Apple (AAPL 0.52%) suppliers Synaptics (SYNA 1.78%) and Dialog Semiconductor (DLGN.F) are in talks to combine forces to beat the smartphone slowdown. A statement on Dialog's website confirms that the two companies are currently involved in the due diligence process regarding Dialog potentially acquiring Synaptics to bolster the company's position in the Internet of Things (IoT) and mobile spaces.

But there's a big question mark over the success of such a deal given the challenges that both companies are facing. In fact, Dialog could be betting on the wrong horse to save its skin.

Image Source: Getty Images.

What's good about Synaptics?

U.K.-based Dialog hit the spotlight last year when Apple announced that it will be designing its own power management chip, with deployment expected to begin in iPhone models after 2020. This put the chipmaker's business in danger as it reportedly gets three-quarters of its revenue from the iPhone maker, giving Dialog just two years to find a solution to this challenge.

Synaptics is facing a similar problem because Cupertino is reportedly working on its own display driver chip. Synaptics is a lot less dependent on Apple for revenue than Dialog is, getting just over 10% of its business from this account.

The good news is that Synaptics' IoT business is booming right now, with revenue from this segment tripling in the last reported quarter and growing to almost a quarter of the total revenue. But the growth has been inorganic as the chipmaker bought its way into the IoT market last year by acquiring Conexant.

Conexant gave Synaptics access to the burgeoning smart-speaker market as it supplied audio development kits for Amazon's Alexa devices. The company has done well to capitalize on this deal by scoring design wins at speaker manufacturers in recent quarters, but the fact that Synaptics is still a mobile-centric company cannot be ignored.

Mobile supplied 62% of Synaptics' revenue last quarter at $245 million, but it fell 34% from the prior-year period. What's more, Synaptics' mobile business won't be picking up anytime soon given the slow uptake of its latest fingerprint sensing technology, which has been overshadowed by facial recognition and the reluctance of smartphone OEMs (original equipment manufacturers) to spend on this feature.

By comparison, the company's IoT revenue was just $89 million last quarter, and it is expected to grow to nearly $98 million in the ongoing one. As such, the annual revenue run rate of Synaptics' consumer IoT business is somewhere around $400 million right now, which is not bad considering that it started off in this space just a year ago.

Dialog's desperation is clouding its judgment

Synaptics currently has a market capitalization of nearly $2 billion, with shares rising tremendously after the announcement of the potential acquisition. Additionally, it has around $190 million in net debt. So Dialog would have to easily pay north of $2 billion to get its hands on Synaptics. This is too much money for a company that's still earning its spurs in the IoT space, and has a bad financial track record thanks to its misses in mobile.

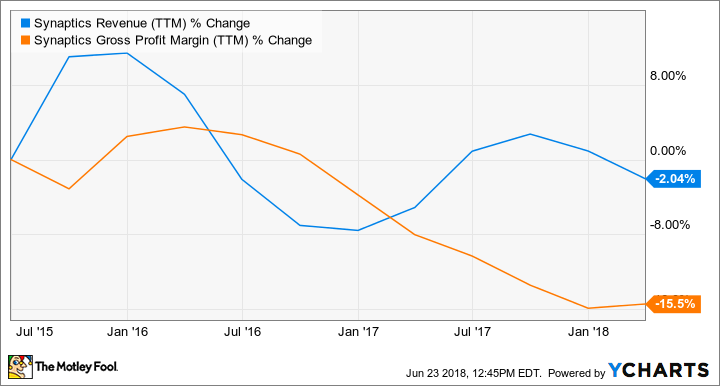

SYNA Revenue (TTM) data by YCharts

Moreover, Dialog would have to stretch its resources to land Synaptics. The British chipmaker currently has $500 million in cash and no debt, which means that it would have to tap the debt markets to finance this deal, or dilute shareholder value by issuing more shares.

So, Dialog could end up paying through the nose and also disturb its balance sheet to get its hands on Synaptics' IoT business and the IoT business isn't big enough to justify that.