As a small business owner, you’re likely the person in charge of payroll. You might feel like a payroll clerk when you’re manually entering each employee’s hours every two weeks.

Let’s get you a promotion to payroll manager.

Overview: What is payroll management?

Payroll management is the umbrella term for running payroll, remitting payroll taxes, and storing required documents. Those tasks are cumbersome for business owners who would rather spend their time working on improving their products and planning for the future.

Cut down on time spent calculating payroll taxes by implementing a robust payroll management system: Software is the payroll clerk, and you’re the manager.

The 9 phases of the payroll management process

Payroll software saves business owners countless hours in clerical gymnastics. Though software relieves much of the burden, business owners still need to know how payroll works to correctly set up their software and detect errors.

1. Gather and update payroll information

Before you start processing payroll, give your payroll software everything it needs to cut accurate paychecks and make proper tax payments and contributions.

During the onboarding process, collect these documents from each employee:

- Form W-4, which lists their federal withholdings

- State income tax withholding forms

- Form I-9, which verifies employment eligibility

Since you don’t make payroll tax payments for independent contractors, they don’t submit Form W-4 or state income tax withholding forms. Instead, they fill out Form W-9, for which you need to generate year-end tax forms.

Then, set up your business for payroll:

- Have an employer ID number (EIN)

- Get a state tax ID number for every state in which your employees live

- Decide on a payroll schedule, whether it’s weekly, bi-weekly, or semi-monthly

- Implement a time-tracking system to track hourly employees

- Open a separate payroll bank account to speed up payroll reconciliation

- Collect direct deposit bank information from your employees

- Agree on each employee’s hourly wage or salary

Aside from time tracking, all of this information goes directly into your payroll software.

2. Calculate gross pay

Now that we’re past the initial payroll management setup, we’re ready to begin calculating paychecks.

Collect time cards or timesheets from your hourly, non-exempt employees. Take note of overtime during the pay period, because you may owe time and a half.

If you’re doing payroll for a restaurant, tipped employees must report their collections. Employers who claim the Federal Insurance Contributions Act, or FICA, tip tax credit need daily tip reports, and other employers need them monthly.

Implement a time clock software that integrates with your payroll software to avoid having to manually enter each employee’s hours.

Now you can calculate gross pay, or earnings before deductions, which include taxes and contributions to health and retirement plans.

Let’s say you own a small hardware store, where employee Christina worked 45 hours last week. She’s paid $15 per hour and receives a weekly paycheck.

Since she worked more than 40 hours, she’s entitled to 5 hours of overtime pay.

Her regular wage counts for the first 40 hours of work:

$15 x 40 hours = $600

Let’s add in her overtime pay, which is subject to time and a half ($15 x 1.5 = $22.50).

$22.50 x 5 = $112.50

Christina’s gross pay is $712.50.

3. Subtract payroll deductions and calculate net pay

Payroll deductions come in three parts: pre-tax, tax withholdings, and post-tax.

Subtract the following payroll deductions to arrive at net pay, which is the amount your employees see on their paychecks.

Pre-tax deductions

Pre-tax deductions, such as contributions to health insurance and some retirement plans, decrease taxable wages.

Pre-tax deductions reduce your federal income tax liability, but they don’t necessarily lower all payroll taxes. Medicare and Social Security taxes, known as FICA, are calculated based on gross pay.

Tax withholdings

As an employer, you withhold a portion of employee pay for regular tax payments. Subtract from gross pay:

- Federal income tax withholding

- State and local income taxes withholding

- One-half of Medicare and Social Security taxes (FICA)

- State unemployment tax (SUTA), depending on the state

- Additional Medicare taxes for high-earners

Check out our guide to calculating small business payroll taxes.

Post-tax deductions

Now, subtract post-tax deductions from employee pay. Wage garnishment, life insurance plan contributions, and Roth 401(k) contributions are post-tax deductions.

4. Calculate employer payroll taxes

Don’t walk away from the tax table just yet. Employers pay taxes based on employee compensation. They are:

- Federal unemployment tax (FUTA)

- State unemployment tax (SUTA)

- One-half of Medicare and Social Security taxes (FICA)

- Local taxes

Use our small business guide to employer-paid taxes so you don’t miss a required payroll tax.

5. Check your work with a payroll reconciliation

Before paychecks go out the door, complete a payroll reconciliation.

A reconciliation adds comfort that your payroll software is running correctly.

While it seems like an unnecessary step when payroll software automates the process, remember that mistakes can always happen, and business owners are ultimately responsible for errors.

6. Prepare payroll journal entries

Payroll software can often integrate with your accounting software to automatically prepare payroll journal entries. Journal entries are the language of accounting. Brush up with Bookkeeping 101.

A payroll journal entry includes all the costs to process payroll, including wages, employee- and employer-paid payroll taxes, and payroll deductions.

Companies that use accrual accounting have more involved payroll journal entries. Payroll journal entries comprise many non-cash costs associated with your employees, including accrued vacation and sick time.

7. Cut the checks

You’ve double-checked your employees’ paychecks. Now it’s time to send them out.

Whether you pay employees through direct deposit or paper checks, attach pay stubs to show how you arrived at the paycheck amount. Employees can catch errors and better understand where their money is going.

Many states require employers to make pay stubs available, but don’t wait to be asked for a pay stub. Generating pay stubs with every paycheck benefits both you and your employees, and we’ll get to why in phase 9.

8. Make tax, health, and retirement payments

You withheld taxes and contributions from employee pay in step 3, and you calculated employer payroll taxes in step 4. Now, it’s time to send those payments and contributions where they need to go.

