How to Calculate Your Pre-Money Valuation

The term sheet you receive from a venture capitalist will have a bevy of negotiable assumptions. Foremost among those is pre-money valuation.

So-called because it is the startup valuation before venture capital (VC) investment, everything comes from the pre-money valuation. The higher you can negotiate the pre-money valuation, assuming all else is equal, the more of your company you will retain.

In this article, we will talk about the pre-money valuation, how it relates to post-money valuation, and a pre-money valuation formula for your company.

What is pre-money valuation?

Pre-money valuation is the calculated value of your business before the new cash from the investment is added to your balance sheet. The pre-money valuation is typically negotiated and then the post-money is a calculated number based on the pre-money, total shares, and the investment.

An example of pre-money valuation

Let’s take a look at SaaSy Stylez, which I recently wrote about in my article explaining post-money valuation.

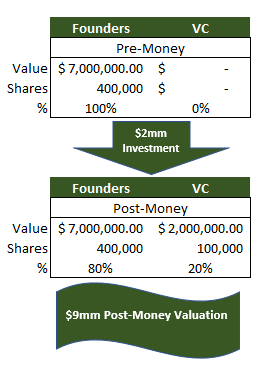

SaaSy Stylez has a pre-money valuation of $7 million. Image source: Author

The company agreed with its investors to a capital valuation of $7 million. Before the investment, there were 400,000 outstanding shares and the founders owned 100% of the company. The investment adds $2 million in cash in exchange for 20% of the company, so 100,000 new shares need to be issued, and the post-money value is $9 million.

What to consider when choosing a valuation model

While the pre-money valuation is a negotiated amount, it still helps to have good analytical backing for whatever number you come to the table with.

1. Do you have revenue?

To a point, a startup seeking venture capital with $500,000 of revenue doesn’t differ from one that is pre-revenue. If you’re projecting billions of future cash flow, $500,000 doesn’t make much difference, and the cash burn from startup expenses makes it difficult to reliably value the company based on cash flow.

There is a legitimate difference if your company has breached seven figures of revenue and has a long-term cost structure in place. Much of your valuation will still be based on revenue, but there are other factors including EBITDA and return on capital that will impact the valuation when considering a more mature company.

2. Do you have reliable comparable multiples?

Once you have your financial projections down, it’s time to find comparable multiples. VCs love nothing more than comparisons. They’ll compare you to other managers they’ve worked with, your market placement to other companies, and your valuation to competitors.

There are traditionally four types of comparable multiples:

- Historic: Compare the multiple at an earlier time to now.

- Public stocks: Compare the multiple to similar companies trading on the stock market.

- Acquisitions: Compare the multiple to similar, recently acquired companies.

- Other VC investments: Compare the multiple to other recent funding rounds for similar companies.

The key is similar companies. If you run a $5 million revenue medical device company with an exciting new product, it makes no sense to compare your business to a stodgy old railroad company trading on the stock market.

Use public stocks for comparison only if nothing else is available. They will typically be far too big for comparison, and they will almost certainly trade for a lower multiple than a fast-growing startup should.

Historic multiples can be a trap. If your company is progressing and proving itself, you want to see some sort of multiple expansion that reflects that. The multiple settled on three rounds ago should have been based on a lot less certainty than there is now.

Other VC investments would be nice to compare, but it is exceedingly hard to find reliable information, especially as the business owner.

The best multiple to lean on is recent acquisition. Ideally, find companies that do something similar to what you do with a similar business model and a similar size. You’ll probably hear these acquisitions called, “precedent transactions.” You can rely on the acquisition price to argue that it is a potential exit for the VC. VCs never want to make an investment without a reasonable exit in mind.

3. Share dilution

Ownership dilution may be the number one source of wealth loss for startup founders. It is the $640 toilet seat of the venture capital world.

Here are a few ways your shares can be diluted:

- Anti-dilution provisions: Ironically, you can be diluted by anti-dilution provisions that early round investors insert into terms such as valuation caps. The provisions are meant to stop the investors from being diluted, but those extra shares usually come from you.

- Venture debt: Using debt for growth as a startup is possible, but it comes with a high cost. Venture debt typically imposes rates much higher than bank debt and probably has a conversion option, meaning the lender can convert it to common stock and become a part owner. Investors and lenders need to be able to participate in the upside of startups because of the high risk involved.

- Option pool: Employee stock option plans (ESOP) are a great way to incentivize employees and attract new talent. Hard working and enterprising employees know their worth and want to be compensated for it. The lottery ticket aspect of working for a start-up accomplishes that goal. Just remember, those shares aren’t coming out of the VC’s ownership.

When choosing your model and doing your valuation, you have to keep dilution in mind -- the VC certainly will.

How to calculate your pre-money valuation

Let’s take a look at how SaaSy Stylez (starting to regret this fake name choice) calculated its $7 million pre-money valuation.

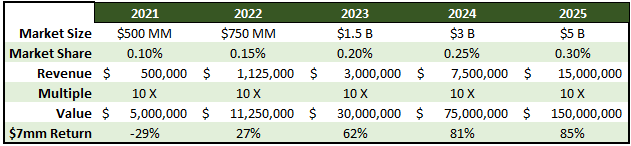

At a $7 million valuation, the investor could earn 85% per year for five years. Image source: Author

Let’s look at each line on the table. Market size is notoriously hard to predict. As I wrote before, I once spent an afternoon walking around a sporting goods store counting the number of items on various end caps to try to predict what the market size would be for portable solar panels.

The market size is the aggregate dollars spent on the entire industry. Typically, this is a domestic number, but companies that can easily sell their product overseas would use a global estimate.

Market share is the percent of the market that goes to your company. Market share times market size is equal to revenue.

10x revenue would actually be a low estimate for a startup, but since I was using the back-in to a number method to make the graphic work, it’s what we’ll go with. The revenue amount each period times the multiple is equal to a projected value in that year. The projected value in 2025 is $150 million and the pre-money valuation is just above $7 million. What gives?

Venture capital is about high returns. An 85% return to the investor seems like a rip-off to the founder but it’s a give-and-take. Eighty percent of $150 million is far more than 100% of $7 million. If you need the cash to grow, it’s worth sacrificing some ownership.

From the investor’s viewpoint, out of every ten companies that a run-of-the mill VC invests in, zero will get to a $150 million valuation. VCs have to discount management projections and then build in a high projected return to make up for the high risk they assume with the investment.

It’s more about the negotiation

Ultimately, pre-money valuation is a negotiated number. No standard formula or accepted resource exists to value every company. It’s about what you can back up and how much you can negotiate for.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles