Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that. In a nutshell, Social Security is designed to support disabled and retired workers and their families by providing a guaranteed source of lifetime income for those who meet certain criteria.

Here's a closer look at how the program works, the different types of Social Security benefits available, and what you can expect when you're ready to claim benefits.

How Social Security works

Social Security is a government program that collects taxes from working Americans and distributes these funds to qualifying disabled workers, retirees, and their families to help them remain financially secure.

A worker typically must earn 40 credits to qualify for Social Security, though if they die or are disabled young, they may qualify with fewer credits. A credit is defined as $1,640 of earned income in 2023 and $1,730 of earned income in 2024. You can earn up to four credits per year.

You may claim Social Security based on your own work record, if you've earned enough credits, or you may be eligible to claim spousal benefits based on your current or ex-spouse's work record if this amount is larger than what you're entitled to on your own. Dependent children and other family members may also qualify for family benefits in certain circumstances.

When you're ready to apply for Social Security, you must fill out an application online or at your local Social Security Administration office. A government representative will verify the information in your application to determine if you qualify and then you'll begin receiving monthly checks.

Types of Social Security benefits

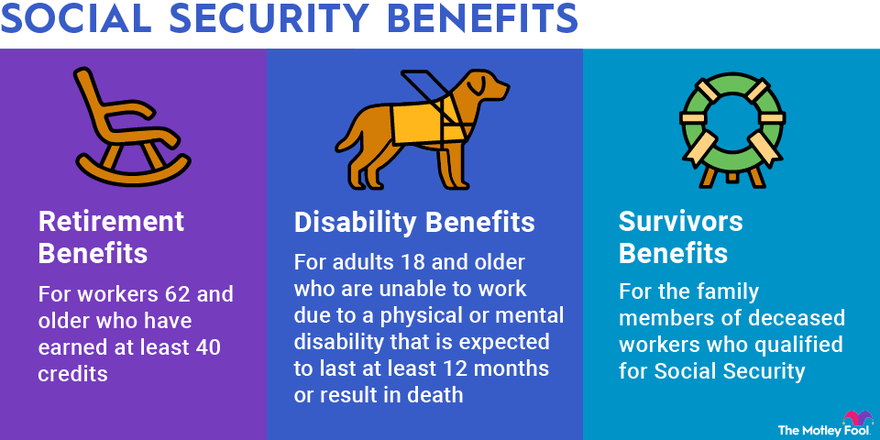

There are three main types of Social Security benefits:

- Retirement benefits

- Disability benefits

- Survivors benefits

Retirement benefits

Social Security retirement benefits are for workers 62 and older who have earned at least 40 credits. The size of your benefit checks depends on your average indexed monthly earnings (AIME) over your 35 highest-earning years, and the age at which you begin benefits.

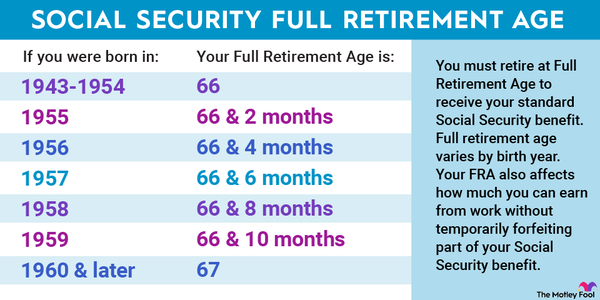

You must wait until your full retirement age (FRA) to claim your standard benefit based on your AIME. Your FRA is 66 if you were born between 1943 and 1954. For those born between 1955 and 1959, FRA rose by two months every year thereafter. For anyone born in 1960 or later, full retirement age is 67.

Claiming benefits before your full retirement age (FRA) reduces your checks.

If you begin claiming at 62, you'll get only 70% of your standard benefit if your FRA is 67 or 75% if your FRA is 66. Every month you delay benefits increases your checks slightly until you reach the maximum benefit at 70. This is 124% of your standard benefit if your FRA is 67 or 132% if your FRA is 66.

Receiving Social Security benefits under your FRA could cause you to lose some of that money back to the government if your income is high enough. The Social Security Earnings Test withholds:

- $1 from your checks for every $2 you earn above $21,240 per year if you will be under your full retirement age all year in 2023.

- $1 from your checks for every $2 you earn above $22,320 per year if you will be under your full retirement age all year in 2024.

- $1 for every $3 you earn over $56,520 if you will reach full retirement age in 2023.

- $1 for every $3 you earn over $59,520 if you will reach your full retirement age in 2024.

Once you're past your FRA, the government recalculates your benefit to include the amount it withheld.

Certain family members can claim benefits on your work record if doing so would give them more money than they're eligible for on their own work record.

Eligible family members include:

- Spouses

- Ex-spouses, if the marriage lasted for at least 10 years and they have not remarried

- Children under 18, or up to 19 if still enrolled in high school

- Children of any age who were disabled before 22 and are not earning more than $1,470 per month in 2023 or $1,550 per month in 2024. Social Security defines disability as a medical condition that results in severe functional limitations and that is expected to last 12 months or longer or result in death

Spouses and ex-spouses must be at least 62 in order to claim benefits, and spouses and children must wait for the worker to begin claiming benefits themselves before they can claim family benefits on their record.

