Loading paragraph...

Loading image...

Loading paragraph...

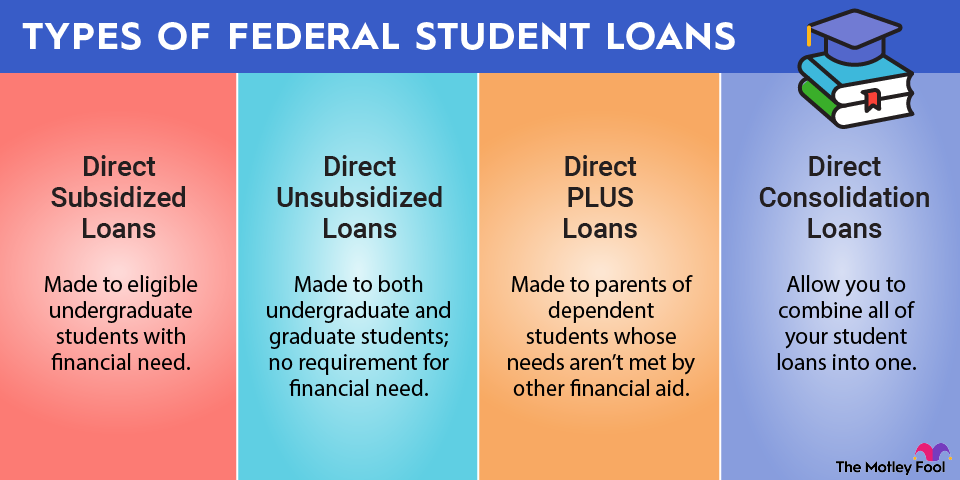

Direct Loans are federal student loans made directly by the U.S. Department of Education to students or parents.

Loading paragraph...

A subsidized student loan is a type of federal student loan that is designed to help borrowers with demonstrated financial need pay for college.

Loading paragraph...

Loading paragraph...

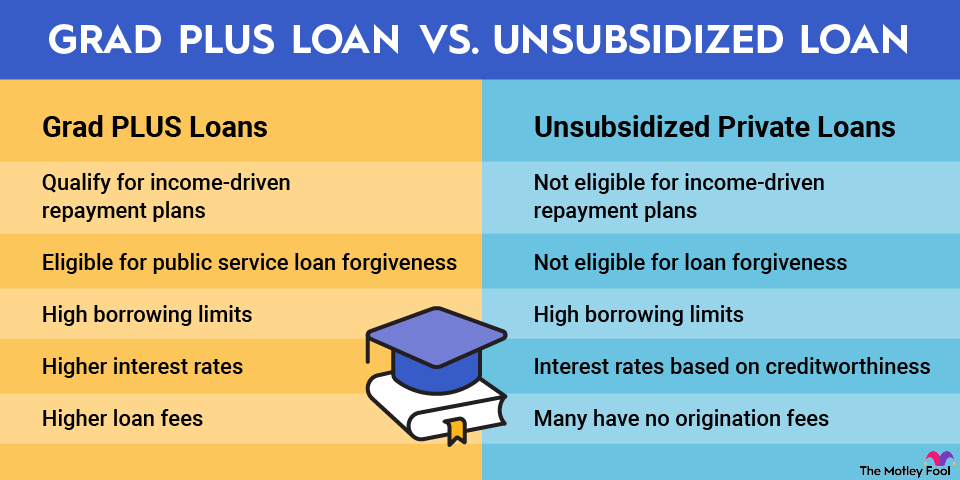

Unsubsidized student loans are a form of student loan where the borrower is responsible for paying all interest that accumulates, even when in school or on a deferment.

Loading paragraph...

Loading table...

Loading paragraph...

Loading table...

Loading paragraph...

Loading paragraph...

Loading paragraph...

Loading hub_pages...

Loading paragraph...

Loading paragraph...

Loading faq...

Adam Levy is a contributing Motley Fool stock market analyst covering technology, consumer, and financial stocks and how policy, economic, and consumer trends shape personal finance, Social Security and retirement savings. Before The Motley Fool, Adam was a financial advisor at Edward Jones. He studied finance and electrical engineering at Carnegie Mellon University.

The Motley Fool has a disclosure policy.