Many married couples team up on a business venture without realizing they've formed a partnership. Some form limited liability companies (LLCs) for the legal protections, unaware that these entities are also taxed as partnerships at the federal level. At tax time, they just report their income on a joint Form 1040, attach a Schedule C, and get back to work.

Yet under federal tax laws, these small family businesses must file partnership tax returns. That wouldn't be a big deal, except that it adds about 270 hours’ worth of paperwork and $4,400 in professional fees to their annual tax filings by Internal Revenue Service (IRS) estimates.

Husband-wife partnerships may shed that burden by electing to be taxed as a qualified joint venture (QJV) instead of a partnership. Find out whether a QJV makes sense for your business.

Overview: What is a qualified joint venture?

A qualified joint venture is a federal tax status married couples may elect if they run a business together. To qualify, your business must meet these criteria:

- The only members are yourself and your spouse

- You file a joint tax return

- You both materially participate in the business

- You both make the qualified joint venture election

- You have not formed a legal business entity or you have formed a limited liability company (LLC) in a community property state

To qualify as a QJV, your married partnership must be a shared business or trade. Joint ownership of property alone doesn't qualify for QJV treatment.

Typical Small Business Tax Burden for Qualified Joint Ventures vs. Partnerships

| Qualified joint venture | Partnership | |

|---|---|---|

| Form 1040 | ✔ | ✔ |

| Schedule C or F | ✔ | ✔ |

| Schedule SE | ✔ | ✔ |

| Schedule E | ✘ | ✔ |

| Form 1065 | ✘ | ✔ |

| Schedule K-1 | ✘ | ✔ |

| Schedule M-1 | ✘ | ✔ |

| Estimated time | 52 hours | 322 hours |

| Estimated cost | $470 | $4,870 |

Qualified joint ventures have much less tax paperwork to file each year than partnerships.

How the qualified joint venture works

You can elect qualified joint venture status on your annual tax return by filing a joint IRS Form 1040 and attaching a separate tax Schedule C for each spouse, along with separate additional schedules such as Schedule SE as required.

If you run a rental real estate business, you must file a joint Schedule E and check the "QJV" box on line two. Unlike the other schedules for the QJV, you do not file multiple Schedule E tax forms.

As a qualified joint venture, you're being taxed as two sole proprietors. Sole proprietorships are simple to manage because they are disregarded entities, meaning they need not file separate tax returns for the business.

That makes your QJV tax return relatively simple and quick. Partnerships, as you can see from the above chart, must file Form 1065 and accompanying schedules besides the 1040.

If you've filed partnership returns for a qualified business in the past, you can switch to QJV status just by filing the joint 1040 and required dual schedules for the following tax year. If your business no longer qualifies, you automatically revert to partnership status and must file partnership returns.

Once you make the QJV election in a tax year, it can only be revoked with permission from the IRS. You can find further details on qualified joint ventures on the IRS website.

Proportional shares of income

As a QJV, you must split profits between spouses according to your shares of ownership in the company. If you each own half the business, you must split the profits on your tax returns 50/50. That means splitting income, gains, losses, deductions, and credits accordingly.

This equal division of profits has the added benefit of ensuring that each spouse receives credit for earnings under Medicare and Social Security. It also allows both spouses to contribute fully to a qualified retirement plan account.

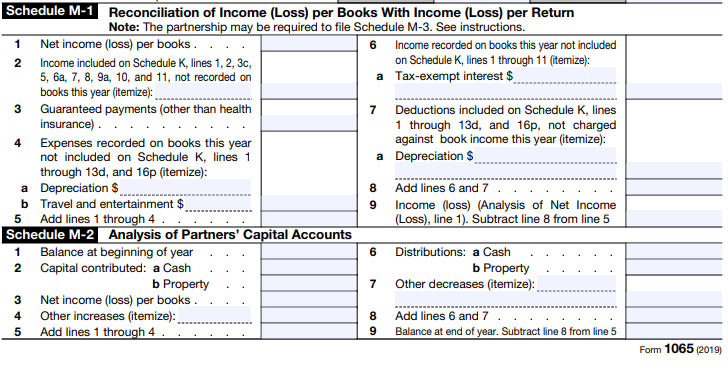

Partnership returns require complex financial analysis such as capital account reconciliation. Image source: Author

Married-couple LLCs in community property states

The IRS designed qualified joint ventures for unincorporated businesses. If you have formed a legal business entity such as an LLC, you generally can't take advantage of the election.

