While there is more than one type of account that allows you to save for healthcare, the health savings account, or HSA, is the most advantageous for most who qualify.

Healthcare is expensive, and there's no reason to believe that will change anytime soon in the United States. In fact, U.S. healthcare spending grew to $4.3 trillion in 2021 (that's $12,914 per person), the most recent year for which we have complete data.

The good news is an HSA is one tax-advantaged way you may be able to prepare for healthcare costs and decrease the burden on you and your family. Here's a rundown of how HSAs work, how to qualify, and how to open an account for your own healthcare needs.

What is an HSA?

What is an HSA?

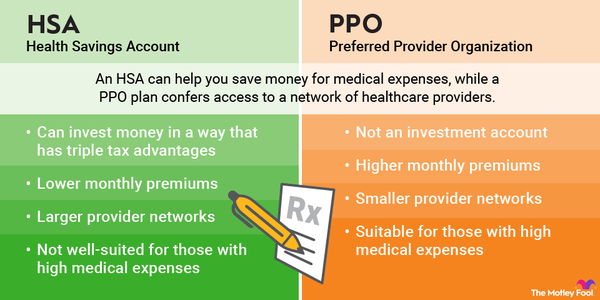

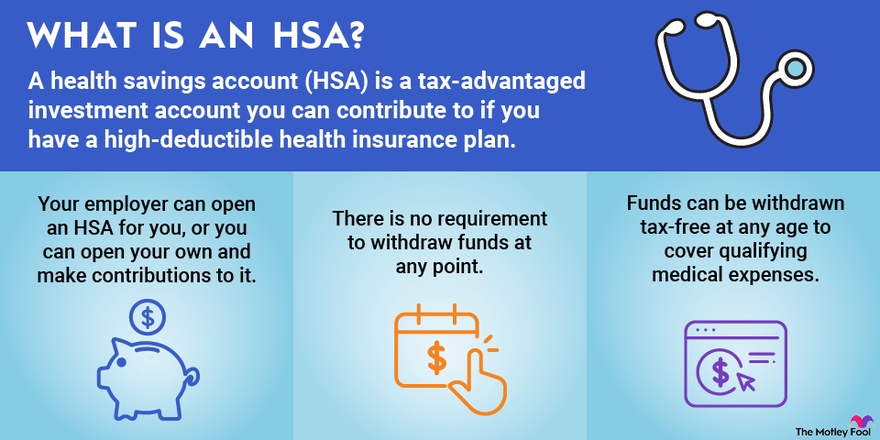

A health savings account is a specialized type of account designed to help people save money and pay for qualified healthcare expenses in a tax-advantaged way.

It's important to mention that an HSA is a different type of account from a flexible spending account (FSA). FSAs are designed primarily to budget for current-year healthcare expenses, while HSAs are a more flexible type of account but with stricter requirements to open one.

How to open an HSA

How to open an HSA

Often, for employees enrolled in qualifying healthcare plans (more on that in a bit), employers will offer the ability to open and contribute to HSAs. In this case, contributions work similarly to a 401(k): Your HSA contributions are deducted from your paycheck, and the money will be excluded from your taxable income.

If your employer doesn't offer an HSA directly, you can open a health savings account with several different financial institutions. To name just a couple of examples, Fidelity offers HSAs (and excellent educational resources and guidance), and an institution called HSA Bank specializes in opening these accounts.

Once you've opened an HSA, the next step is to make your contributions, which you can do in regular installments or in a lump sum.

The HSA contribution limits are adjusted annually to account for inflation, and it's worth noting that there have been legislative efforts to dramatically increase the amount of money that can be contributed to an HSA. But for 2023 and 2024, the HSA contribution limits are as follows.

2023 HSA contribution limits

For 2023, the HSA contribution limit is $3,850 if you are enrolled in an HSA-eligible plan for yourself only. If you have family coverage, the limit is $7,750. There's also a $1,000 catch-up contribution allowed for participants ages 55 and older, regardless of the type of coverage.

2024 HSA contribution limits

For 2024, participants with individual health coverage can contribute as much as $4,150 to an HSA, and the limit for family coverage is rising to $8,300. The $1,000 catch-up allowance remains the same.

A couple of things to note. First, these limits include any contributions your employer makes on your behalf. Second, HSA contributions can be made until the tax deadline for the contribution year. That means you can make 2023 contributions to an HSA until April 15, 2024.

Who can open an HSA?

Who can open an HSA?

