You may worry about leaving your loved ones saddled with your student loan debt if you die when you still owe money. If you're wondering what happens to student loans when you die, the answer will depend on a number of factors, including whether your loans are federal or private and if you had a cosigner.

What happens to federal student loans when you die?

If you die owing money on federal student loans, the U.S. Department of Education will discharge your loans. That means your family members won't be responsible for paying off your debt.

This applies whether you took on federal student loan debt to pay for your own education or if you took out a Parent PLUS loan to pay for your child's education. In fact, Parent PLUS loans can be canceled if the student or the borrowing parent dies.

To get someone's federal student debt discharged after their passing, the person's loved ones will need to submit proof of their death to their student loan servicer.

What happens to private student debt when you die?

Most (but not all) private lenders offer a death discharge, which means they'll cancel student debt when you die. Things get a bit more complicated if you have a cosigner, which we'll discuss in the next section.

Cosigner

However, if your lender doesn't offer a death discharge, it can still make a claim against your estate, like any other creditor. If your debt exceeds your assets, such as savings accounts, stocks, and other investments, your estate will be insolvent. That means there won't be money left for an inheritance for your loved ones, but you don't have to worry that your family will "inherit" your debt. If your estate doesn't have enough assets to cover the balance, your lender simply won't be repaid in full.

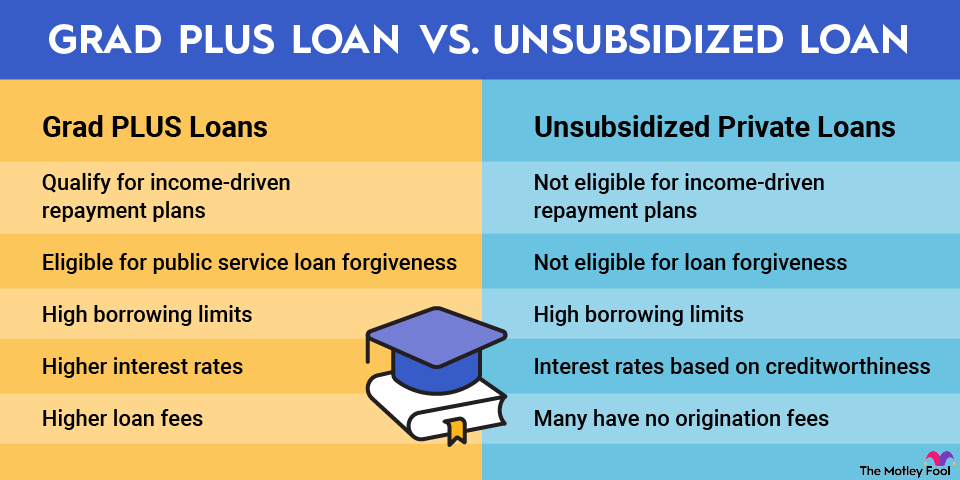

Private Student Loans

What happens to cosigned loans or a spouse's loans?

If you're the primary borrower and your student loan cosigner dies, you'll still be responsible for paying private student loans. Most private lenders will allow you to continue making payments as usual. Some, however, have what's called an automatic default policy that says the entire loan balance is due immediately if the cosigner dies or goes bankrupt. In this situation, you may be able to get the lender to agree to a cosigner release, depending on your creditworthiness.

When the primary borrower dies, many private lenders will discharge the debt without going after the cosigner. In fact, federal law requires that lenders automatically release student loan cosigners if the primary borrower dies for any loan taken out after Nov. 20, 2018. For loans taken out before then, what happens will depend on the loan agreement.

In most circumstances, you won't be expected to repay your spouse's student loan if they die, but there are a few exceptions. If you cosigned for the debt, you could still be held responsible if the loan was taken out prior to Nov. 20, 2018, and the lender doesn't provide for an automatic release. If you live in one of the nine states that follow community property law -- Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin -- creditors could also pursue your spouse for the debt if it was incurred while you were married.

Remember: All of the above applies only to private student loans. Federal student loans are forgiven when the borrower dies.

Pay attention to student loan terms

You probably weren't thinking about what happens to your student loans when you die when you initially took on the debt. But it's important to be aware of how a lender would handle things should the worst occur.

With federal student loan debt, it's pretty simple: The debt is forgiven once survivors provide proof of death. But with private student loans, examine the fine print carefully. If you don't have a copy of the documents you signed, contact your lender or servicer. Be on the lookout for an automatic default policy if you have a cosigner since you could be responsible for repaying your loan immediately should they die.