Deciding between a revocable and an irrevocable living trust can be one of the more difficult financial decisions you’ll make. Both have their benefits and drawbacks, and both can ensure that your property will be disposed of how you choose, but there are differences.

What is a revocable trust?

What is a revocable trust?

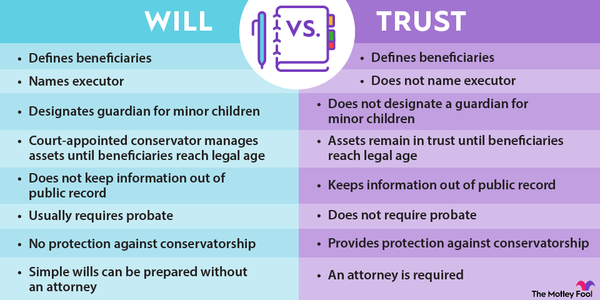

A revocable trust, also known as a living trust, is a trust in which the owner generally retains control and can change it as they see fit at any time -- it’s structured very differently from a will. This can be great if you’ve not quite settled on the property you’ll own for the rest of your life or the number of children you'll have. But the level of control that you retain over the trust means that the assets in your trust are at risk of lawsuits from creditors and remain subject to estate taxes.

What is an irrevocable trust?

What is an irrevocable trust?

Unlike a revocable trust, an irrevocable trust becomes an ironclad container for assets the moment the paperwork is finished. As with a revocable trust, the owner is able to specify how the assets will be divided, when, and under what conditions. But unlike a revocable trust, an irrevocable trust is almost impossible to change. And because you no longer have any day-to-day control over these assets, they’re generally protected from creditors and estate taxes.

Key differences

Revocable vs. irrevocable trusts: Key differences

Although both are important for retirement planning, revocable and irrevocable trusts function very differently.

In very simple terms, the main difference between revocable and irrevocable trusts is that one can be changed easily and one cannot, although that’s not the whole story. While you can change a revocable trust fairly simply on a whim and you can’t change an irrevocable trust unless everyone involved is in full agreement, there are many other important differences.

For example, irrevocable trusts are almost entirely managed by an independent trustee and sometimes a trust protector as well. Revocable trusts are generally managed by the person who owns the trust, which is a big part of why there aren’t as many protections for those assets as with irrevocable trusts.

Irrevocable trusts secure assets against litigation, as well as most estate taxes. They require a separate tax return and a different tax calculation on the assets they contain. Revocable trusts also do not shield assets from lawsuits or collections or soften the blow when it comes to estate taxes.

There are many differences, briefly outlined in the table below. As always, these differences will depend on exactly how your trust is set up, regardless of type.

| Question | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Who controls it? | Often self-administered | Independent trustee (and optional trust protector) |

| Is it modifiable? | Yes, at will | Not unless all parties agree |

| Does it offer estate tax protection? | No | Yes |

| Does it avoid probate? | Yes | Yes |

| Does it offer litigation protection? | No | Yes |

| Does it count against government benefits? | Yes | No |

| Does it require a separate tax return? | No | Yes |

Examples

Revocable vs. irrevocable trusts: Examples

Let’s look at a couple of very simple examples. In our scenario, you’re trying to pass a substantial family home with land to your children, who will inherit it when you die.

Revocable trust example

If you were to establish a revocable trust containing the house and the property surrounding it, you would be able to add or subtract items from that trust until you were no longer capable of making those decisions for yourself. You could also add or subtract people from the trust; for example, you could add your grandchildren as they’re born, or a favorite nephew.

However, none of this property will be protected if you accumulate substantial medical bills in your waning years. If you can't pay what's left after your insurance pays its part, the hospital could potentially go after your estate, including the revocable trust, to collect what it's owed. It could sue your trust, and would likely win, potentially forcing the sale of the family home you were trying to protect.

When it comes to paying your annual taxes, you’d pay taxes on all this property as if it were not in a trust, since you still have control of it. It would also count against you if you need access to government benefits as you age. Medicaid and Supplemental Security income both generally require you to deplete your assets before you can qualify, and a revocable trust is still considered an asset, even if the intent is to leave it to a family member.

In addition, if the home and property are substantial, worth more than about $13 million in 2023, they will be subject to estate taxes when the property passes to the trust beneficiaries. Even though those beneficiaries will be taxed only on the part that’s above the cutoff for the year they receive the property, that’s tax that they might not have to pay otherwise.

Irrevocable trust example

Let’s say you want to place the same property into an irrevocable trust instead. The irrevocable trust is a static object, and you can’t change it when you want, so you have to make sure that the beneficiaries you include are exactly the people you want to inherit the property. They will have to be responsible for caring for anyone else you otherwise would have included in the trust, such as family members who come under your care in the future.

If you get sick and have substantial bills in your future, the property is protected against lawsuits and collections, since the trust is basically in a legal vault and sealed away. You can’t dispose of it at will, so it’s not a liquid asset that can be pursued. (In practice, it sort of already half belongs to someone else.)

The same logic applies to your annual tax bills. You will no longer personally pay any income taxes on property locked in the trust if it generates income, such as from rental houses on the property. But it also won’t be included in your estate, so it's not considered in estate tax calculations. Please note: You do still have to pay taxes on any income generated by what’s locked in an irrevocable trust, it’s just separate from your regular taxes and reported on its own return.

The really good news for you, though, is that if you do need Medicaid or Supplemental Security income, your irrevocable trust isn’t considered an asset for those purposes. Although it will no longer be property that you can dispose of, you will be able to draw these benefits without risking your ability to pass the property on if your goal is to pass it along to your heirs.

Revocable trusts vs. irrevocable trusts: FAQs

Is a revocable trust better than an irrevocable trust?

A revocable trust isn’t better or worse than an irrevocable trust, but it is very different. If you need access to your trust-bound assets, or want to be able to make changes to your trust during your lifetime, a revocable trust is the only solution. However, if you don’t need those assets and are hoping to preserve them for future generations, irrevocable trusts can shield them from a lot of different problems, including lawsuits and estate taxes.

Why would someone want an irrevocable trust?

The biggest reason to have an irrevocable trust is to protect assets for future generations. Once in the trust, the assets can’t be seized by other parties to satisfy debts or lawsuits, and they’re shielded from estate taxes, which can be very helpful if you have a significant estate to pass to your heirs.

What is the downside of an irrevocable trust?

Irrevocable trusts are just that -- irrevocable (except in very rare circumstances). They’re difficult to change or dissolve, so you can’t move property into and out of them, and you can't change the beneficiaries once they’re set. If you set up an irrevocable trust, you have to be certain about how you want inheritances to look because undoing it can be impossible.