How to Amend Your S Corp Tax Return Form 1120-S

Mistakes happen. When you make an error on your S corporation’s tax return, it’s your responsibility to correct it by filing an amended return. Here’s how to amend Form 1120-S.

Overview: What is an amended 1120-S?

Let’s say you own an S corp, and you just filed your business tax return Form 1120-S. You’re sitting back and reviewing it, reveling in pride for filing your business taxes a month before the deadline.

Then you see it. It’s an error and glaringly obvious, like a pimple that crops up on your face overnight. You accidentally left off a source of revenue that you recorded in your accounting software on Dec. 31.

To correct some tax forms, you aren’t required to redo the entire return. You simply file another form that explains only what you did wrong and what should be changed. Other tax forms, like Form 1120-S, have you start over and refile the same form.

Even if you catch an error on a filed S corp tax return before the due date, you must correct it by filing a fresh copy. When you re-submit before the tax deadline, you’re filing a “superseding return.” You have until three years after you file a tax return to correct it through an “amended return.” Whatever you call it, S corps can only fix already-filed erroneous returns by doing it all over again.

And since S corps are pass-through entities -- where you pay business income taxes through your personal tax return -- a change to your S corp tax return causes you to file an amended personal tax return, too.

2 reasons you might need to amend your federal tax return with Form 1120-S

Either an error or new information will cause you to file an amended S corp return.

1. You made an error

You need to file an amended 1120-S when you make an error that affects your business income, deductions, or tax credits.

Say you omitted revenue or deductions when you initially filed your business taxes. If the error is a small dollar amount that doesn’t affect your tax liability, you might not have to file an amended return. It’s best to talk to a tax professional about any errors, even if they appear insignificant. Some tax software, like TurboTax, can connect you with a CPA who can tell you whether you’re required to refile.

Tax software should protect against this, but if you catch an arithmetic error, you don’t have to file an amended business tax return. The IRS will correct your math error and inform you of any additional tax owed. So don’t worry if you catch an error where you incorrectly summed two lines on your return; the IRS has calculators.

Likewise, if you accidentally left off a required schedule, the IRS will reach out and ask for it. You don’t have to refile for a missing document. Again, talk to an expert when you notice any error.

2. You have new information

Here’s a common amended 1120-S example. Let’s say you realize only after you file your S corp taxes that you forgot to claim a small business tax credit that could substantially lower your tax liability. That’s a reason to refile.

When new information surfaces that could affect your business tax return, turn to an expert for help with determining whether you need to refile Form 1120-S.

How to amend a federal S corp return with Form 1120-S

Follow these steps for making changes to your filed Form 1120-S. The IRS offers brief amended 1120-S instructions on its website.

1. File a new Form 1120-S

S corporations don’t have the luxury of filing a quick one- or two-page form to describe and correct mistakes. Instead, S corp owners have to recreate their Form 1120-S.

Through some cursory Googling, you might think you can use Form 1120-X, the corporate amended tax return form. Unfortunately, S corps can’t use 1120-X, and there’s no 1120-S-X.

It’s best practice to keep copies of every tax return you file. So pull up your initial return and correct the errors. If you used tax software for your first filing, all of your data should be saved.

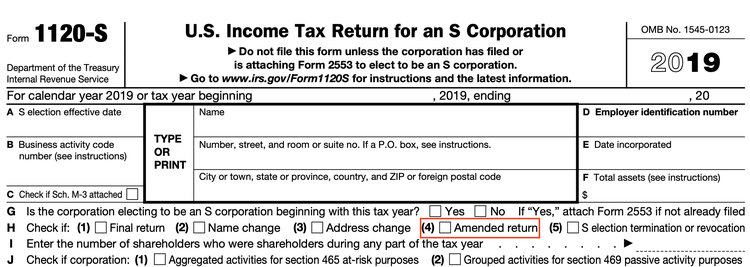

When you file the amended return, check the box on page one that says “amended return.” If you’re refiling before the form’s original due date, don’t check that box. Instead, mark your return as “superseding” in your tax software.

Check box 4 on line H to indicate you’re filing an amended Form 1120-S. Image source: Author

Your tax software will ask you to explain the changes made to Form 1120-S. Don’t sweat it. Briefly discuss the error or new information that prompted the amended return.

2. Prepare new Schedules K-1 for shareholders

Since your business income changed, you might need to file new compensation forms for your S corp owners, who are called shareholders. S corps are unique in that shareholders who actively participate in management are classified as employees. Therefore, they get paid a salary and potentially receive dividend distributions.

S corp owners receive a Form W-2 every January -- just like any other employee -- and a Schedule K-1. A shareholder-employee’s portion of business profits is reported on Schedule K-1.

If your business income changes, send out new Schedules K-1 to each shareholder.

3. File an amended personal tax return with Form 1040-X

You pay S corp income taxes on your personal tax return. If your Schedule K-1 or Form W-2 earnings changed, you need to amend your individual tax return Form 1040.

Remember how I mentioned that some IRS forms have an associated, simplified amended form that requires you to communicate only the corrections and saving you the hassle of refiling an entire return? Form 1040 has an amended return called Form 1040-X.

Adjust the business earnings reported on Form 1040-X according to the amount on your new Schedule K-1. Your tax software will walk you through the process.

Like with filing an amended Form 1120-S, you need to explain the changes made compared to your first return. You likely also have to refile Form 1040 Schedule SE, where you calculate self-employment taxes.

You must explain every change you make to a personal tax return through Form 1040-X. Image source: Author

4. Make an additional tax payment

If your amended return resulted in an increased tax liability, make another tax payment with your 1040-X filing. Interest and late-payment penalties may apply, depending on how long it took you to file your amended personal tax return.

5. Repeat the process for your state tax returns

Your state tax return likely needs an update, too. Tax software can update both forms simultaneously.

Make amends with an amended Form 1120-S

An honest mistake on your S corp tax return should be no cause for concern. As long as you right the wrong promptly, nobody from the IRS will come knocking on your door.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles