For many small businesses, there are tasks that sit around for ages waiting to be completed. None of the full-time employees has the time or desire to complete them, but they aren’t important enough to hire someone new.

That’s where independent contractors come in. You hire them for short-term projects, don’t pay benefits or withhold taxes, and, if they do well, they can be considered for future jobs. As a result, independent contractors often have relationships with multiple companies.

When it comes time to complete all the business taxes at the end of the year, full-time employees get W-2s and independent contractors get 1099s. Let’s go over how to complete 1099s and how the Form W-9 comes into the equation.

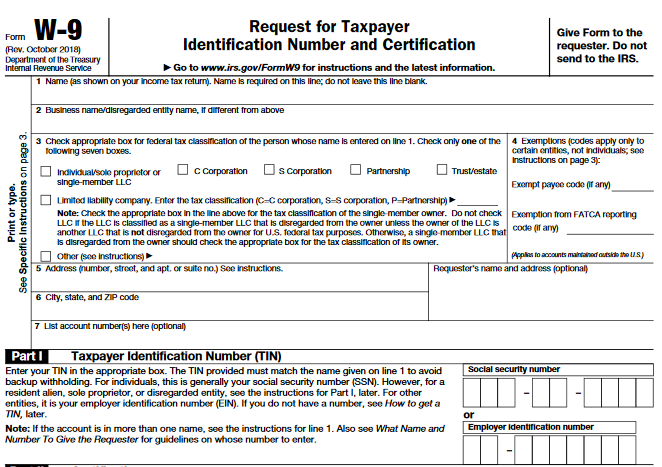

What is Form W-9?

The IRS Form W-9, or Request for Taxpayer Identification Number and Certification, is used to get the official tax ID number of any contractor who is working for you. This includes individuals working as contract employees and other businesses doing subcontract work.

It’s good practice to require the W-9 form to be completed before any payments are made to a contractor. You don’t strictly need it to print checks -- like you would a Form W-4 for full-time employees -- but if you get to the end of the year and don’t have it, you quickly get between a rock and a hard place as the filing deadline approaches.

What is Form 1099?

The Form 1099 is the independent contractor tax form. Employers send W-2s out to all full-time employees detailing the income they have earned that year as well as any tax deductions. The 1099 is the independent contractor version of the W-2. You don’t have to include any deductions on the 1099 because contractors are required to keep track of and pay all independent contractor taxes on their own.

For years employers completed the 1099-MISC form for 1099 contractors. Starting in 2020, the IRS Form 1099-NEC (non-employee compensation) is required to be submitted for independent contractors. We use that form in an example below.

Keep the article above on the 1099-MISC handy. If you are a general contractor who uses subcontractors throughout the year, you will still need to complete 1099-MISC forms for them. Generally speaking, the 1099-NEC is for humans only.

W-9 vs. 1099: What's the difference?

The W-9 is the form that you will send to your contractors (or that will be sent to you by a general contractor or bank) to get their information. The 1099 is the form that you complete and issue to your contractors and the government at the end of the year.

How to complete a W-9

Luckily, the W-9 instructions on the form are clear since you probably won’t be able to sit down with your contractors and help them fill it out. However, you will likely someday get the form from another company you are working with as a W-9 contractor, so see the instructions below for how to complete it.

The IRS Form W-9 requires identification information only. Image source: Author

If you’ve recently started some bank accounts or applied for trade credit, you could probably fill out this whole form in five minutes off the top of your head. You just need to know your business name, entity type, and tax ID number.

If you haven’t done either of those things, you can find all of this information in your business registration documents or on a recent business tax return. If you still can’t find your tax ID number, this article can help.

How to complete Form 1099

As you receive W-9s from your contractors, load them into your accounting software. The program I use has a vendor maintenance section where I enter in the business name, address, and tax ID to be printed onto checks.

With most accounting software, you will be able to either directly complete the 1099s with this vendor information as well as payments made during the year. You should also be able to easily filter to specific 1099 form independent contractors and complete the form manually, which is what we’ll go over next.

If you don’t withhold taxes for your contractors, the only box you need to look up is the compensation box. Image source: Author

Usually when the government changes a form, it is frustrating. Earlier in my career, I spent four years filling out the SBA Form 1919 for clients on an almost daily basis and then overnight the entire form changed. I always thought muscle memory was just for karate until I found myself mindlessly filling in nonexistent squares that had been moved three pages down.

The 1099-NEC is one of the few form changes I’ve seen where it is now a lot easier to complete. You add your company’s information in the payer boxes and the contractor’s information in the recipient boxes. Account number is the 1099 contractor’s number in your system. If you don’t withhold tax, which most companies don’t, then you just complete box No. 1, and you’re ready to send off the 1099s.

Here are a few other items to keep in mind:

- 1099s are only required if total payments made to the contractor amount to more than $600 during the year.

- The reported amount is for cash paid, not for accrued payment. If you have a contractor working on a massive project that straddles two years for one lump-sum payment, you would report it all in the year when the payment is made.

- Businesses often use independent contractors so that they don’t have to provide benefits or pay payroll taxes. Do not call true full-time employees independent contractors. (Picture the IRS as a giant eye of Sauron searching for companies that do this, and you don’t have any eagles to quickly fly you out of Mordor.)

How to file Form 1099 with the IRS

Make sure to purchase your 1099s either directly from the IRS or from your accounting software company. There are five copies of the information we completed above. One is for the federal government, one is for the state tax department, two go to the recipient, and one is for your files.

The form is due to recipients and the IRS on February 1 each year. You can file online with the IRS if your accounting software is able to create the correct file type for the forms. They cannot be scanned.

The easier path is to simply mail all the forms in with the Form 1096, which is a summary of all the 1099s that you are filing. The address is the same as all other assorted small business taxes:

Print and file this graphic since all IRS informational returns are sent to these addresses. Image source: Author

Staying in-formed

It’s sort of a rite of passage for businesses to complete a W-9 from a partner or bank and to start sending out 1099s at the end of the year. Both forms are easy enough to complete and shouldn’t hold you back from exploring all business avenues.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.