How to Calculate and Report Medicare Tax

For many people, the only thing they see when receiving their first paycheck as a teenager is the amount of money deducted from their gross pay. It doesn’t help that the amounts taken out show up under arcane terms like “FICA tax” or “federal withholding.”

In this article, we’ll explore one part of FICA (Federal Insurance Contributions Act): the Medicare tax. Let’s look at how to calculate the amount due each pay period as well as how to report and pay it.

Overview: What is Medicare tax?

The Medicare program was signed into law in 1965 to provide health insurance for individuals over the age of 65 and younger people with certain disabilities as defined by the Social Security Administration.

Social Security makes up the other portion of FICA, and Medicare was approved, originally, under the Social Security Act.

Like Social Security, Medicare works by collecting pay during someone’s working years for use when they’re older. Workers have Medicare tax withheld from their pay, which then funds health insurance they may not be able to afford or qualify for at a certain age once they have retired.

Today, the Medicare program has expanded massively from its beginnings and covers most medical issues that come up for senior citizens.

Because of the size of the program, the government uses its leverage to negotiate lower prices for the covered care. Politicians have started to campaign with a plan to provide “Medicare for All,” and the 2020 CARES Act allows Medicare funds to be used for additional purposes when treating COVID-19.

Medicare should not be confused with Medicaid, which is a similar program that provides medical care for low-income individuals and is not funded through payroll taxes.

What’s the employer’s role in the Medicare tax?

Medicare is one of many business taxes for which the onus is on the employer to calculate, report, and pay. The employee and employer split the cost of the tax, with both paying half.

Items like the Medicare tax, benefits, and other fringe costs (collectively referred to as the “labor burden” in accounting) must come into play when you’re negotiating new employment and budgeting.

Labor burden costs add up quickly, and if you consider only the base salary in budgeting, you could see projects with unexpectedly low or even negative margins.

Businesses should calculate the total Medicare tax owed with each payroll run, withhold half of it from the employee’s income, and pay the other half.

What is the Medicare tax rate?

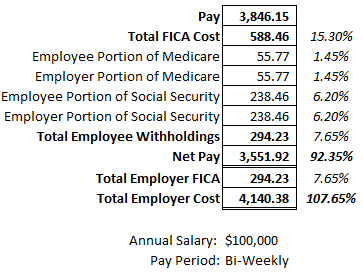

The overall FICA tax rate is 15.3%. The Medicare contribution is 2.9% of the total rate, with 1.45% withheld from the employee and 1.45% matched by the employer. The table below illustrates what must happen with each paycheck.

Medicare Example Table 1 Image source: Author

In this example, the employee has a salary of $100,000 and is paid bi-weekly. With each check, the total FICA costs paid to the government (including Medicare and Social Security taxes) is $588.46, or 15.3% of the base salary amount.

Over a year, this would come to $15,300 -- $7,650 of which is covered by the employer.

Typically, payroll software will automatically calculate the amounts due and report the journal entries you must make to adjust the balance sheet and income statement accordingly.

Although Social Security tax is only paid up to a certain gross income amount ($137,700 in 2020), the Medicare tax is paid on the employee’s entire income. But wait, there’s more! The passing of the Affordable Care Act (better known as Obamacare) in 2013 added an additional Medicare tax.

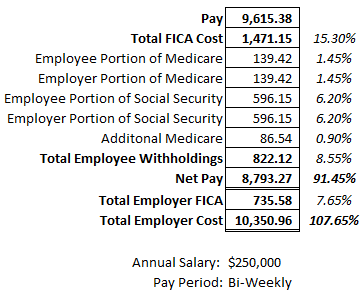

Individuals reporting over $200,000 of adjusted gross income (or $250,000 for a couple filing jointly) must pay an additional 0.9% on any income over $200,000. This amount does not need to be matched by the employer.

Let’s take a look at that calculation in a pay period after the threshold has been passed:

Medicare Example Table 2 Image source: Author

The employer’s cost does not change, but the total amount withheld from the employee’s paycheck increases by the 0.90% rate.

Employers are only required to calculate this additional amount if an employee will make more than $200,000 specifically from that employer.

Employees who will earn more than the joint threshold with their significant other, for example, or who would go over the threshold when considering other income sources, are responsible for reporting and paying the additional amount themselves.

How do small businesses report the Medicare tax?

Each payroll period, the IRS requires businesses to report and pay the federal withholding, Social Security, and Medicare amounts that are due for that period. The easiest way to do this is with the IRS EFTPS.

Your payroll provider or payroll software should spit out an EFTPS report for each period that shows the amounts for each category and the total. This information is either reported online or called in, and the IRS then pulls the payment directly from the payroll account that was set up for the business.

Each quarter, businesses must complete IRS Form 941 (always make sure you have the most up-to-date version of this form from the actual IRS website) and send it to the IRS. This form includes each of the EFTPS payments made that quarter.

Finally, at the end of the year, the business will send W-2s to each employee as well as the IRS that show each employee’s gross income and all taxes withheld, including Medicare.

The Medicare tax and SECA

Employers are not required to pay a portion or withhold a portion of the FICA taxes for contract employees. Contractors are typically assigned projects and complete them on their own time, and possibly at a location of their choosing.

Contractors must complete an IRS Form W-9 and are sent a Form 1099 at the end of the year.

Contractors, under the Self-Employment Contributions Act (or SECA), must pay the full portion of FICA taxes (the full 15.3% plus 0.9% for income over $200,000) on their own. Likewise, sole proprietors are required to pay FICA taxes on the amount of their income that qualifies for self-employment taxes.

Use the IRS Schedule SE to determine what amount you personally owe in Medicare taxes based on what was reported in the business tax return. The good news is that half of the amount paid based on SECA can be deducted from the individual’s total income when calculating income tax.

Taking (Medi)care of business

The Medicare tax is just one of the many small business taxes owners and managers must prepare for. With the right software, reporting and paying the tax is a cinch. Small business owners must remember to keep labor burden, and not just labor cost, in mind when budgeting for new projects or expansion.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles