A Small Business Guide to Pass-Through Entity Types

You probably already know what a pass-through entity is without realizing it. You might even run a pass-through entity without knowing the word for it.

If you pay your small business taxes on your personal tax returns, you run a pass-through entity.

Overview: What is a pass-through entity?

A pass-through entity is a company that pays tax solely on its owners’ tax returns.

For tax purposes, businesses are either pass-through entities or C corporations. Most small businesses organize as pass-through entities to avoid double taxation and the colossal list of administrative rules that come with owning a C corporation.

Pass-through entities pay no entity-level tax, putting the entire tax burden on owners. C corporations pay a 21% flat business tax and file a business tax return before distributing earnings to shareholders, who are subject to another layer of tax.

Read more about C corporations in our guide to starting a corporation.

Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040. An owner’s income tax liability depends on his or her income tax bracket.

Most pass-through business types also file information tax returns to detail their earnings to the IRS, but it’s not for tax-paying purposes.

How does a pass-through entity work?

Pass-through entities, also called flow-through entities, roughly follow the same tax-paying process:

- The entity calculates taxable income before the owners’ compensation

- The entity divides taxable income according to ownership percentage (more on that later)

- Owners report their share of income on their personal tax return Form 1040

- Owners pay tax based on their personal taxable income

Let’s consider an example with a limited liability company (LLC), one of many pass-through entity types. AJC Design Consultants, LLC, earned $150,000 last year before paying its owners, Adam, Janice, and Clarise. The owners, also called members, each own one-third of the company.

Pass-through entities divide their taxable income according to their ownership percentage. In an organization with one owner -- a sole proprietorship or single-member LLC -- the ownership percentage is 100%. With AJC, each member’s ownership is 33.3% (100% / 3 equal members).

AJC’s earnings get split three ways, leaving Adam, Janice, and Clarise with $50,000 each. Adam, Janice, and Clarise each report $50,000 in income on Schedule E of Form 1040, their personal tax return.

Most pass-through entities, including most LLCs, are subject to IRS self-employment tax. Each member pays 15.3% on his or her potion of earnings. Earnings are also subject to state, local and federal income taxes.

You might notice we didn’t talk about how much income each member actually took home, called a member’s draw. That’s because it’s irrelevant to the tax calculation.

Let’s say Adam drew $30,000 during the year. Why is he being taxed on $50,000, $20,000 of which he didn’t take home?

It doesn’t matter if AJC kept some of its earnings in its business bank account. LLCs don’t pay tax outside of their owners’ tax returns, so all income must be taxed at the owner level.

Even though Adam didn’t receive his full share of income in cash, he’s still responsible for paying tax on his share of income.

Types of pass-through entities

Business owners have a selection of pass-through entity types to choose from, each coming with different tax and legal advantages. Here are the most popular pass-through entity types.

Type 1: Sole proprietorships

Sole proprietorships are the most common business type because they’re the default for independent contractors. Sole proprietorships have one owner and are a straightforward business type suitable for freelancers.

You’re automatically a sole proprietor once you report business income on your personal tax return. There’s no business registration process for sole proprietorships.

Sole proprietorships don’t need to file an information tax return, unlike most other pass-through entities. Since sole proprietorships don’t file an information return, they’re considered a “disregarded entity.”

Sole proprietorships report business income on Schedule C of Form 1040. Though sole proprietorships come with no legal or financial protections, they require little business documentation until they hire an employee.

Type 2: Partnerships

Partnerships must have at least two owners. It’s the default type of business for companies with two or more owners.

Unlike sole proprietorships, partnerships must go through the business registration process. That’s when the partners establish their ownership percentages. Partnerships must file information return Form 1064 with the IRS.

From a tax perspective, Limited Liability Partnerships (LLPs) operate the same way but benefit from legal and financial protections.

Type 3: Limited liability companies (LLCs)

Limited liability companies (LLCs) are the chameleon of business types because they may be taxed in many ways. LLCs may elect to be taxed as their default classification, a C corporation, or an S corporation.

By default, an LLC with one owner -- called a single-member LLC -- is taxed like a sole proprietorship. A single-member LLC owner enjoys the legal and financial protections of the business type but is considered a disregarded entity to the IRS. That means single-member LLCs don’t file information returns.

Similarly, multi-owner LLCs receive the same tax treatment as partnerships unless they elect a different IRS classification. Multi-owner LLCs taxed as partnerships must file information return Form 1065 that relays earnings to the IRS.

