Ford Motor (F 0.69%) versus Tesla (TSLA 4.96%)? The Dearborn dinosaur versus Elon Musk's futuristic dream? Seriously?

Yes, seriously. For starters, both stocks are down sharply from highs earlier in the decade. And while the two companies are different, both are facing similar challenges as investors start to confront the possibility of a recession sometime in the next couple of years.

So which is the better buy now? It's not as simple as you might think. Read on.

Valuation and stock performance

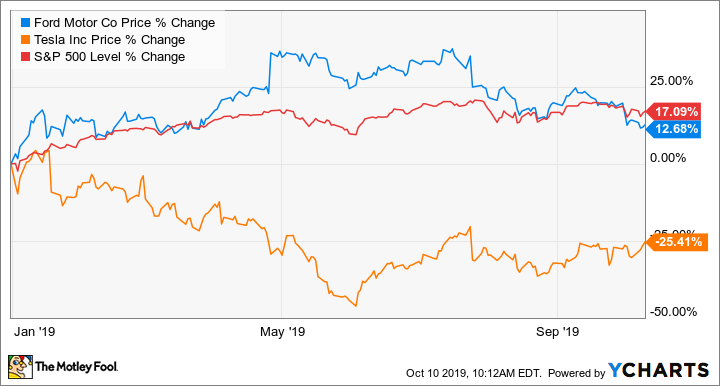

If you haven't been following the two companies closely, you might be surprised to learn that Ford's stock has outperformed Tesla's since the beginning of 2019 -- but both have trailed the S&P 500 Index's (^GSPC -0.46%) year-to-date gain.

Ford's stock has risen in 2019, but it's still cheap by historical measures. Right now, Ford's shares are trading at around 6.5 times its adjusted earnings over the past four quarters. The historical norm for a healthy automaker is around 10 times earnings, at least in periods when sales are strong (as they are now, for the most part).

It's not fair to value Tesla using traditional earnings-based metrics, as the company has yet to reach sustainable profitability. An alternative is to look at Tesla's enterprise value, a metric that aims to capture a theoretical acquisition price by adding the value of a company's debt to its market cap. For most established automakers, the enterprise-value-to-revenue ratio is right around 1. (Ford's is about 1.05 at the moment). Tesla's is about 2.16 -- about double its larger peers'.

At least by these metrics, Ford's stock looks cheap and Tesla's looks expensive. But again, it's not that simple. Let's dig deeper.

Tesla's Model S was a groundbreaking product that captured the imagination of investors. Image source: Tesla.

Tesla's valuation is all about its story

Tesla's valuation isn't driven by its current financial performance; it's driven by investors' expectations of future growth -- a story, in other words. As the story goes, Tesla's sales will continue to rise sharply over the next several years as the developed world embraces electric vehicles, until it's one of the world's largest and most profitable automakers.

While the company's shares have sagged over the past year, many Wall Street analysts are still bullish about Tesla's near-term growth potential. While analysts polled by Thomson Reuters expect Tesla to post a loss of $3.47 per share in 2019, they expect a profit of $4.02 per share, on average, in 2020 -- and more growth for several years thereafter.

Here are the high points of the bull case for Tesla, in a nutshell:

- Tesla's factory in Shanghai, currently under construction, will begin cranking out Model 3s for the local market within months.

- Tesla's long-awaited compact crossover SUV, the Model-3-based Model Y, is expected to launch next year and to sell in big numbers.

- Tesla will soon show an electric pickup truck with the potential to challenge the Detroit stalwarts.

- Overall demand for Teslas will remain strong, exceeding Tesla's production capacity, helping it to get strong prices and margins for its current and upcoming models.

Of course, there's a bearish view too:

- Demand for Teslas may be peaking. Many early adopters have already bought, and Tesla has yet to see significant demand from mainstream car-buyers. Tesla's third-quarter deliveries were up just 2% sequentially, giving this argument some weight.

- To the extent that Tesla's sales are growing, the lower-profit Model 3 is cannibalizing sales of Tesla's larger and more profitable Model S and Model X. Sales of both of the larger Teslas fell in the third quarter.

- Tesla's U.S. factory doesn't have room to build an additional high-volume product, meaning that the company will have to make some big investments before the pickup -- or anything else -- comes to market. That isn't happening -- in fact, the company has reduced its capital spending amid hefty losses.

- Tesla could soon face another cash crunch. While it had $5 billion on hand as of the end of the second quarter, it also lost $408 million during the period -- while spending just $250 million on capex. If it can't figure out how to generate more cash from operations to fund its ambitious growth plans, they might not happen as soon as investors would like -- or at all.

The bear-case points have been drivers of Tesla's share-price decline in 2019. But Tesla's stock is still very expensive -- unless you believe that big near-term sales and earnings growth is still in the cards.

Ford's F-Series pickups sell in huge numbers and deliver huge profits. Image source: Ford Motor.

Ford's valuation is a different story

Why did Ford's stock do so well earlier in the decade -- and why has it slipped since?

F data by YCharts. Chart shows Ford's share price from Oct. 1, 2012, through Oct. 10, 2019.

