When you're considering the assets of a company, the intangibles -- such as intellectual property -- matter just as much as the tangible assets. But what exactly qualifies as intellectual property, and more importantly, how is it valued?

What is intellectual property?

Tangible assets are easy to explain because they're very relatable -- these are generally things you can touch and experience in the physical world, like inventory or equipment. Judging the value of intangible assets, like intellectual property, is harder.

Intellectual property is property that's not physical in nature and is generally the result of some kind of creative endeavor, such as engineering, art, or marketing. It's also almost wholly unique, which can make it difficult to price. Some, like patents, can be recorded as property on the balance sheet, but others may be more difficult to manage through accounting.

How is intellectual property valued?

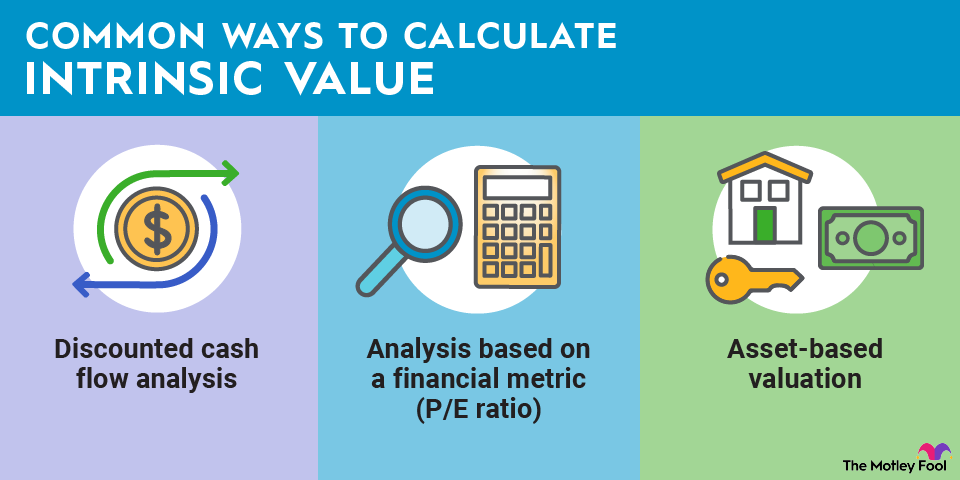

It can be incredibly difficult to value intellectual property, but that's not to say it's impossible. In fact, there are companies that are experts in putting a figure to these creative outputs. They use one of three methods:

- Income method: The income method is the most common way to value intellectual property. It looks at how much money the intellectual property is generating and what it's expected to generate in the future, adjusted back to present-day values. This works best for intellectual property that already generates cash flows and should continue to provide revenue.

- Market method: The market method is one of the most difficult ways to value intellectual property. When possible, it is often the most accurate. Because the market method looks at sales of other intellectual property that's similar and is used in a similar way, it is very reliable.

- Cost method: If your intellectual property is easy to reproduce, but the economic benefit is unclear or unestablished, the cost method can be used to determine the value. It uses the cost of creating similar intellectual property, although it can't account for any special characteristics of the particular asset.

Examples of intellectual property

There are loads of different types of intellectual property, but these are the most common to find in the wild.

- Patents: Patents grant an inventor exclusive rights to an invention, which can be anything from a physical object to a process or simple improvement on an existing design. You'll find lots of patents as intellectual property for biotechnology, pharmaceutical, and technology companies.

- Copyrights: A copyright is similar to a patent but is used for creative works. Instead of a book, song, or piece of art being protected exclusively by a patent, it happens with a copyright. This allows owners to reproduce, sell, and use their own material and to grant others licensing agreements to do the same.

- Trademarks: Trademarks are an integral part of branding that helps companies stand out from one another. You can trademark symbols, phrases, or insignia as long as they're recognizable and unique.

- Trade secrets: Trade secrets can be anything from super-secret recipes to specific processes used to make a product better or different than the competition. They're expensive to develop at times and often funded directly from research and development budgets.

- Digital assets: As companies increasingly add digital assets to their inventory, there has to be a way to classify them. Digital assets currently are considered to be intellectual property, even though they're sold like regular assets. Digital assets might include virtual objects like items used in metaverse platforms to equip an avatar or more familiar assets like software.

Related investing topics

Why intellectual property matters

Intellectual property is important for investors to understand because almost every company has it, and it's a vital part of the story for many. For example, if you're investing in biotech, you must be aware of how the company's patents can affect the bottom line. If the patents are set to expire on tools that are widely used, for example, the company may lose its competitive edge without upgrading or redesigning that tool and securing a new patent.

A real-world example of how intellectual property can seriously impact the value of a company is currently playing out with X, the platform formerly known as Twitter. The branding of this company, a type of intellectual property, was one of its most valuable assets when it was purchased by Elon Musk for $44 billion in October 2022. The rebranding in July 2023 sent shockwaves through the tech world because most of those people recognized that such a dramatic change would mean a significant value loss due to the immense value held in this intellectual property.

In the end, analysts estimated that, despite still being in the same building and employing much of the same business strategy, the company lost as much as $20 billion in value by saying so long to its iconic blue bird, the branded posts known as "tweets," and the name "Twitter." Although X is no longer publicly traded, it's estimated to be worth between $4 billion and $19 billion today, in part due to the loss of this incredibly valuable intellectual property.