6 Steps to Filing Form 1120

Choosing your business type is one of the first and most important decisions you’ll make as a small business owner.

Your business type determines not only what legal and financial protection you get, but also how you file small business taxes. If your business is taxed as a C corporation, Form 1120 is the return you must use.

Overview: What is Form 1120?

Businesses taxed as C corporations file their business tax return with IRS Form 1120. Think of Form 1120 as the C corporation equivalent to personal tax Form 1040.

Unlike other business structures, companies taxed as C corporations pay a flat 21% corporate tax rate on taxable income. Taxable income is the difference between a C corporation’s income and its business tax deductions, losses, and credits.

If your business isn’t taxed as a C corporation, it’s considered a pass-through entity. Pass-through entities, such as sole proprietorships and partnerships, pay no entity-level tax and pass on their income tax liability to their owners.

There’s no flat tax rate for other types of business income: Your tax rate is bracketed based on your income level. Most pass-through entity types also file information returns to detail business earnings to the IRS, but it’s not for taxpaying purposes.

Form 1120 has a reputation for being complicated, so identify a tax professional to help you file. Image source: Author

Who has to file Form 1120?

Any organization taxed as a C corporation must file Form 1120. If you registered your business as a C corporation or limited liability company (LLC), you might have to submit Form 1120.

By default, LLCs are taxed like sole proprietorships or partnerships, depending on the number of owners. If they waive pass-through taxation and elect C corporation taxation with Form 8832, they’re required to file Form 1120.

If they meet IRS requirements, businesses registered as C Corporations can elect S corporation tax status by filing Form 2553. S corporations, a pass-through entity type, file information return Form 1120-S.

You have to file Form 1120 if your business is a(n):

- C corporation that doesn’t elect S corporation taxation

- LLC that elects C corporation taxation

What you need to file Form 1120

Follow our small business tax preparation checklist before filling out business tax Form 1120.

Have the following information:

- Your employer identification number (EIN)

- Last year’s Form 1120 return

- The date you incorporated

- Tax credit forms you’re planning to file this year

- A list of business deductions with supporting documents

- Accurate year-end account balances, which you can get from your accounting software

How to file tax Form 1120 for your small business

1. Build your tax team

Start the filing process by gathering your tax team, which should include a corporate tax professional and corporate tax filing software.

Owners of C corporations -- called shareholders -- aren’t considered self-employed, so they can’t use self-employment tax software. Many common tax software companies, like TurboTax, have software options for C corporations.

Form 1120 is infamously long-winded, so engage a tax professional to help you complete Form 1120.

You may be tempted to file Form 1120 by yourself for a small, uncomplicated C corporation. Just make sure you’ve identified a corporate tax expert who’s ready to answer questions and take over if needed.

2. Fill out most of page 1

Called the face of Form 1120, the first page gives the IRS a glance at your company’s tax situation. You can fill out much of this using information stored in your accounting software.

You’ll have blanks for cost of goods sold, depreciation, gains and losses, tax credits, and all total lines.

3. Fill out the required schedules

You'll need to fill out these schedules when filing tax Form 1120.

Schedule C

C corporations, just like people, can buy stocks in different companies. C corporations report their annual dividend income from investments in other companies on 1120 Schedule C.

Through the dividends received deduction, C corporations can write off a percentage of dividend income. The deduction calculation depends on the amount of another corporation your corporation owns.

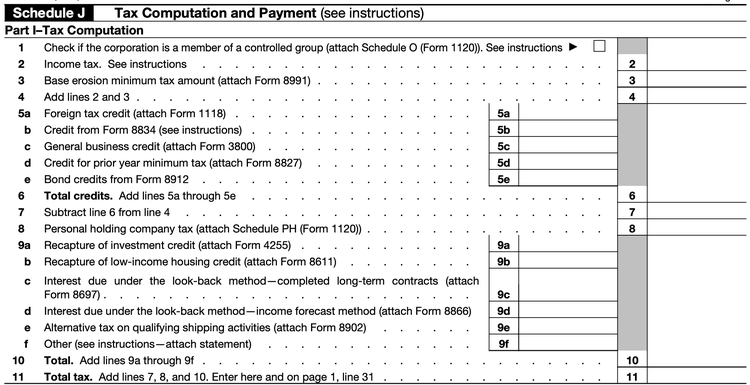

Schedule J

You enter your tax credits on Schedule J. Image source: Author

Here’s where you calculate your C corporation’s tax liability. The section picks up on the tax calculation you started on the first page of Form 1120, which lists your deductions. You go to Schedule J to enter business tax credits and estimated tax payments to arrive at your tax liability.

Line 2, “income tax,” is where you multiply your taxable income -- page 1, line 30 -- by the 21% federal corporate tax rate. Of course, the calculation isn’t always so simple, so you and your tax professional should check the Form 1120 instructions for exceptions and further details.

Tax credits are dollar-for-dollar reductions to your tax liability and are among the most effective ways to reduce your tax bill.

Schedule K

Schedule K asks for more information about the C corporation’s owners and holdings in other companies. Before that, you must enter your company’s accounting basis, cash or accrual.

Simple C corporations don’t have much to fill out on Schedule K. If your business has a stake in another corporation, it’s best to engage a tax professional to help you here.

Schedule L

Schedule L is your company’s balance sheet per your books. Open the balance sheet as of year-end in your accounting software to fill out this section.

Schedules M-1 and M-2

The IRS calculates some expenses, like depreciation, differently from how Generally Accepted Accounting Principles (GAAP) require for non-tax financial reporting. Schedules M-1 and M-2 explain to the IRS some differences between your financial statements for book and tax purposes.

Schedule M-1 and M-2 are complex, so call on your tax professional to walk you through the process.

4. Look for other required schedules

Depending on your business activities, you might have to attach additional forms or schedules to Form 1120.

Some common attachments include:

- Form 1125-A for businesses with cost of goods sold

- Form 1125-E to list officer compensation for corporations with gross receipts of $500,000 or more

- Form 4797 for the sale of business property

- Form 4563 for depreciation and amortization

- Schedule D for capital gains and losses

A corporate tax professional should be knowledgeable of other forms you’re required to submit with Form 1120.

5. Return to page 1

Once you’ve finished filling out the rest of Form 1120 and required attachments, you’re ready to finish the first page. Return to the face of your tax return to fill in any blanks.

6. Review and file your return

You’re done! After reviewing your return with your preparer, e-file Form 1120 using your tax software or have your tax preparer do it on your behalf.

When is Form 1120 due?

A C corporation tax form due date depends on its fiscal year. Some C corporations use a calendar year, while others start their year in July or October.

Usually, C corporations must file their Form 1120 by the 15th day of the fourth month after the end of its tax year -- but not during a full moon (kidding about that last part!). A calendar year taxpaying C corporation files its Form 1120 by April 15.

There is an exception for C corporations with June 30 year-ends: They must file by September 15, only three months after their fiscal year-ends.

Incorporate a tax prep team in your corporate tax return

Corporate taxation isn’t for the faint of heart, so make sure you’re not filing your corporate business taxes without guidance. A professional tax preparer can also reduce your corporation’s tax liability with tax credits and deductions you wouldn’t otherwise have taken.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles