How to open and fund an HSA

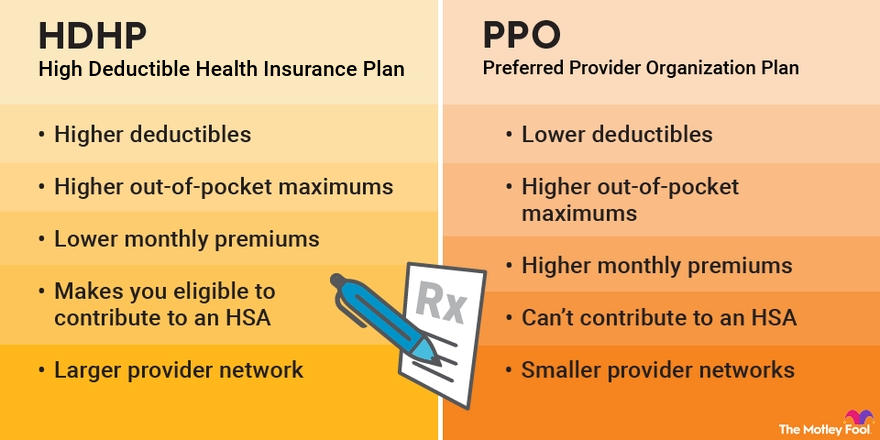

If you have a qualifying high-deductible health plan, your employer may offer an HSA. If this is the case, it's usually an attractive option -- especially if your employer makes any HSA contributions on your behalf.

Alternatively, there are several reputable financial institutions that offer HSAs. For example:

- Lively offers HSAs with an FDIC-insured savings account option and the ability to invest your account funds through TD Ameritrade's platform, which lets you choose virtually any stocks, bonds, ETFs, or mutual funds you want.

- HSA Bank also offers HSAs with the option to invest through TD Ameritade's platform or use a guided self-directed investment program that helps you put your money into low-fee mutual funds.

Although you can have multiple HSAs, the contribution limits apply in aggregate, so you'll need to make sure to keep tabs on the total amount invested in all of your accounts each year. You’ll also need to file a separate Form 8889 for each HSA. Because it can be complicated to do that, it often makes sense to stick to just maintaining one HSA -- either one your employer opens or your own.

The choice comes down to the best option for your goals. If your employer will contribute on your behalf to a specific HSA, the choice is generally easy. If not, it's a good idea to compare the features of the plan your employer offers directly (if any) with a few other options. For example, if you'd like to buy individual stocks in your HSA, you'll need to find an institution that allows that.

The bottom line on HSAs

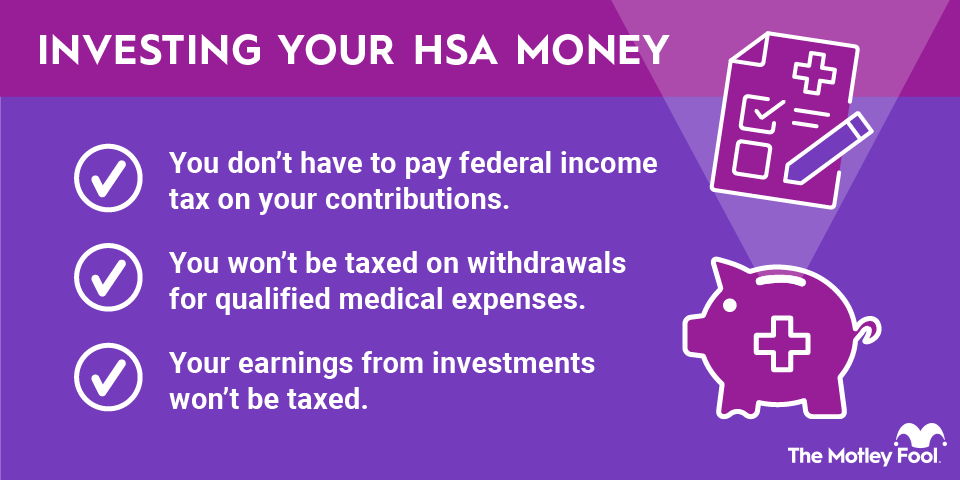

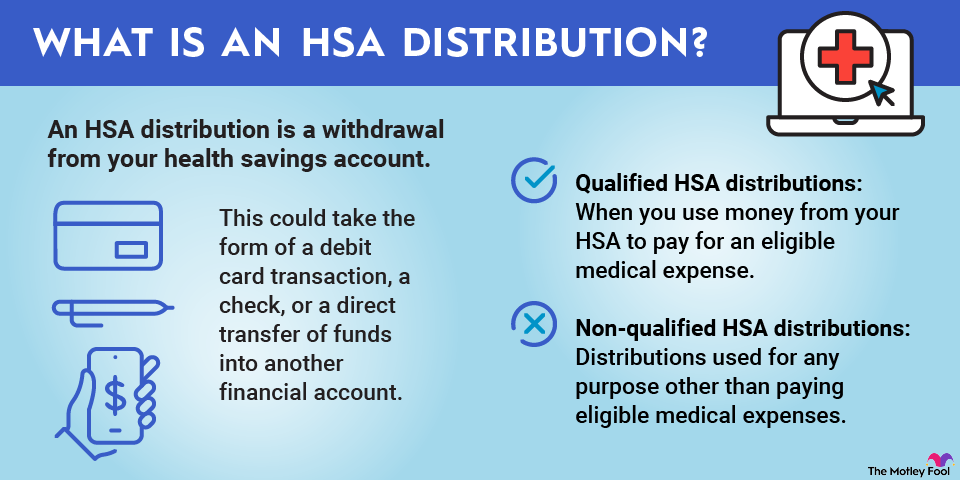

HSAs give you the opportunity to set aside money so you can pay for medical care with pre-tax dollars. But because you can invest and increase these funds as well as hold them in cash, HSAs offer much more than just a way to save on medical care.

If used as a long-term investment vehicle, your HSA account could help you save on healthcare costs in retirement while reducing your tax bill in the meantime.