It's been a little over a year since I last recommended buying shares of BAE Systems (OTC: BAESY), the British defense giant, and, well, things haven't gone quite as I envisioned them.

Don't get me wrong -- BAE's business is doing fine. Revenue grew a modest 2% in the first half of 2019, but profit surged ahead 62% to $1 billion earned in the last six months, and $1.7 billion over the last year, with $1.3 billion in trailing free cash flow. Despite all this, though, BAE's stock price is down 13% since last August.

But perhaps not for long.

With $22 billion in trailing sales and a market capitalization of $22.5 billion, BAE Systems stock already sells for not much more than the one-times-sales long-term average valuation for defense stocks. Meanwhile, it sells for a steep discount to the current valuations of the larger U.S. defense stocks against which it competes -- such as General Dynamics (1.4 times sales), Lockheed Martin (1.9 times sales), and Raytheon (2 times sales) -- which suggests defense investors lately have become willing to pay higher-than-average prices to own these kinds of stocks.

Moreover, BAE Systems may soon deserve a bigger market capitalization. Last week, BAE won a big Pentagon contract that promises to boost its sales significantly. Considering the historical link between sales and market cap, I'd expect it to boost the company's stock price as well.

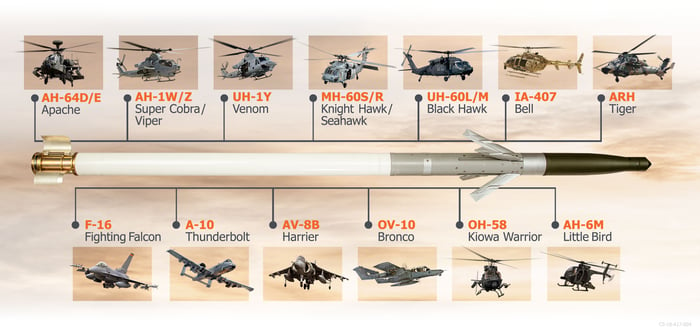

As the Pentagon announced in its September 25 daily update of contracts awarded, BAE has been contracted to produce the next five full-rate production lots of Advanced Precision Kill Weapon System (APKWS) II rockets for the Navy. Valued at $2.7 billion in total, the contract hires BAE to produce an unspecified number of the 2.75-inch "semi-active laser guided precision" rockets for the U.S. Navy, Army, and Air Force, as well as for the militaries of Afghanistan, Australia, Iraq, Jordan, Lebanon, Netherlands, the Philippines, Tunisia, and the United Kingdom.

Image source: BAE Systems.

APKWS in dollars and cents

BAE, of course, will not fulfill its contract all in one day, nor will the company receive all of this $2.7 billion in one lump sum. Rather, BAE's contract will stretch all the way from its award date through December 2025, as it produces batches of rockets as needed. But even stretched over more than five years, the contract is a significant win for BAE.

The contract value is equivalent to about one-eighth of a year's revenue for the company and could therefore either add to, or at worst secure more than a third of the 5.7% annual sales growth rate analysts are modeling for BAE stock (per S&P Global Market Intelligence data). Moreover, this revenue will flow through BAE's second most profitable business division, Electronic Systems, which is responsible for production of the "seeker optics" that transform a basic unguided 2.75-inch rocket into a "pinpoint" accurate smart weapon.

At Electronic Systems' 15.3% operating profit margin, this contract should produce total operating profit of more than $410 million for BAE, or about one-sixth of all the profit it earned last year.

The upshot for investors

At roughly 13 times trailing earnings, with a 6%-ish growth rate and a dividend yield of nearly 4%, BAE stock looks close to fairly priced to me. Then again, with similar defense companies being awarded much higher valuations by investors, I could be wrong about that, and BAE might actually be undervalued relative to the competition. Factor in a big boost to sales at above-average profit margins from this latest Pentagon contract, and there's even more potential for BAE stock to go up.