a receipt showing that your business remitted its federal taxes. A business tax receipt is a sign of approval from a local government that you paid a nominal fee to start your business.

Many cities and counties require you to have a business tax receipt before your business opens its doors to the public. Obtaining a business tax receipt is one of the first steps in the business registration process.

Local governments charge a relatively low business tax -- anywhere between $20 and $500 -- for a business tax receipt. Most governments require that you renew it annually for the same amount.

Not all jurisdictions call a business tax receipt by that name. Some call them business tax certificates, business tax licenses, or something else entirely.

Your tax software might not tell you about this business tax, so do your due diligence to make sure you’re following the rules to opening a business in your area.

Examples of business tax receipts

Many -- but not all -- jurisdictions require business tax receipts before you start selling products and services. Let’s look at a few cities and counties requiring business tax receipts for their local businesses.

Orlando, Florida

Businesses that share a city with Disney and Universal Studios must pay a local business tax before opening.

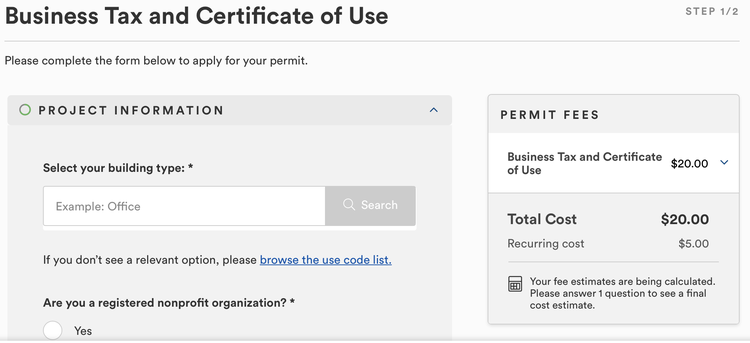

The Orlando business tax receipt, called a business tax and certificate of use, costs about $20 and must be renewed annually. Orlando business owners also need an Orange County business tax receipt.

Orlando, Fla.., requires a business tax receipt for most businesses to operate. Image source: Author

Lompoc, California

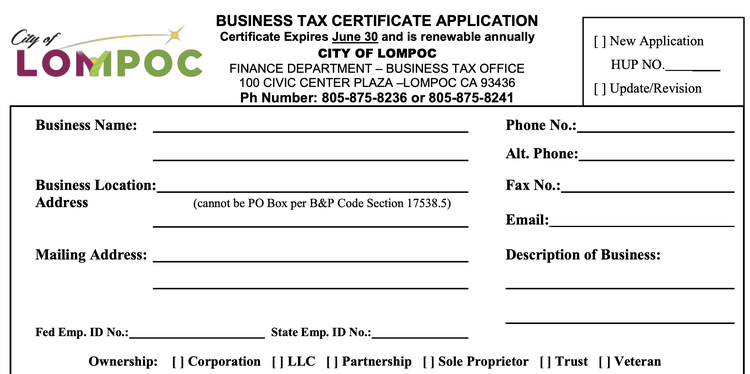

Businesses in Lompoc pay between $30 and $475 for a business tax receipt, depending on the business’s annual revenue. The city uses the tax revenue to fund its police and fire departments, parks and recreation programs, and other local services.

Lompoc, Calif., funds local services with business tax receipt revenue. Image source: Author

Fairfax County, Virginia

This county in northern Virginia requires that businesses pay a Business, Professional and Occupational License (BPOL) tax within the first 75 days of operation.

The tax amount depends on the business’s revenues. Companies that bring in $100,000 or less pay a flat fee, while businesses with higher revenues pay a rate based on their industry.

The business tax receipt amount for companies in Fairfax County, Va., varies by gross receipts. Image source: Author

How to obtain a business tax receipt

Follow these steps to get a business tax receipt for your company.

1. Register your business

You need a business before you can ask the local government to let you start operating. Follow our guide to business registration.

2. Apply for the business tax receipt

Once you have a business, complete an application for the business tax receipt in your city, county, or both.

You’ll need the following information to complete the application:

- Federal employer ID number (EIN), also called a business tax ID

- State taxpayer ID

- Owner name

- Business name

- Business address

- Description of business

- Contact information

Many local governments have online applications, while others require you to mail in a paper form. You should expect to wait a few weeks to receive a decision on your application.

3. Pay the business tax

You’ll pay for the business tax receipt at the time of application or after you’re approved, depending on the local government’s requirements.

Once you’re approved and paid up, you’re ready to open your business. Depending on the type of establishment you’re operating and where your business is located, you might need to display your business tax receipt in a place where customers can see it.

FAQs

-

Your local government website can answer this for your specific business.

A mailing address change within the same jurisdiction doesn’t always trigger the purchase of a new business tax receipt. If you sell your business to another party, the new owner might need to pay to transfer the business tax receipt.

-

Most business tax receipts last just one year and require annual renewal. Check your town and county tax collector websites to see the terms of your business tax receipts.

-

Usually, you need a business tax receipt for every business you operate. For example, if you have three businesses operating in Orlando, Fla., you need three separate business tax receipts.

Check with your local tax collector website to learn the requirements for your business.

-

Not all cities and counties require business tax receipts. However, it’s likely your city or county will make you pay for a business license before you start operating.

Don’t forget that cities and counties can levy taxes on residents and businesses in their jurisdiction. They could add a business tax receipt requirement or impose a similar tax by a different name.

-

Your jurisdiction might exempt certain types of businesses from obtaining business tax receipts. For example, Deltona, Fla., does not require business tax receipts for nonprofit libraries, art galleries, and museums that are open to the public.

Generally, though, at-home businesses are not exempt from a business tax receipt requirement.

Local taxes are IRS-deductible

When you file your federal business tax return, you might be able to deduct the business tax receipt as a business expense.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles