A Guide to Tax-Advantaged S Corp Health Insurance Deductions

As you decide on your business structure, you’re probably considering each type's legal and financial protections. It’s unlikely you’re thinking about the tax implications of your healthcare costs. That’s where the S corporation business tax structure can surprise many business owners.

Business owners start corporations to insulate themselves from their company’s debts. Some corporations can elect S corporation taxation to avoid the double taxation that comes with traditional C corporations.

S corporations further advantage owners involved in management because they can pay themselves in dividends after a reasonable salary. Dividends are subject to federal and state income tax but not payroll taxes.

But the S corporation waters muddy when it comes to providing owners with health insurance benefits. Follow our guide to achieve the maximum tax advantage for S corporation owners’ health insurance.

How do health insurance benefits work for S corporations?

Just like other business structures, S corporations can offer health insurance premium coverage for their non-owner employees as a tax-free fringe benefit. The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return.

S corp owners who participate in management are considered employees, but they’re treated more like the self-employed for insurance benefits. Unlike non-owner employees, shareholders with more than a 2% stake can’t receive accident or health insurance as a tax-free fringe benefit.

When an S corporation offers a shareholder-employee health insurance, the costs are included in gross wages, are subject to federal and state income taxes, and appear on the shareholder-employee’s Form W-2.

If you follow our guide, you can avoid paying FICA taxes, which comprise Social Security and Medicare taxes, on the S corporation’s contribution. You can also get a personal tax deduction for your health insurance premiums.

Before we start, don’t try to get smart with the IRS. You can’t employ your non-owner spouse to get insurance for you and the rest of your family: Your S corporation ownership extends to your spouse and family members in this case.

You also can’t take the personal tax deduction for health insurance premiums if you or your spouse were eligible for another subsidized health insurance plan. The deduction only applies to S corp shareholders who cannot get health insurance any other way.

How to deduct shareholder health insurance for S corporations

Follow this guide to tax-advantaged health insurance benefits for S corporations.

1. Offer health insurance to you and your employees

You lock in the best tax savings when you offer your employees the same health plan as you offer yourself. If you’re the only employee in your S corporation, skip this step.

It’s not a legal requirement for businesses with fewer than 50 full-time employees to offer health insurance, but that’s how you avoid paying FICA and federal unemployment (FUTA) taxes on your personal health insurance benefits.

The IRS lifts FICA and FUTA payroll taxes when all or a class of employees can get health insurance coverage. For example, you can avoid payroll taxes by offering health insurance to all full-time employees.

You might also qualify for a small business tax credit when you cover at least half of your employees’ health insurance premiums.

If it’s available to you, purchase a health insurance policy through your S corp. Some states don’t allow corporations to buy health insurance policies when there’s only one employee. In any case, you can qualify for a self-employed health insurance tax deduction.

2. Pay insurance costs through your S corporation

Your S corp must pay your health insurance costs to get the personal tax deduction. When you pay your premiums with personal money, make sure that your business reimburses you. Even better, use business funds to directly pay your insurance company.

Use your accounting software to track your health insurance expenses. You need to know your healthcare costs for step three.

3. Add health insurance costs to gross wages on your W-2

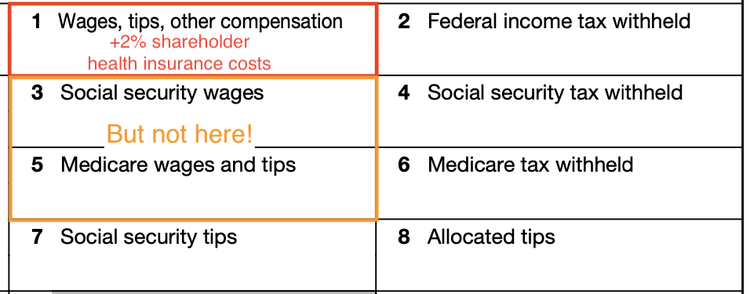

S corporation owners who participate in management are considered employees, which means they’re issued a W-2 every January. In W-2 box one, gross wages include healthcare costs your S corp paid during the year.

If you correctly followed the steps above, healthcare costs shouldn’t be included in boxes three and five, which list your wages subject to FICA taxes.

S Corp shareholders of 2% or more include their company-paid health insurance premiums in box one on Form W-2. Image source: Author