Disability benefits

Social Security disability benefits are available to adults 18 or older who are unable to work due to a physical or mental disability that is expected to last at least 12 months or result in death. You may still be eligible even if you haven't earned 40 credits, depending upon your age at the time of your disability. Your benefit is determined by your average lifetime earnings, so individuals who earned more while they were working will receive larger disability checks.

You must provide the government with information about your work history and your medical condition, including relevant supporting documents, when you apply. The Social Security Administration will review your case to decide if you are eligible. If it rules in your favor, you'll receive disability checks for as long as your disability lasts or the rest of your life, depending on the condition. If it rules against you, you may request a reconsideration or appeal to an administrative law judge.

Family members may be able to claim benefits on a disabled worker’s work record if they are:

- A spouse 62 or older or of any age if caring for a disabled worker’s disabled child or child 16 or younger

- Ex-spouses who were married to the disabled worker for at least 10 years and have not remarried if they meet the same criteria as spouses

- Unmarried children up to 18, or 19 if still attending high school

- Children of any age who were disabled before 22

Survivors benefits

Survivors benefits are benefits for the family members of deceased workers who qualified for Social Security.

The amount of the survivors benefit depends on the deceased worker's average income, adjusted for inflation, and their relationship to the deceased.

Surviving spouses who are 60 or older (50 or older if disabled) may claim survivors benefits, as can surviving spouses of any age if they are caring for the deceased worker's child who is under 16 or disabled. The same rules apply for ex-spouses as long as they were married to the deceased worker for at least 10 years and have not remarried.

The deceased worker's children under 18, or up to 19 if still enrolled in high school, are eligible for benefits, as are disabled children of any age if they were disabled before 22. Parents of the deceased worker may also qualify for benefits if the deceased was providing 50% or more of their financial support before they died.

In addition to these benefits, the surviving spouse or children may be eligible for a one-time death benefit of $255.

Related Retirement Topics

Brief history of Social Security

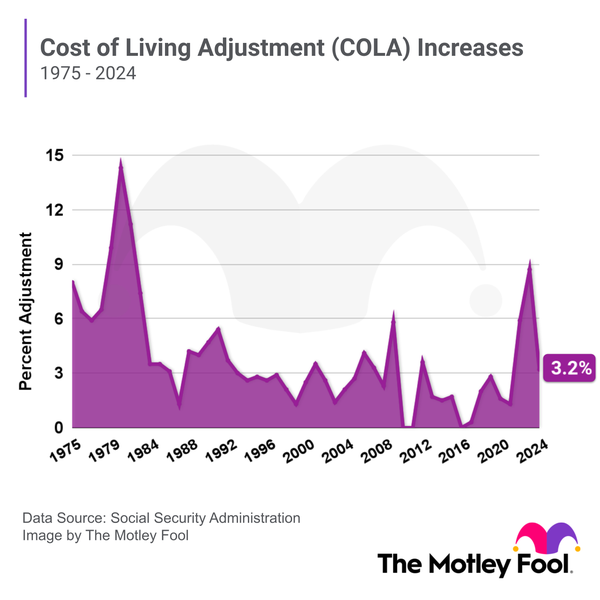

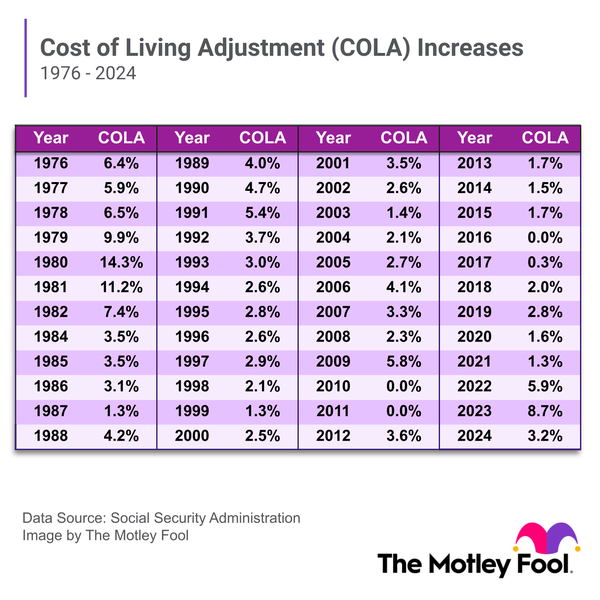

The Social Security program was created by the Social Security Act that President Franklin D. Roosevelt signed into law in 1935. The first checks went out in 1940. Originally it paid benefits only to workers 65 and older, but in the 1970s the government altered it to allow workers to claim benefits as early as 62. It also instituted annual cost-of-living adjustments (COLAs) to help Social Security keep pace with inflation.

The program has worked fairly well so far, but many people fear for the future, when there will be fewer workers to support a greater number of Social Security recipients.

The latest Social Security Trustees' Report indicates that the program's retirement trust fund could be depleted by 2033, after which it would be able to pay out only about 77% of benefits to retirees. Though previous reports estimated that Social Security's disability trust fund would run dry by 2057, the latest trustee's report projects that the disability trust fund will not be depleted in the next 75 years.

The government has proposed several possible solutions for ensuring the long-term sustainability of the program, but at present no plans have been set. There's no risk of the program disappearing in the next decade or two, but it's possible future benefits may not go as far as they do today. That's why today's workers need to prioritize their personal retirement savings, so they can cover most of their expenses on their own.