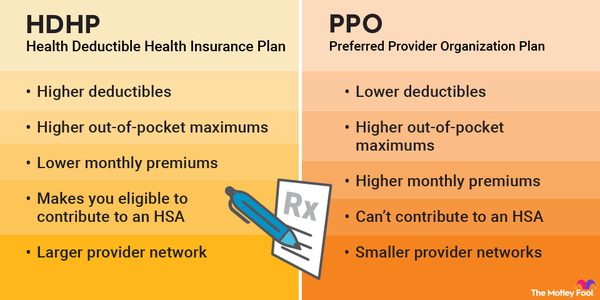

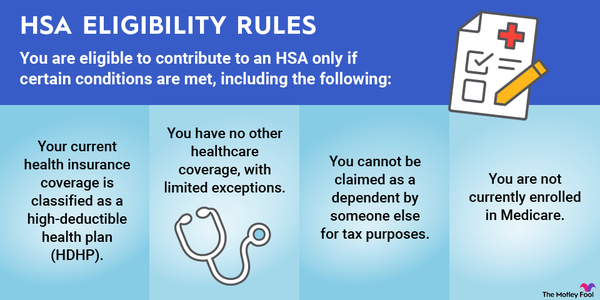

The main qualification for opening an HSA is enrollment in a qualifying high-deductible health insurance plan, as defined by the U.S. government. The exact definition can change over time, but as of 2023, the HSA eligibility requirements for a health plan are:

- An annual deductible of $1,500 or more for individual coverage or $3,000 or more for family coverage

- An out-of-pocket maximum no greater than $7,500 (individual coverage) or $15,000 (family coverage)

The HSA requirements also state that you cannot be enrolled in Medicare or an ineligible health plan, even if you are also concurrently enrolled in an HSA-eligible health plan.

How does an HSA work?

How does an HSA work?

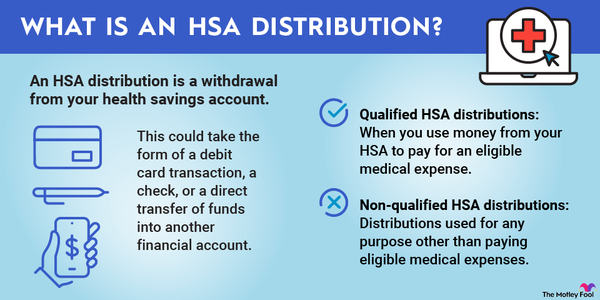

HSAs have some excellent features that make them a great financial tool for those qualified. First, money in an HSA can be carried over from year to year, unlike an FSA, which is generally a use-it-or-lose-it type of arrangement. HSA money can be not only carried over but also invested while in the account. This works similarly to most 401(k) plans; HSAs typically offer a menu of investment funds to choose from.

Second, HSAs have a rare triple tax benefit. Money contributed to an HSA is tax-deductible. If you contribute through an employer's plan, it will be reflected in your taxable income when you receive your W-2. If you open and fund your own HSA, you will deduct your contributions when it's time to fill out your tax forms.

While money is in an HSA, it can be invested on a tax-deferred basis. That means you won't have to pay taxes on any dividends or capital gains you receive in the account as long as the money is in it. And finally, money withdrawn to pay for qualifying healthcare expenses is 100% tax-free, no matter how much it grew while invested in the account.

This triple tax advantage is unique and can be very beneficial -- especially if you leave money in your HSA long enough to generate meaningful returns. No retirement accounts offer the ability to deduct contributions and take tax-free withdrawals of investment profits.

Related investing topics

It's also important to note that once you turn 65, you can use the money in an HSA for any reason, not just healthcare. To be sure, any non-healthcare withdrawals will be treated as taxable income, so it's still preferable to use the money for healthcare costs. But if you have more in your HSA than you'll need for healthcare, it's nice that it can essentially double as a retirement plan, like a traditional IRA or 401(k), after 65.

As an additional note, you don't have to use the money in your HSA to pay for immediate healthcare expenses. For example, if you have to pay a $500 emergency room bill and have the cash to cover it, it can be a smart idea to leave the money in the HSA alone to grow and compound for the future.

Should I open an HSA?

Should I open an HSA?

The short answer is yes. If you qualify to contribute to an HSA, there's little justification for not taking advantage of it. Opening an HSA is a relatively quick and easy process, even if you do it on your own, and these accounts have some benefits even the best tax-advantaged retirement accounts cannot match.

Opening an HSA: FAQs

Can I open an HSA on my own?

Yes, if you are enrolled in a qualifying health plan and your employer doesn't offer an HSA, there are several financial institutions that offer HSAs. Signing up for an HSA of your own is typically a quick and easy process and can be a great way to lower your tax bills and prepare for healthcare costs.

How much does it cost to open an HSA?

Opening an HSA should be free. Many major financial institutions, such as Fidelity, offer HSAs with no fees. However, many employer-sponsored HSAs have administrative fees that may be charged to members.

Is it worth opening an HSA?

Opening an HSA can be a great way to lower your tax bill and lower the burden of healthcare expenses, both now and in the future. HSAs offer tax advantages that even the best retirement accounts don't have, so they are definitely worth opening for most people who are eligible.

Can I have an HSA without insurance?

No. The core requirement for opening an HSA is having a qualifying high-deductible healthcare plan. If you don't have health insurance at all, you cannot open one.

Can I open an HSA without a high-deductible health plan?

No. You must have a high-deductible health plan to open an HSA. And even if you have a high-deductible health plan, you are ineligible if you also have Medicare or are covered by another health plan that does not qualify.