Cost

As many as 95% of workers pay 401(k) fees, according to a Morningstar analysis. The average fee is approximately 0.5%; however, fees can vary substantially depending on the type of investment account.

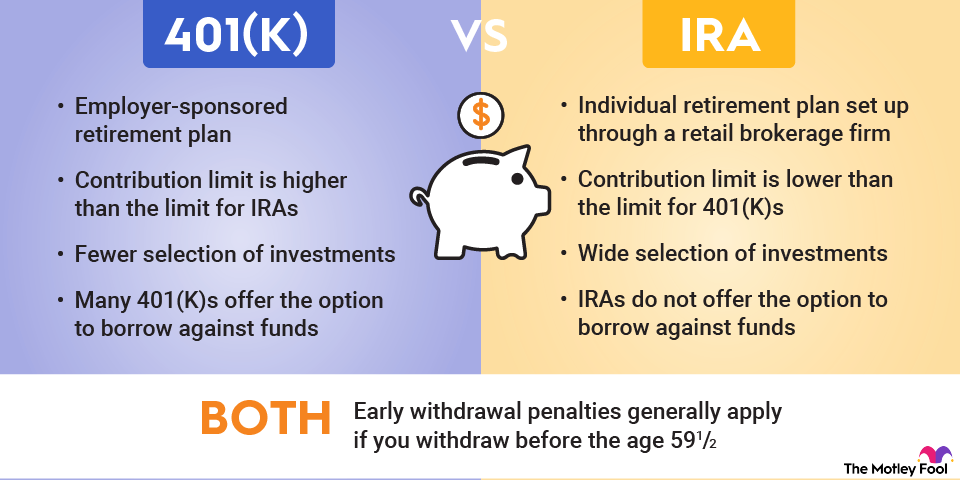

Because 401(k) plans offer limited investment options, you may be restricted to only buying shares in mutual funds, which often charge higher fees than other types of securities accessible with IRAs.

By contrast, investments in IRAs typically come with few or no fees. Most brokers don't charge a fee to open an IRA account and have eliminated commissions on trades. You can compare IRA providers to identify those that don't impose fees. Plus, with a broader choice of investment types, you may also save money in fees by choosing low-fee exchange-traded funds (ETFs) for your IRA's portfolio.

Flexibility

Most 401(k) plans offer the choice of investing in just 20 or fewer mutual funds, according to BrightScope. A minority of 401(k) plans now allow you to establish self-directed accounts -- meaning you can invest in many different types of securities, the same as you could with a typical brokerage account -- but self-directed 401(k)s are not the norm.

An IRA is more like a typical retail brokerage account in that your investment options are not restricted. If unrestricted investment choice is important to you, then an IRA is your best alternative. However, some investors appreciate the simplicity of having only a few investment funds from which to choose; in such cases, a 401(k) may be preferable.

Ultimately, as you compare all of the differences between IRAs and 401(k)s, you may decide that you prefer one over the other, or you may opt for both. Either way, the important thing is that you're saving now for your later years and building a diversified portfolio of sound investments that will provide for you in retirement.