4. Deduct employee insurance premiums on your business tax return

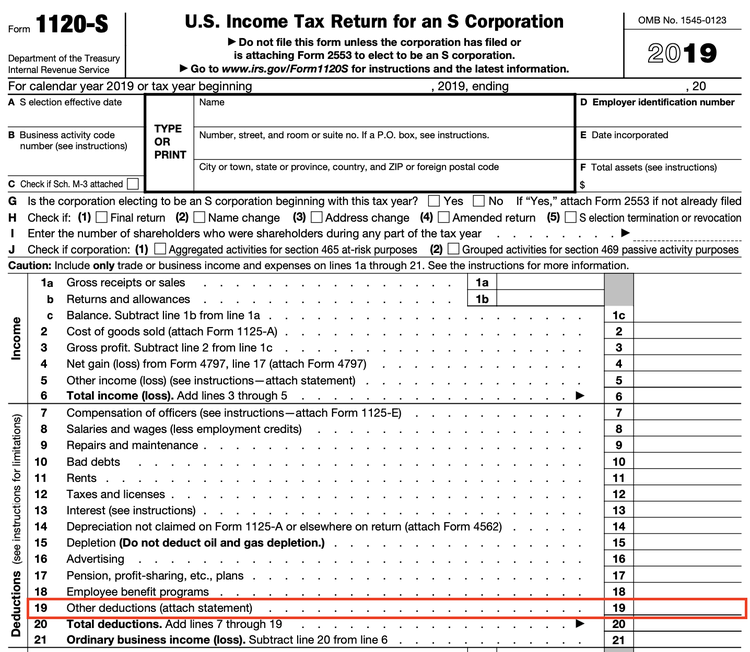

S corporations are pass-through entities, meaning they pay their small business taxes solely on their shareholders’ personal tax returns.

Still, S corporations file information return Form 1120-S, which details business earnings to the IRS. It’s on this form -- line 19, to be specific -- that you deduct insurance premiums paid to employees. It reduces your business’s taxable income, which lowers your personal tax liability when it floats onto your personal tax return.

Report your S corporation’s contributions to non-shareholder health insurance premiums on line 19 of Form 1120-S. Image source: Author

5. Deduct your insurance premiums on your personal tax return

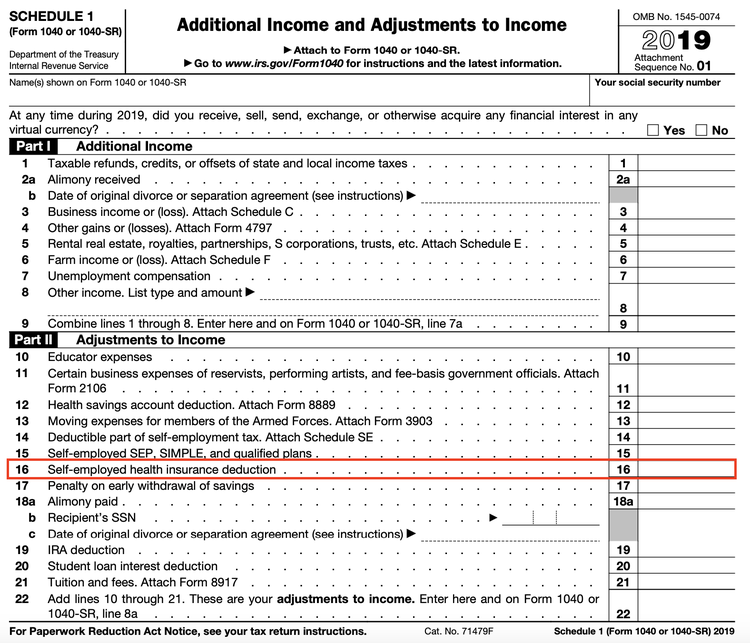

When it comes to health insurance, you’re treated like a self-employed person as an S corporation owner. You can deduct the cost of healthcare premiums for you, your spouse, and your dependents on Form 1040 Schedule 1.

Take your self-employed health insurance deduction on Form 1040 Schedule 1. Image source: Author

This is a special deduction. I’m going to nerd out for a second, but I’ll come back to explain what I mean. Self-employed health insurance deductions are called “above-the-line” deductions, which lower adjusted gross income (AGI).

What that means is potentially more tax savings. Most other tax deductions are “below the line.” This is significant because AGI -- the “line” we’re talking about -- is the barometer that determines your eligibility for many tax deductions and credits. The lower your AGI, the more likely you are to qualify for more tax savings.

Your self-employment tax software can walk you through taking the self-employment health insurance deduction.

FAQs

-

For you, a 2% or more S corp shareholder, the Affordable Care Act (ACA) doesn’t affect how you deduct your S corp-provided health insurance benefits. Things get sticky for your employees, however.

The ACA requires that S corporations establish group health insurance plans instead of reimbursing employees for their individual plan costs. Companies that violate ACA rules are subject to a daily $100 excise tax for every employee and violation.

S corps with fewer than 50 full-time and full-time equivalent employees can get a pass, though. If they follow all the rules, small S corps can reimburse their employees for medical costs up to a maximum amount.

Check the IRS website for more information about Qualified Small Employer Health Reimbursement Arrangements (QSEHRA). Better yet, offer a group health insurance plan to avoid this issue.

-

Your self-employed health insurance deduction cannot exceed your portion of S corp income. Say you own 25% of an S corp, which earned $50,000 last year. You and your family’s medical health insurance premiums totaled $15,000 last year.

Since your portion of S corp income is only $12,500 ($50,000 x 0.25 ownership), that’s the maximum self-employment health insurance deduction you can take despite higher premiums.

-

Your payroll software automatically generates your Forms W-2 at the beginning of every year, but your gross wages will be wrong if you don’t add your healthcare costs into the record.

Your software likely has a feature that lets you enter your shareholder healthcare costs for tax reporting purposes. You can probably find a software-specific guide doing a Google search of “Report S corp shareholder premiums,” along with the name of your payroll software.

One of the few downsides

The S corporation business structure has a lot to offer. Yes, the road to tax-advantaged health insurance might make the structure feel less worthy for your business, but many business owners happily deal with this list because of the longer list of advantages.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles