Running payroll for the first time is always challenging, but running restaurant payroll can be particularly challenging. In fact, even experienced restaurant owners often struggle with restaurant payroll management.

We’ll break down some of the challenges that restaurant owners face, along with ways to make processing payroll for restaurant employees just a little bit easier.

What to consider when setting up and running payroll for a restaurant

Before you get started with payroll for your restaurant, you’ll want to have these four things in place:

- Your EIN (Employee Identification Number) and state tax I.D. numbers

- A separate bank account to pay employees and taxes

- Completed employment forms, such as I-9 and W-4

- A payroll schedule

Once these items are complete, you can move on to setting up your payroll system.

The first thing that is different about restaurant payroll is the minimum wage requirement. Unlike standard employees, restaurant employees who receive tips as part of their income can also earn a minimum wage that is different than other employees, depending on the state your business is in.

For instance, even though the federal minimum wage is currently $7.25, states like Texas and New Mexico can pay tipped workers $2.13 minimum wage, while other states like Illinois and Florida have a higher tipped minimum wage requirement in place.

To add to the confusion, there are states like Nevada and California, where restaurant owners are required to pay full minimum wage to their tipped employees.

There may also be some local minimum wage requirements where your business is located, which can supercede federal minimum wage requirements. The difference between the tipped wage paid to your employees and the federal minimum wage is considered a tip credit.

Having this information is imperative before you look for restaurant payroll services, since you may or may not have to calculate the difference between the restaurant minimum wage and the standard minimum wage to determine if the employee has made up the difference.

Here are a few other things to consider when setting up payroll for your restaurant.

1. Tip reporting

In order to calculate payroll properly, you will need to institute a proper tip reporting system. If you are taking a tip credit, your tipped employees will need to report their tips to you on a daily basis in order to ensure proper payment.

All other tipped employees can report tips to you on a monthly basis, which will ensure accurate tax payments. It’s important that you retain a copy of all reported tips in case of an IRS audit or an employee complaint.

If your business is in a state where tip credits can be taken, the Fair Labor Standards Act (FSLA) requires you to provide tipped employees with the following information:

- The amount of their wage, which can be no lower than $2.13 per hour.

- The maximum tip credit that you (as an employer) can take is $5.12 per hour.

- The tip credit taken cannot exceed the amount of tips the employee earns.

- It is the employer’s responsibility to substantiate that wages paid to all employees meet the minimum wage requirement.

- If the tip credit does not meet minimum wage requirements, you have to make up the difference.

- You are barred by federal law from deducting any breakage or register shortages from employee wages.

- Overtime is calculated based on the standard minimum wage minus the tip credit.

2. Minimum wage vs tipped wage

Unless your business is in California, Nevada, Oregon, Washington, Montana, Minnesota, or Alaska, you will need to be sure to calculate wages properly. To understand how payroll works for a restaurant, look at the following calculation for a tipped employee working in a state that allows a reduction in minimum wage.

Sharon currently earns $2.13 an hour. She worked 37 hours last week and earned $150 in tips. To calculate her check, you would do the following:

37 x $2.13 = $78.81

Next, we’ll add her tips to her wages:

$78.81 + $150.00 = $228.81

We next have to determine if Sharon’s tips are enough to make up the difference between the federal minimum wage and the tipped minimum wage, so we’ll calculate that:

37 x $7.25 = $268.25

Sharon needs to be paid at least $268.25 in order to meet federal minimum wage requirements, but she only earned $228.81, meaning that her pay was short.

$268.25 - $228.81 = $39.44

Because Sharon’s tips weren’t enough to make up the difference between the two wages, you will need to add an additional $39.44 to Sharon’s paycheck to make up the difference.

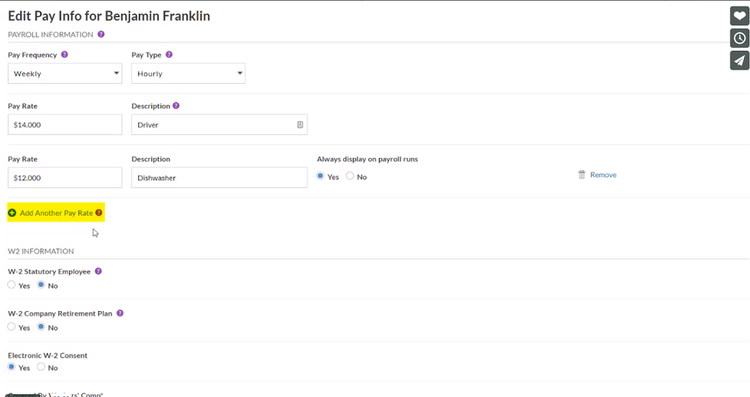

3. Multiple pay rates are necessary

Unlike an office or administrative role, restaurant employees often have more than one role to fill.

Patriot Payroll lets you enter multiple rates for your employees who do multiple jobs. Image source: Author

With those multiple roles come multiple pay rates. It’s important that you are able to track how many hours Sam works as a cook, and how many hours he works as a floor manager.

It can become even trickier when tipped employees enter the mix, since you’ll also have to track tipped wages vs federal minimum wage as well as the hours worked in another capacity.

4. Paying overtime properly

If tipped employees work overtime, there is a special calculation you will need to do in order to pay them properly.

For instance, Brad is a waiter who worked a total of 47 hours during the week. He currently lives in Texas, one of the states where his tipped wage is $2.13. How do you calculate his overtime?

First, calculate Brad’s regular pay:

40 x $2.13 = $85.20

Next, you’ll have to calculate the standard overtime wage:

$7.25 x 1.5 = $10.88 per hour

After this, you’ll subtract the tip credit allowed in your state. Since Brad lives in Texas, the tip credit his employer can take is $5.12.

$10.88 - $5.12 = $5.76 per hour for overtime

Since Brad worked 47 hours, he’s entitled to 7 hours of overtime, which is calculated as follows:

7 x $5.76 = $40.32

Brad’s total pay for this week is:

$85.20 + $40.32 = $125.52

When figuring his final pay for the week, don’t forget to calculate in any tips earned, which will determine whether you need to add an additional amount to his paycheck.

How to run payroll for your restaurant

If you live in a state where you have to calculate the difference between your tipped employee’s minimum wage and the regular minimum wage, you’ll need to first determine exactly how tips are handled in your restaurant. Here are some options:

- Each tipped employee retains his or her tips

- Tips are pooled between all commonly tipped employees

- Tips are shared based on roles, such as 15% to bussers, 20% to bartenders, and 65% to servers

- Tips are shared between all employees

On a side note, if you institute a policy where you require tips to be shared among all employees, be sure to check out your state’s individual laws regarding pooling tips.

Keep in mind that if your policy allows sharing of tips among all employees, you are required to pay all of your employees full minimum wage, not the reduced wage. If you choose not to institute a tip policy, your employees will simply retain their own tips.

If you’re paying a reduced wage to your tipped employees, here are the steps to follow to prepare and run payroll:

- Collect timesheets and calculate gross pay

- Collect tip reports from all tipped employees

- Calculate the difference between reduced minimum wage and required minimum wage and enter the difference, if necessary

- Calculate all taxes due, including federal income tax and both Medicare and Social Security (FICA) tax based on both wages and tip income

- Be sure to keep a copy of each employee’s reported tips in their personnel file

As an employer, you’re responsible for the following taxes:

- Payroll taxes to the IRS, which include both federal withholding as well as the employee and employer portion of FICA.

- Federal Unemployment Tax Act (FUTA) is paid to the federal government, which funds state unemployment programs. FUTA payments are due quarterly.

- State Unemployment Tax Act (SUTA) is a tax collected by your state that funds unemployment.

- Any city, county, or local taxes, as determined by the location of your business.

