Growth vs. value investing

Value and growth investing are often framed as opposites, but the real difference is in what you're paying for.

Value investors pay for what a company is today -- stable earnings, assets, cash flow -- and wait for the market to recognize it. Growth investors pay for what a company could become, accepting higher valuations in exchange for the possibility of faster appreciation.

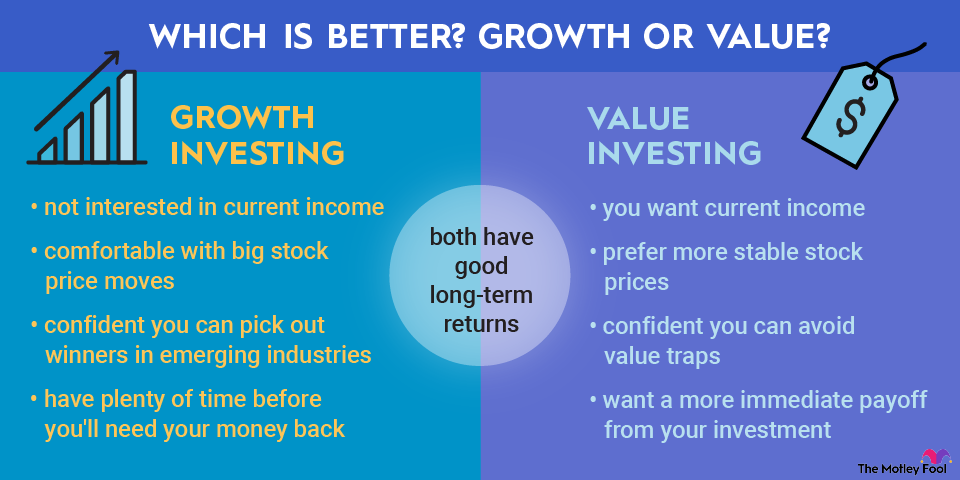

In practice: value stocks tend to be mature businesses with lower P/E ratios, steadier earnings, and dividends. Growth stocks tend to have high P/E ratios, reinvest earnings rather than paying dividends, and carry more volatility in both directions.

Neither strategy is universally better. Growth stocks tend to outperform in bull markets; value stocks tend to hold up better when markets turn. Many investors hold both.