If you live in a community property state, however, you may be eligible even if you have formed a husband-and-wife LLC. Your LLC must be formed in the community property state and solely owned by you and your spouse, and you must both make the qualified joint venture tax election.

Community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Why the different treatment? It's because the IRS recognizes only three kinds of businesses: corporations, partnerships, and sole proprietorships. Single-member LLCs are taxed as sole proprietorships and multi-member LLCs as partnerships.

Community property laws threw this system into a loop because they treat spouses as one person. In response, the IRS enacted Rev. Proc. 2002-69 allowing spouses who operate LLCs in community property states to be taxed as QJVs, essentially treating them as sole proprietorships.

Both spouses must materially participate

Another key aspect of qualified joint ventures is that both spouses must materially participate in the business. Having one spouse participate as an investor is not enough to qualify.

The IRS has seven rules for determining material participation. The rules are complex, and this is a high-level summary.

You and your spouse materially participate if any one of the following rules is true in the prior year.

- You worked in the activity for more than 500 hours

- You worked more than any other owner or worker

- You worked for more than 100 hours and at least as much as any other person

- You worked in several activities, each for more than 100 hours, with all hours totaling more than 500

- You materially participated for any five of the past 10 years

- The activity is a personal service and you materially participated for any 3 prior tax years

- You worked regularly, continuously, and substantially in the activity for at least 100 hours; you paid no one to manage it; and no one spent more time managing it than you did

Material participation is a complex area of federal tax law. You can read the full requirements in IRS Publication 925, but caffeinate yourself beforehand.

To ensure compliance, keep sufficient activity logs as part of your regular business documents to show you and your spouse worked in the business to meet one or more standards.

A document management system such as DocSend can make managing everyday paperwork from your business much easier.

Document management software such as DocSend can help you manage paperwork efficiently. Image source: Author

Spouses need separate taxpayer identification (ID) numbers

Like sole proprietorships, QJVs don't require a separate Employer Identification Number (EIN) for the business unless you need one for filing other taxes such as sales or employment taxes. You can simply file under your Social Security numbers.

Whether or not you use EINs for the business, each spouse must have a separate taxpayer ID number.

Should you choose to be treated as a qualified joint venture?

Is QJV the best choice for your business? Here are some factors to consider.

When a qualified joint venture makes sense

A QJV is a good fit for spouse-owned businesses when:

- You're in it together: QJVs are designed for businesses with two materially participating spouses, a relatively high standard.

- You aren't incorporated: Corporations and most LLCs don't qualify.

- You're not looking for new owners: If you don't foresee bringing on new partners or investors, a QJV might be right for you.

When a partnership makes sense

Partnerships make the most sense when:

- You need limited liability protection: In most states, you have to choose between liability protection and the simplicity of QJV tax status.

- You need to file separately: If filing jointly is not advantageous, a QJV won't work for you.

- S corporation status is a better choice: While S corps won't save you any paperwork, they can lower your bottom-line tax bill.

FAQs

-

Yes. If your business has employees, you can file as a QJV. Either spouse can report and pay employment taxes individually under a Social Security Number or EIN.

-

If you qualify for QJV status and you've been reporting your business income jointly, simply file the correct forms going forward. Since it doesn't change your bottom-line tax bill, the IRS is unlikely to object to your past filings.

If you do get a request from the IRS to file Form 1065 for a prior tax year, you can call the toll-free number on the notice and let them know how you filed. Again, since it only affects your paperwork, and not the taxes you pay, there's no point in correcting past oversights unless prompted. Just do the correct paperwork going forward.

-

Unfortunately, if you're not in a community property state, you don't have the option of filing as a QJV, and you need to file partnership returns.

-

No. If you filed for an EIN for the partnership, it remains tied to the partnership permanently. You'll need to get separate EINs for each spouse or use Social Security numbers for your QJV.

A benefit for your small business

Qualified joint ventures are the IRS's way of showing a little love to small family businesses. And since it's just a matter of adding a few schedules to your joint tax returns, it's easy to make the switch if you qualify. By knowing your options, you can file with confidence each spring and get right back to growing your business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.