You’re also responsible for filing IRS FORM 941 quarterly, which reports the total federal withholding tax and both employee and employer FICA tax, as well as IRS FORM 940 - Employer’s Annual Federal Unemployment Tax (FUTA), annually.

If you take tip credits, you can also file IRS Form 8846 - Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. Some restaurants use Form 8846 to obtain a credit on a portion of Social Security and Medicare taxes paid by you on behalf of your employee.

The best payroll software options for restaurants

Overwhelmed yet? Not to worry; there are plenty of restaurant payroll services available that can help ease your mind. To learn more, check out our in-depth reviews of payroll software, but here are a few that we wanted to call out in particular.

1. OnPay

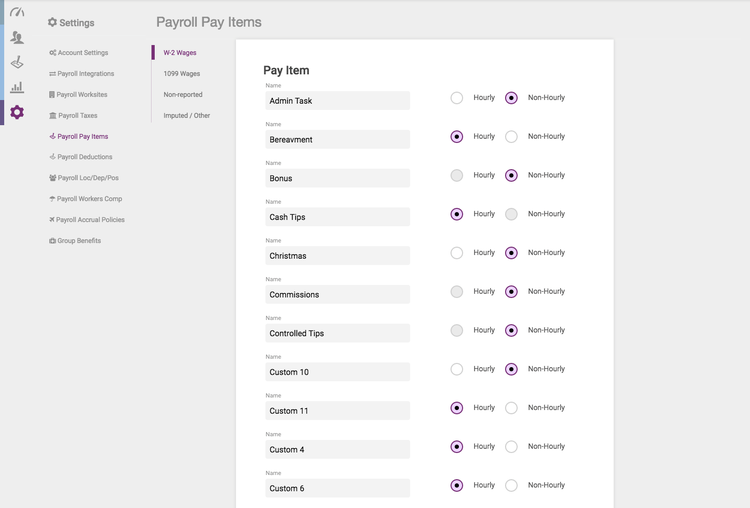

Along with features like unlimited pay runs and new employee self-onboarding, OnPay offers features designed with restaurant owners in mind, including the ability to add cash tips as a pay type in your payroll.

You can set up multiple Pay Items in OnPay for easy tip tracking. Image source: Author

Source: OnPay.com

OnPay offers the following features for restaurants:

- Easy tip entry and calculation

- Minimum wage tip makeup to stay in compliance

- Multiple pay rates for employees

- Files Form 8846

Completely online, OnPay charges a $36 base fee plus a $4 fee per employee.

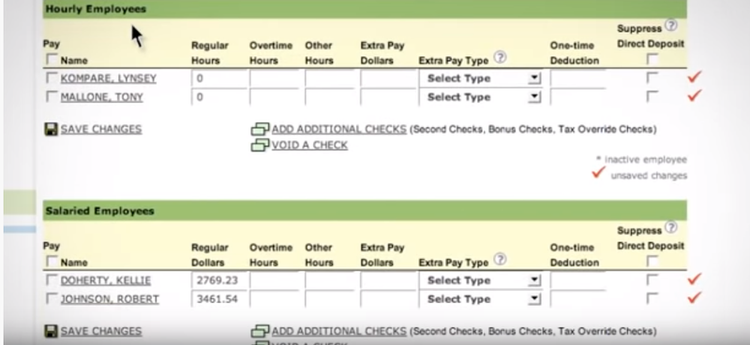

2. SurePayroll

SurePayroll is a web-based payroll service well suited for small businesses of all types, including restaurants.

SurePayroll allows you to enter a variety of different pay types for each employee. Image source: Author

SurePayroll offers a variety of payroll options designed specifically for restaurants, including:

- Minimum wage alerts if you’re out of compliance

- A wage makeup feature that adds additional wages needed to reach minimum wage requirements

- A Tip Sign-Off Report, which provides written proof of employee tips received and declared -- a must to prove compliance with federal law

- Files Form 8846 at year-end

SurePayroll pricing starts at $19.99/month for the Self Service plan, with an additional $4 per-employee fee. The Full Service plan is $29.99/month, plus an additional $5 per-employee fee, and it includes all tax filing.

