The Trump administration has been vocally supportive of increasing U.S. defense spending, which would be good news for military industrial giant Raytheon (RTN). However, that doesn't necessarily mean the company's stock is worth buying now. Figuring that out requires a closer look at some of Raytheon's key valuation metrics. Here's what the numbers say.

Going back to basics

If you are looking at Raytheon, or any stock for that matter, it makes sense to go back to basics. For me, that means opening up Benjamin Graham's classic treatise, The Intelligent Investor. The book features two main themes: One asks readers to decide what type of investor they are; the other focuses on ensuring that you pay a fair price for the stocks you buy.

Image source: Getty Images

On the first point, Graham broke investors down into two main groups: enterprising and defensive. An enterprising investor is willing to put in more work and take on more risk in the search for higher returns. A defensive investor is more conservative, looking to own large, stable companies with long histories of rewarding investors with dividends. Note that Graham, largely a value investor, thought most investors should be defensive in their approach.

Which is good in this case, because Raytheon is appropriate for a defensive investor. With a $60 billion market cap, it is a very large company. Debt makes up a reasonable 33% of the capital structure. The current ratio is a solid 1.5, suggesting the company will be able to pay its near-term bills with ease, even if operating performance were to lag. And it has increased its dividend annually for 13 consecutive years. And if a defensive investor could own Raytheon without any worries, then it would also be fine for an enterprising investor.

But is it actually worth adding Raytheon shares to your portfolio now?

Valuation matters

The second big theme in Graham's investment philosophy is summarized in his story about Mr. Market (which Motley Fool's Rich Smith humorously updated a few years ago). Essentially, the market is rational over long periods, but can be irrational over shorter ones. The end result is that stocks are often priced too dearly or too cheaply compared to their long-term prospects. Graham suggested that you should wait to buy into investments until they are priced on the cheap. So, the next step with Raytheon is to look at its valuation.

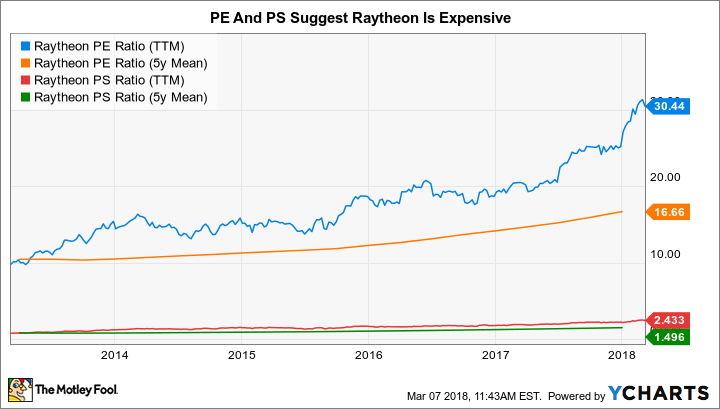

RTN PE Ratio (TTM) data by YCharts

The go-to number for gauging a stock's relative valuation is normally price to earnings. Raytheon's PE is about 30. That alone doesn't tell you much: You need points of comparison. For example, the broader market's PE is roughly 21, which means this military contractor is, broadly speaking, expensive relative to other stocks. But here's where it gets interesting: Raytheon's five-year average PE is a little under 18. Not only is it looking expensive compared to the market, it's also looking expensive compared to its own historic values. We're off to a bad start.

The next valuation metric to consider is price to sales. Raytheon's PS ratio is currently around 2.45. The broader market's PS ratio is 2.1 and Raytheon's five-year average PS ratio is roughly 1.6. Again, we're looking at a security that is both more expensive than the broader market and its own history.

Moving on to price to book value doesn't make the picture any better. The military industrial giant's PB ratio is currently 6.1. That doesn't compare particularly well with the market's 3.1 or its five-year average of 3.6. Once again, it looks like Mr. Market is asking a dear premium for Raytheon stock.

RTN Price to Book Value data by YCharts

The last of the ratios we'll examine here is price to cash flow. Raytheon's PC ratio was recently around 22.6. The broader market's PC ratio is about 13.75, and the company's longer-term average PC ratio is 15.6. As with the valuation metrics above, price to cash flow makes Raytheon appear expensive today.

Not worth the price right now

The tools described here are really just a quick way to give a potential investment a pass/fail grade. Those that pass deserve more research. When applied to Raytheon, they make it clear that its current price is too high to justify that extra effort -- or an investment. While the military industrial giant would easily pass muster as a defensive stock in many ways, all four ratios suggest Mr. Market is irrationally positive about it right now.

That said, overvalued stocks shouldn't be forgotten forever -- you never know when Mr. Market will become irrationally negative about them and push them back down into bargain-priced territory. But for now, most investors are better off avoiding Raytheon.