From student loan payments resuming after their pandemic pause to ongoing inflation, many borrowers are having a tough time managing their monthly finances, leading them to consider income-driven repayment plans as a way to help keep their financial house in order.

There are several options to consider when choosing to take the income-driven repayment plan route for federal loans, so it's important to consider the differences between the various plans, including the pros and cons. And, of course, whether an income-driven repayment plan, in general, is a smart choice for individuals. Bear in mind, also, that changes are coming after July 1, 2024 -- something that borrowers should remember to consider when digging deeper into the details of these plans.

Types of income-driven repayment plans

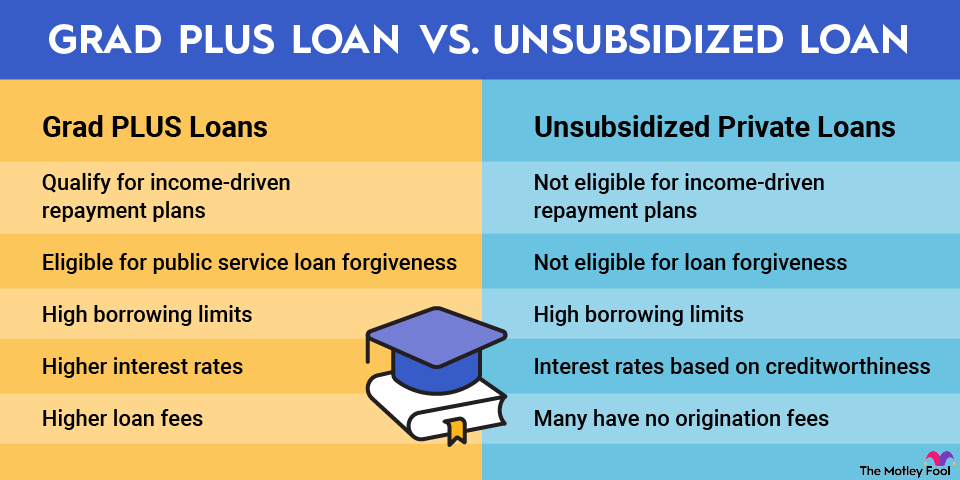

Borrowers have four different options with regard to income-driven repayment plans. While people with Direct Subsidized and Unsubsidized loans, as well as Direct PLUS loans for graduate study or professional students, are eligible for any of the following plans, borrowers with other loan types may only be eligible for certain income-driven repayment plans.

1. Income-Based Repayment (IBR) Plan

Of the four income-driven repayment plans, the IBR is open to those with the greatest number of loan types, including Subsidized and Unsubsidized Federal Stafford loans, Direct and Federal Family Education Loan (FFEL) PLUS loans made to students, direct or FFEL Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents.

Monthly payments are based on when borrowers took out their loans, but the payments will never exceed the 10-year Standard Repayment Plan amount.

2. Income-Contingent Repayment (ICR) Plan

Distinguishing itself from other income-driven repayment plans, the ICR is the only one available to those with Direct Consolidation Loans that include a Direct PLUS loan for parents. Similarly, the ICR is the sole option for borrowers with a Direct PLUS Loan for Parents or FFEL Consolidation Loans that include a Direct PLUS Loan for parents, but only if they're both consolidated.

Borrowers can expect monthly payments to be the lesser of 20% of their discretionary income and the amount they would pay on a repayment plan with a fixed payment over 12 years, adjusted according to their income.

3. Pay As You Earn (PAYE) Repayment Plan

People interested in this plan must be new borrowers on or after Oct. 1, 2007, and they must have received a disbursement of a Direct Loan on or after Oct. 1, 2011 to qualify.

This income-driven repayment plan has borrowers paying Uncle Sam 10% of their discretionary income each month, but payments will never exceed what they would pay under the 10-year Standard Repayment Plan.

4. Saving on a Valuable Education (SAVE) Plan

Launched in August 2023, the SAVE plan is a new income-driven repayment plan option for borrowers. Borrowers who have Direct PLUS Loans made to students and Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents are eligible.

People with undergraduate loans will have monthly payments of 10% of their discretionary income. Individuals with both undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income based on the original principal balances of their loans.

How do these income-driven repayment plans work?

Just as there were many questions to answer when students filled out their Free Application for Federal Student Aid (FAFSA) at the start of their higher education journeys, there are numerous questions to consider as they begin to repay their loans. Odds are if borrowers have a federal student loan, they are eligible for at least one type of income-driven repayment plan. There are some things to keep in mind with these options, though. First, borrowers who have defaulted on their loans are not eligible for income-driven repayment plans, so they would need to get out of default before applying. Another consideration is that some of these plans require that loans be consolidated, leaving borrowers with extra steps to accomplish before proceeding.

Applying for these plans is free of charge, and income-driven repayment plan forms are found on the studentaid.gov website, where borrowers can see which type of plan is most apt for them.

An important reminder for people who enroll in an income-driven repayment plan is that they must recertify their income every year, although this can be done automatically if they choose.

FAFSA

Pros of income-driven repayment plans

- Your loan may be forgiven in time. After making payments for the term of the plan (yes, all four of them), the remaining loan balance will be forgiven. The specifics of the income-driven repayment plan forgiveness vary, though, so borrowers should be sure to read the fine print.

- You may pay less. Should you experience a decrease in salary or the number of your family members grows, your monthly payment may decrease.

- Get some more breathing room. If you've struggled with high monthly payments, enrolling in an income-driven repayment plan may result in a lower bill each month and help you get your financial house in order.

Cons of income-driven repayment plans

- Your education may become more expensive. Depending on what plan they choose, borrowers may end up paying more in interest over the repayment period since they're making smaller monthly payments.

- Your low monthly payment may get higher. Just as your monthly payment can decrease if you make less money, you may be shelling out more each month if your income rises.

- You may pay more in taxes. Borrowers whose loans are forgiven at the end of the repayment periods may have to pay state taxes on the forgiven amount.

Can't afford income-driven repayment plans?

Hopefully, borrowers were able to save money in college and have some financial security upon leaving their campuses. But this isn't always the case, and they may believe that choosing an income-driven repayment plan will give them some breathing room financially. However, this isn't always the case, and even if choosing this route is something that borrowers can't afford, it's important for them to contact their loan providers. By doing this, they may be able to get a deferment or forbearance.

Other options include reducing expenses and growing income to help make the monthly payment. Additionally, borrowers should consider automatic payments since the interest rates on federal student loans are reduced by 0.25% when borrowers enroll in automatic payments.

Related investing topics

Should I use an income-driven repayment plan?

Like your freshman philosophy class, this question is complicated. Individuals' situations vary, and it's impossible to state categorically if one should choose an income-driven repayment plan or not since the advantages and disadvantages vary.

On one hand, no one wants to carry student loan payments into retirement, nor do they want to pay excessive penalties for late payments. Opting for an income-driven repayment plan can be an effective way to avoid that situation since there are fixed repayment periods; of course, it's not the only choice.

Also, if borrowers feel they may forget to recertify their income annually, choosing an income-driven repayment plan may be a poor choice. Failing to recertify one's income can have serious consequences. For example, if you're under the SAVE Plan and fail to recertify income, you'll be removed from the plan and placed on an alternative repayment plan.

All in all, one of the best moves a borrower can make is to use the loan simulator on the U.S. Department of Education's website to gain a better understanding of their individual situation.