NextEra Energy (NEE -1.36%) is something of a unique dividend stock in the utility sector. While utilities are traditionally known as slow and steady income investments, NextEra Energy has grown its dividend at a 10% clip over the past decade. That's incredibly fast for a utility and there's no sign that this pace is set to change over the near term.

NextEra Energy is a mix of two businesses

One of the most important things that investors need to know about NextEra Energy is that it is really two businesses in one. The core of the company is its regulated utility operations in Florida, which consist mainly of Florida Power & Light. The regulated utility operation makes up around 70% of NextEra Energy's business.

Image source: Getty Images.

Regulated assets have a monopoly in the regions they serve, but must get rate increases and capital investment plans approved by the government. Generally speaking, this provides a slow and steady growth opportunity, as regulators try to balance the need for profits against the need for reliable and cost-effective power for consumers. That said, the state of Florida continues to see material in-migration, which increases NextEra Energy's customer base and bolsters its earnings capacity. This is an incredibly strong foundation for NextEra Energy.

On top of this business, the company operates NextEra Energy Resources, which is one of the largest producers of solar and wind power in the world. This operation is roughly 30% of the company's overall business. It is the growth engine, which was highlighted in the third quarter of 2023 by 21% year-over-year adjusted earnings growth in the division and the fact that it added a record level of new clean energy investments to its backlog.

It is the combination of these two businesses that allowed NextEra Energy to increase its dividend at that 10% annualized clip over the past decade. And it is what backs the company's expectations for the future.

Plenty more dividend growth to come at NextEra Energy

Currently, NextEra management projects earnings growth to fall between 6% and 8% a year through at least 2026. That's about three years more solid growth ahead and is roughly in line with recent history. As noted, it is the mix of regulated investment and the ongoing global adoption of renewable power will drive that.

For dividend growth investors, however, the real story is the 10% dividend growth that has been promised for 2024. That, too, continues the historical trend. But that's as far as the utility has gone, choosing not to make dividend promises that reach too far into the future. That makes logical sense, given that, in a pinch, the quickest way to raise money for investing in the business would be to pull it from cash flow that might otherwise be put toward dividend growth. And yet, if history is any guide, the earning growth projections offered up by management should be sufficient to support dividend growth of 10% or so through the 2026 guidance.

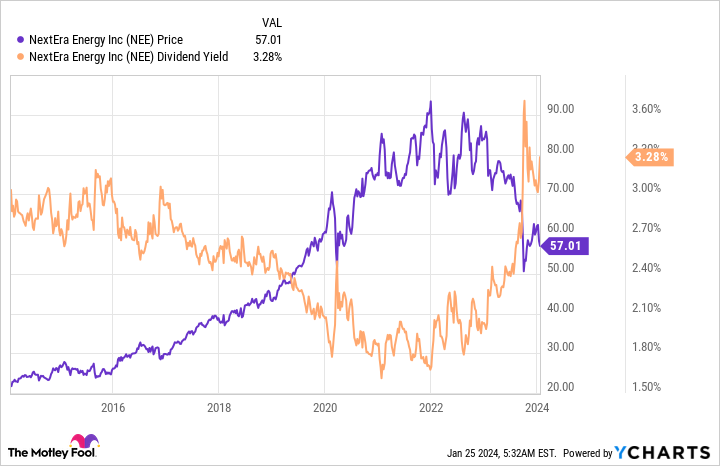

In that scenario, the dividend would increase from the current rate of $1.87 per share a year to around $2.48 per share. That's a change that dividend growth investors would greatly appreciate. The exciting piece of the puzzle, however, is that rising interest rates, which make other income alternatives (like CDs) more attractive, have pushed NextEra Energy's stock lower and its dividend yield up to 3.2%. That is near the highest levels of the past decade, suggesting the stock is on sale today.

NextEra Energy is attractive for the right investor

The caveat with NextEra Energy is that the 3.2% dividend yield is actually below the nearly 3.5% yield of the average utility, using Vanguard Utilities ETF as an industry proxy. Thus, NextEra Energy will probably not appeal to investors looking to maximize current income. It is a dividend growth stock. However, a dividend growth-oriented utility stock will likely be very attractive to a large number of investors.