Your payroll software usually withdraws enough from your bank account each payroll cycle to make these payments on time.

Check at least quarterly that tax payments and other contributions actually reach the IRS, state tax authority, and other third parties, especially on behalf of employees living in a state where your company hasn’t paid tax before.

Employers need a state tax ID for every state where they remit taxes. To get a state tax ID, you have to register on the state tax website. You might have to make the first state tax payment manually before your payroll software can do it automatically.

Refer to the IRS website for payroll tax due dates.

9. Generate, send, and store payroll documents

At the start of every year, you’re required to send both your employees and the IRS forms about the previous year’s earnings, such as Form W-2, Form 1099-MISC or 1099-NEC, and Form W-3.

I know that looks like a bunch of letters, numbers, and symbols thrown together. And that list is not comprehensive, so check with a tax professional familiar with your state’s tax filing requirements and your business’s payroll deductions. Your tax software can take care of this for you, too.

Once you create and send off the gamut of tax documents, you must keep a copy.

The Fair Labor Standards Act (FLSA) requires that you hold onto employee payroll records for at least three years. Refer to the FLSA fact sheet for a list of the 14 required payroll records.

The IRS’s record-keeping rules, found on the IRS website, are similar but require that you hold onto the records for at least four years.

To be safe, keep all payroll documents for at least seven years.

The benefit of managing payroll for your small business

Once your payroll management system is in place, there’s no downside.

1. It reduces errors

Some errors, such as a missed tax filing, can cost your business hundreds of dollars in penalties. Having an efficient payroll system limits the likelihood of mistakes that affect your business’s bottom line.

If you’re not sure where to start, invest in a payroll application that serves your business’s needs. You can easily manage payroll when most of the work is done for you.

2. Inquiries become less of a pain

Have you ever received a letter from the IRS asking for some information about your payroll? How about one of your employees who thinks there’s been a mistake?

A well-managed payroll system neatly houses all your payroll documents for easy access in those situations. Any tax professionals you bring in to help you answer an IRS inquiry letter will thank you for having an organized payroll system.

3. You have more time for everything else

You’re a business owner, so you probably feel like you do five people’s jobs. You don’t need to be the payroll clerk, too.

If you can rely on a streamlined payroll management system, you’ll have more time to focus on other areas of your business that need your attention.

The best payroll management tools for your small business

The first place to start when implementing a payroll management system is by picking the best software to fit your business’s needs. Here are a few that stand out.

1. Intuit Quickbooks Online Payroll

Quickbooks Online Payroll seamlessly integrates with the Quickbooks Online accounting software. If you’re already in the Intuit Quickbooks ecosystem, this online payroll management software makes a great choice.

The program walks you through the most laborious part of implementing a payroll management system, which is entering all the facts and figures about your business. Quickbooks Online Payroll creates a to-do list that takes you through the onboarding process.

Intuit Quickbooks Online Payroll walks you through onboarding with a to-do list. Image source: Author

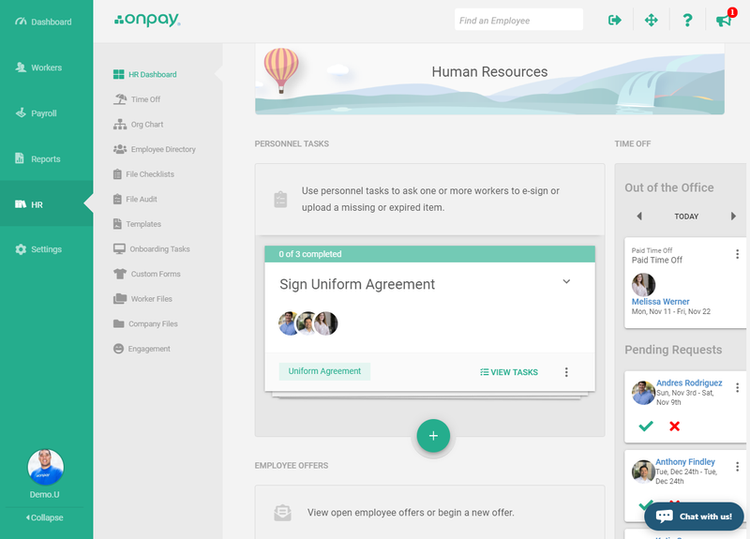

2. OnPay

For business owners looking to get more out of their payroll software, customization is key.

OnPay integrates with many third-party applications to simplify the payroll process. You can sync timesheet software with OnPay so you don’t have to enter each employee’s hours by hand. That automation reduces human error and speeds up the amount of time it takes to do payroll.

OnPay offers HR solutions, making it an ideal solution for small businesses looking for a home-based software for all of your business’s essential functions.

OnPay offers HR tools that make the software a one-stop solution. Image source: Author

3. Payroll4Free

Free payroll software that actually works? Yes, it exists. Payroll4Free doesn’t cost anything for employers with up to 25 employees, and it remains modestly priced at $12.50 when you add more.

You’ll miss out on integration with third-party software, and you have to suffer through a slow setup process. And the interface doesn’t look as sleek as one might expect today. But if payroll software isn't in the budget, Payroll4Free is there.

Payroll4Free offers free payroll processing for companies with up to 25 employees. Image source: Author

You’re not alone in managing your payroll

Running payroll can feel intimidating to a business owner who’s never done it before. But once you get a payroll system in place, your attitude will change.

Invest time now to get your payroll system set up correctly, and you’ll be rewarded with fewer errors and more time to dedicate to other areas of your business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.