Type 4: S Corporation

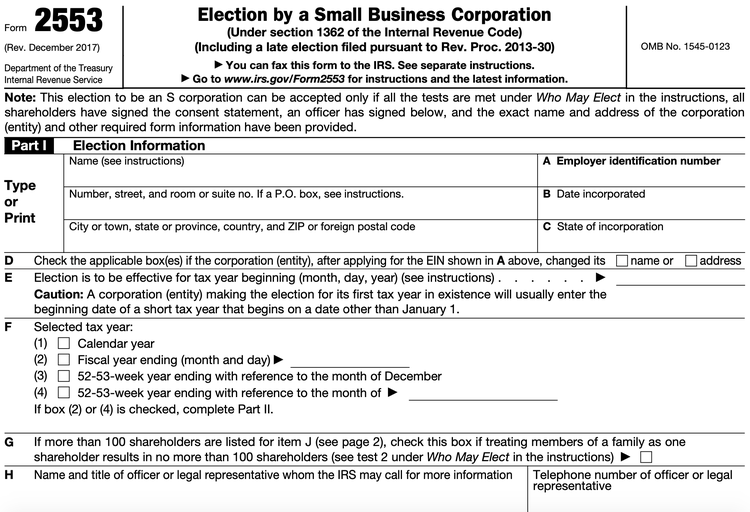

To get your business taxed as an S corporation, you must first get C corporation status. Then, you can file a second request to become an S corporation with Form 2553.

A unique feature of S corporations is that owners who actively participate in the management of the corporation can be treated as employees, which helps them avoid self-employment taxes on a portion of their income.

While S corporations start out as C corporations, they’re purely pass-through entities. There’s no S corp tax rate because all earnings flow through to the owners.

S corporation owners can be paid both a salary and a dividend distribution. Salaried income is subject to payroll taxes, while dividends aren’t. The IRS knows this distinction and requires that S corp owners pay themselves reasonable salaries before taking distributions.

Each year, S corporations file Form 1120-S, an information return. Not all businesses can elect S corporation treatment. Check out the IRS notice to see if you’re eligible to elect S corporation tax status.

If your business qualifies, file IRS Form 2553 to elect S corporation status. Image source: Author

Benefits and disadvantages of pass-through entities

Pass-through taxation offers many advantages to small business owners, but it’s not perfect for all businesses. Weigh the benefits and drawbacks before deciding on your business’s tax classification.

Advantages of pass-through entities

Pass-through taxation allows business owners to avoid double taxation, and it also affords them an extra deduction on their personal taxes in certain circumstances.

Avoiding double taxation

Owners of C Corporations suffer from double taxation, while pass-through entity owners are taxed just once.

C Corporations pay a flat 21% business income tax before income reaches shareholders. Shareholders must report their dividend income on their personal tax returns.

You can’t deduct dividends on your business taxes, so the same dollars go through two rounds of taxation.

Pass-through entities skip the entity-level tax step and send all business income straight to the owners, who pay tax on their portion of business income.

Net operating loss deduction

When a pass-through entity suffers a net operating loss (NOL), its owners can take an NOL deduction on their personal taxes. That means the owner’s personal tax liability gets reduced.

C corporations can also take an NOL deduction, but its benefit doesn’t extend to owners. When a C corporation has an NOL, its shareholders must still pay income tax on any earnings distributed to them.

Disadvantages of pass-through entities

Before you jump into action, though, note the disadvantages of operating your business as a pass-through entity.

Owners pay tax on their entire share of income

Owners of pass-through entities must pay income tax on their full share of earnings, even if the cash wasn’t distributed.

For example, say you own a single-member LLC that earned $200,000 last year before paying you $100,000.

If your business were a C corporation, you’d only report $100,000 in income on your personal taxes. The company would pay a 21% tax on the $200,000 before paying you $100,000.

Because you run a pass-through entity, you report the whole $200,000 on your personal taxes.

Not all pass-through entities are equal

Each pass-through business type comes with a list of pros and cons. It might be hard to decide which is best for your business.

For example, S corporations require the most time to set up, but once that’s done, the benefits are substantial. Consult a tax professional before choosing your business type.

Don’t pass through without guidance

Before you set up your business as a pass-through entity, consult a professional who can advise you on the matter.

Your choice in business type determines whether you can use self-employment tax software or if you need to bring on a tax professional to take care of your C corporation taxes.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles