Importance of enterprise value

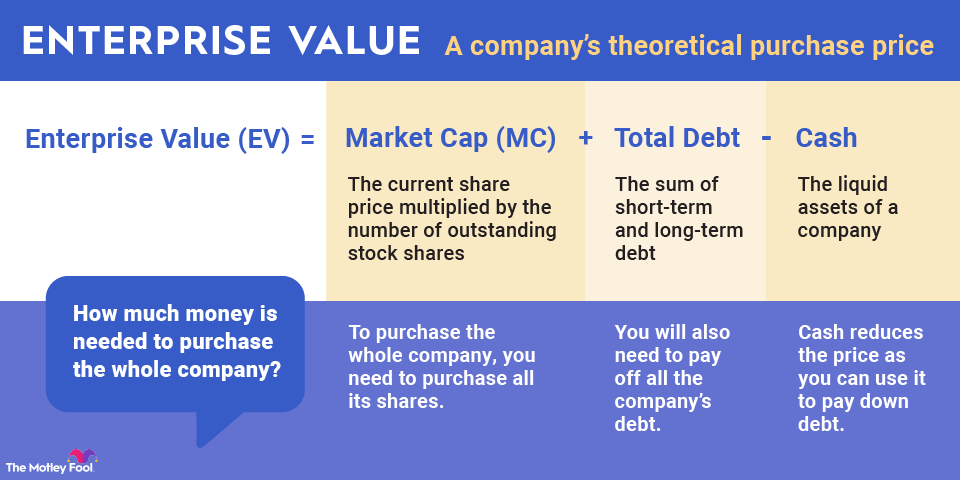

Enterprise value is used when a company is being acquired because the acquiring firm will need to assume the debt of its targeted purchase. But it also gets to add the cash to its own balance sheet, which is why you add debt but subtract cash in the calculation.

For investors, though, enterprise value is a great tool in determining the actual size of a company, along with factoring in how the business has made use of debt. For example, some high-growth tech stocks may look overpriced when you only use market cap. But when you factor in that they have little to no debt and subtract a large balance of cash, the enterprise value may show a drastically different valuation than basic market cap.

Enterprise value vs. market cap

Enterprise value becomes useful since it can reveal the true value of a company based on how it has funded its operations over the years. For example, when comparing GM (GM -4.37%) and Ford's (F -4.18%) market caps of $71 billion and $51 billion, respectively, to Tesla's $730 billion, there would seem to be an incredibly wide disconnect between these U.S. automakers' valuations, especially considering that Tesla sells far fewer vehicles than its two older peers. However, when you add GM and Ford's substantial debt, it reveals the automakers aren't quite as relatively small as they appear on the surface.