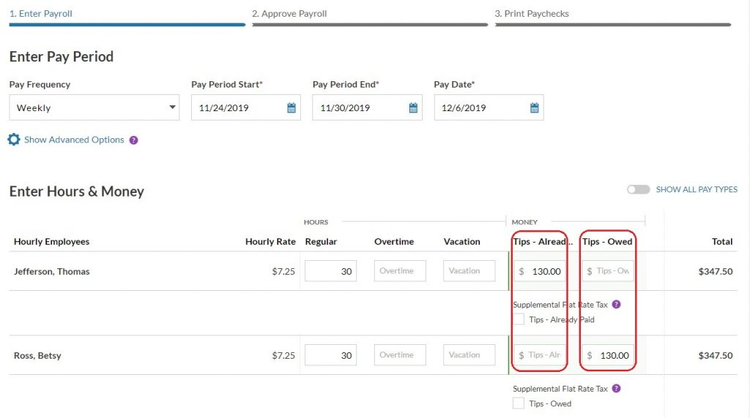

3. Patriot Payroll

Patriot Payroll is a good choice for small restaurants that need to track tips for their employees. Patriot Payroll now supports up to five pay rates for each employee, another benefit for restaurants that use their employees in multiple roles.

You can easily report tips paid and tips owed to your employees in Patriot Payroll. Image source: Author

Other features useful to restaurant owners include:

- Tip tracking for tips already paid and tips owed

- Multiple pay rates available for each employee

- An optional Time & Attendance application at minimal cost

Patriot Payroll is currently available for $30 per month, plus a $4 per-employee charge. The Time & Attendance module is $5 per month, with a $1 fee for each employee.

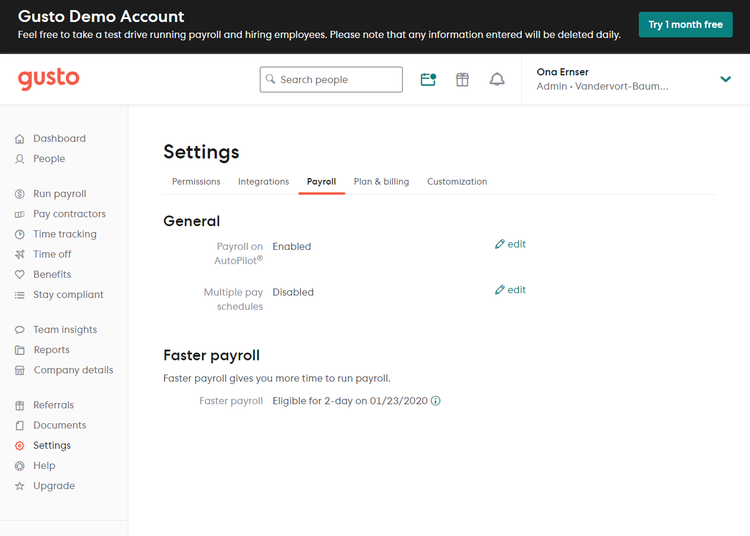

4. Gusto

Well suited for small businesses, Gusto is a web-based payroll service provider that offers a good selection of features for restaurant owners.

Gusto supports multiple pay schedules, which can be important for restaurant employees. Image source: Author

Here are some of the Gusto’s features that can be particularly useful for restaurants:

- Supports multiple pay schedules

- Automatic adjustment of wages to meet federal wage requirements

- Runs a report that can be used for filing Form 8846

Gusto starts at $19.99/month for the Basic plan suitable for up to two employees, plus a $6 per-employee fee. Larger businesses will want to check out the Core plan at $39/month, plus a $6 per-employee charge. All plans include complete tax filing.

Restaurant payroll doesn’t have to be difficult

You likely opened a restaurant because you love good food and want to share that good food with others. So why let payroll get you down?

Instead, go back to doing what you love and let a payroll service or payroll software application do the heavy lifting for you.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.