Ford came out of the 2009 recession hitting on all cylinders. By mid-decade, it was generating strong margins on trucks and SUVs in North America, and it seemed to be in good shape in Europe and on a promising growth trajectory in China.

But things haven't gone so well since:

- While Ford's revenue kept growing, thanks to strong pricing on its trucks and SUVs, its costs also grew, limiting its margin gains -- and eventually reversing them.

- The wheels fell off of Ford's China growth story. Ford was slow to update its product lineup and didn't tailor enough of its products to Chinese tastes. Its promising growth turned into declines, and its profits to losses.

- As investors grew more excited about electric vehicles and self-driving -- not least because of Tesla's success -- Ford seemed to be falling behind on both fronts.

All of these concerns, and more, were exacerbated in the months after CEO Jim Hackett took the helm in 2017. Hackett talked in general terms about a "redesign" of Ford's business, while supplying few specifics. That was a big change from past Ford leadership teams, which tended to share their plans openly with investors -- leading analysts to wonder if Hackett actually had a plan.

Ford did eventually explain what it had in mind: directing its investments away from lower-margin products (like sedans) and businesses, and toward more profitable products (trucks, SUVs, commercial vehicles, and performance models) and businesses, including new tech-enabled mobility ventures. That evolution is ongoing:

- Ford has discontinued the Fiesta, Focus, and Taurus in North America, and will phase out the Fusion over the next couple of years. It has launched all-new versions of the Ranger and Explorer, is in the process of launching an all-new Escape, and it has several other new trucks, SUV, and crossovers set to arrive over the next couple of years -- including an all-new F-150 in 2020.

- In Europe, Ford has pushed upscale with an all-new Focus, added a new small SUV called the Puma, and put heavy emphasis on its profitable commercial vehicle business. Progress is already visible: After a big loss in 2018, Ford Europe earned $110 million in the first half of 2019.

- A drastic overhaul of Ford's China operation is under way, with over 30 new or overhauled products set to arrive by the end of 2021. There's still much work to be done, but Ford's losses in China were down sharply in the first half of 2019.

- Ford is also making heavy investments in electric vehicles -- including an electric F-150 pickup -- and self-driving technology, which have helped to allay some investors' concerns about technological disruption.

Although some progress is already visible, Ford has said that its product-line overhaul will begin to have a meaningful impact on its margins by the end of next year. The company's goal is a sustainable operating margin above 8%, with revenue growth exceeding the rate of growth of global gross domestic product.

When will that happen? The answer depends to some extent on economic factors, but if auto sales remain strong, we should see significant progress within two years.

Ford's self-driving R&D program is less visible than Tesla's, but it's quite advanced. Image source: Ford Motor.

Ford's dividend is an important consideration

Tesla doesn't pay a dividend, and it's not likely to start anytime in the near future. But Ford pays a dividend, and it's an important part of the company's investment case.

Ford has paid a quarterly dividend of $0.15 per share since 2015. It also paid a supplemental dividend early in the year in 2016, 2017, and 2018, after posting strong full-year profits.

Ford chose to keep its regular quarterly dividend unchanged, and it's important to understand why. Ford considers its current dividend to be set at a level that it can sustain "through the cycle," meaning through a recession when its profits will come under pressure.

Put another way, Ford wants to show investors that they can count on its dividend -- so it won't cut the dividend unless things get truly dire. The company believes that between the steady income from its financing subsidiary and its hefty cash hoard ($23.2 billion as of June 30), it will be able to fund its dividend through a downturn without difficulty. And it believes that once it does, Wall Street will give its stock a higher valuation.

Tesla's "affordable" Model 3 has sold well, but its sales are cannibalizing those of the company's more profitable models. Image source: Tesla.

Is Tesla or Ford the better buy now?

Whether Tesla or Ford is the better buy depends on your investment horizon, your risk tolerance, and your faith in Elon Musk. But keep in mind that auto sales are cyclical, automakers' profits and margins tend to rise and fall with sales, the current cycle is quite old by historical standards -- and all of that applies even to innovative high-tech automakers.

If you buy Tesla now, you might double your money or more over the next five years or so. But if Tesla's valuation falls to something more like a normal automaker's, as it very well might during a recession, you could lose a substantial chunk of your investment -- or even all of it, if Tesla runs out of cash and has to take a trip through bankruptcy court. (That's a real possibility, by the way.)

On the other hand, I think if you buy Ford now, reinvest that dividend, and wait five years or so, you stand a good chance of outperforming the market as Hackett's redesign unfolds and Ford's profitability improves. If there's a recession during that period, Ford should weather it without trouble -- and its stock could well jump early in the recovery, as it did coming out of the last recession.

To sum up: Tesla's story is still great, even if it's slowly coming down to earth. It's still possible that its shares could soar. But its finances are much less great, and a downturn could put a big dent in its valuation.

Ford's story isn't nearly as exciting, but the Blue Oval is well positioned for realistic earnings growth over the next several years. If you can afford to be patient and reinvest the dividend, I think it's the better buy for most investors right now.