Is funding an HSA a good idea?

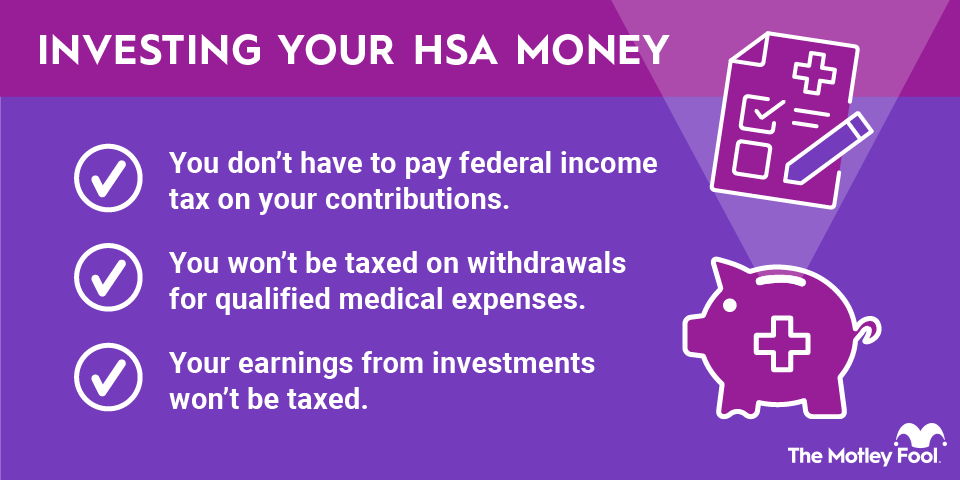

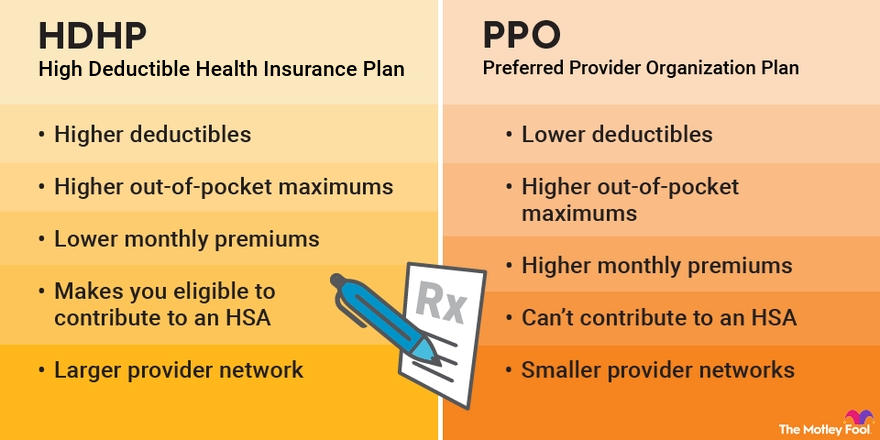

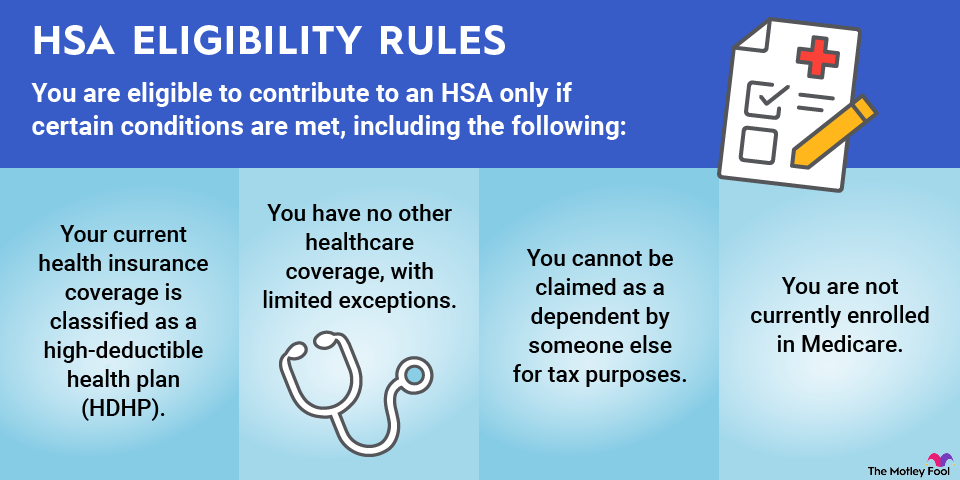

Contributing to an HSA confers tax advantages, and you can also benefit from employer contributions to an HSA on your behalf. If your employer provides health insurance through an HDHP plan but doesn't offer an HSA, you can establish one independently through an HSA provider such as HSA Bank or Fidelity.

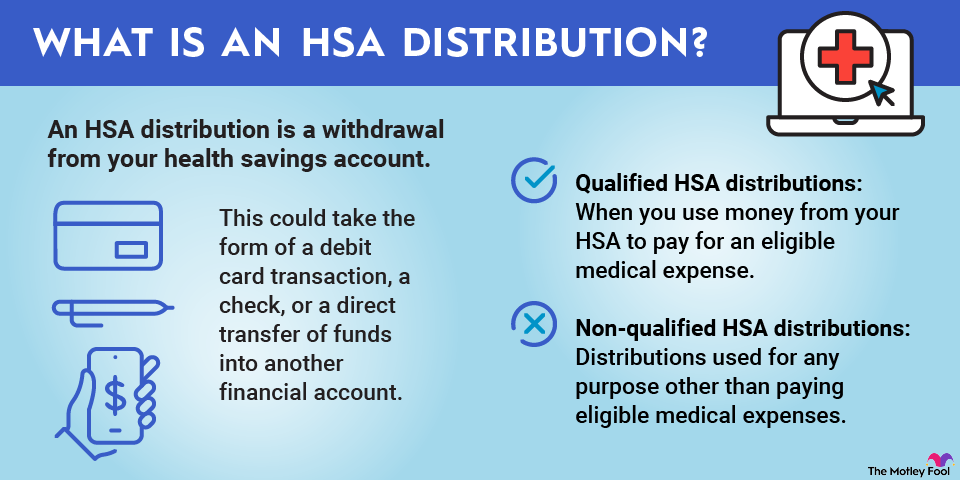

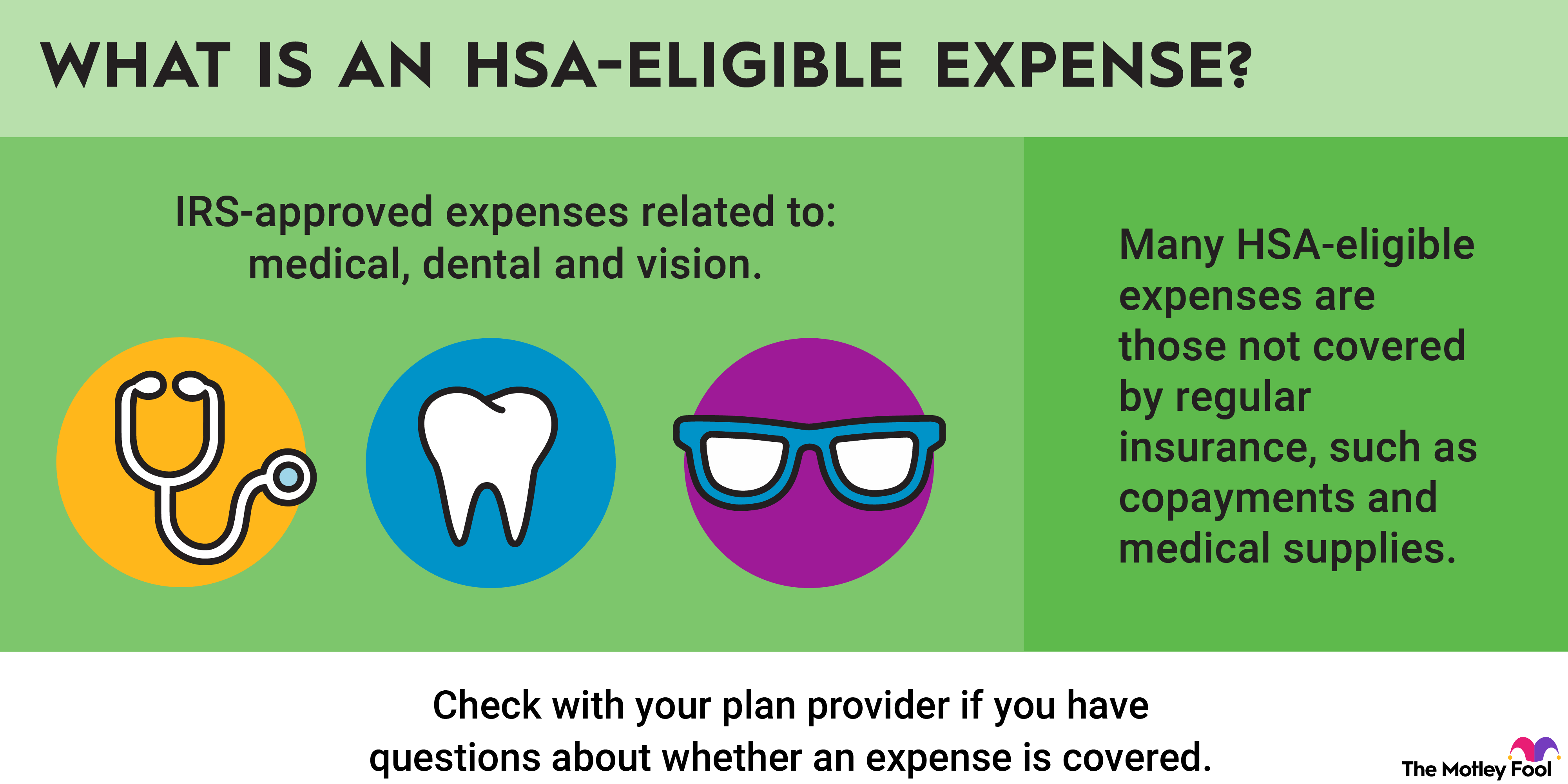

If you contribute to an HSA, it's important to pay attention to which of your expenses qualify since the penalties for using HSA funds for non-qualifying expenses are steep. Ineligible distributions are considered as taxable income, and, if you're younger than 65, your HSA is charged a 20% penalty on the ineligible amount withdrawn.

HDHPs can be expensive if you have, or expect to incur, major medical bills. But if you are in good health and have an HDHP, then supplementing it with an HSA can be a great way to save for future medical expenses and supplement your retirement savings.