ESG bonds offer many of the same benefits of traditional bonds with additional ESG objectives to use investment dollars for a positive impact. Many ESG bonds offer lower interest rates but greater overall stability, making them attractive to private and institutional investors alike. With less volatility than traditional bonds, ESG bonds are an interesting additional element for a well-balanced portfolio.

ESG, or sustainable investing, is a rapidly growing investment strategy no longer relegated to the halls of academia or a few idealists. In 2022, ESG bond issuance totaled $863 billion, and global ESG debt is nearing $5 billion. Bloomberg projects ESG asset growth will reach more than one-third of global assets under management by 2025.

In the global bond markets, Europe was an early leader in ESG bonds, but emerging markets are getting on the ESG bandwagon to raise new capital. That presents both opportunities and need for regulation from an investment perspective.

ESG bonds offer investors the opportunity to hand-pick key environmental or social issues for investment. For people focused on impact investing, ESG bonds are one of the best ways to fund key issues in corporate, community, and government settings.

Understanding ESG bonds

An ESG bond is a type of debt security. A debt security means that the issuer owes the holder a debt and is obligated to pay the principal and interest at a set maturity date. Bonds are a fixed-income security, meaning bond interest is usually payed at set intervals. The interest, payment intervals, and repayment terms are established at bond issuance. Bonds are generally considered a lower-risk investment.

Both traditional and ESG bonds can be issued by corporations, municipalities, and governments to raise funds. ESG bonds have one important distinction: They are issued for projects or companies that show high environmental, social, and governance priorities. For example, a municipality can issue ESG bonds for community development (social) projects. A corporation can issue bonds for solar energy (environmental) projects, waste reduction, or other environmental targets.

The main buyers of ESG bonds are institutional investors, but individual investors can own them as well.

How ESG bonds are used

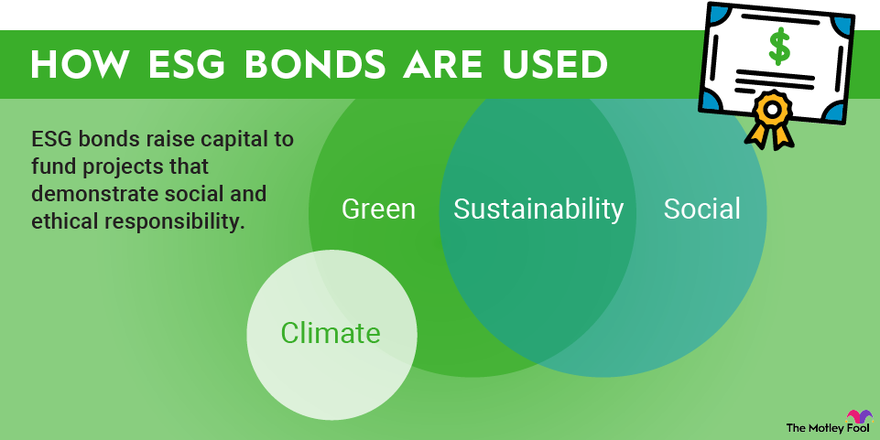

ESG bonds are used to raise capital to fund projects related to ESG objectives. In the best cases, ESG bonds present investors with stable returns and clear reporting about the use of the funds for ESG purposes. This makes ESG bonds an attractive option for investors interested in assets that demonstrate social and ethical responsibility and that align with their values.

Bonds and other fixed-income securities are an important part of any investment portfolio, along with ESG ETFs and ESG stocks. Bonds have the benefits of generating regular income and offering relative stability and liquidity.

Standard investment strategies suggest keeping about 15% of a portfolio in bonds and other fixed-income securities. For the sustainability-minded individual investor, ESG bonds can comprise some or all of that 15%.

Depending on the issuer, some ESG bonds can also be exempt from state taxes.

Pros and cons of ESG bonds

Pros

- Higher ratings: Standard & Poor’s and Moody’s may rate ESG bonds higher than bonds with similar risk profiles. This is because ESG issuers tend to be more transparent than non-ESG counterparts.

- Lower risk: ESG bonds are some of the most stable investment options, balancing any investment portfolio. A study published from the Jönköping International Business School in Sweden found that even with lower interest rates, ESG bonds are attractive to private and institutional investors because of their lower risk.

- ESG transparency: ESG bond issuers may be obligated to provide additional reporting or third-party verification of fund allocation and desired bond outcomes. However, this is not required, and transparency depends on the bond issuer and pressure from investors.

- Stable returns: ESG bonds share similar advantages with traditional bonds in terms of interest and repayment terms. Bonds can also be bought or sold any time, making them a liquid asset.

- Impact investing: ESG bonds allow investors to choose bonds that work toward their personal ESG priorities and require accountability to ensure funds are spent on environmental, social, or governance objectives. As more investors prioritize ESG, more funds are potentially available for important ESG initiatives.

Cons

- No reporting standards: While companies may voluntarily report according to International Capital Market Association (ICMA) standards or offer third-party compliance reporting, there is no standard set of principles set out by the U.S. Securities and Exchange Commission. Investors may believe they are funding solar panels, but without a detailed spending report, they may be funding new company cars.

- Lower interest rates: Jönköping also found green bonds yield an average of 15 to 20 basis points lower than comparable conventional bonds.

- Price fluctuations: Because bonds can be bought and sold at any time, their price changes with market fluctuations.

How to invest in ESG bonds

Investors can purchase ESG bonds from investment dealers, online brokerages, wealth management advisors, and other financial institutions.

ESG bonds fall into several common categories:

- Green bonds raise money for renewable or clean energy, clean transportation, buildings, wastewater management, and other sustainable climate adaptations. Green bonds are the most common ESG asset class. ICMA has issued voluntary green bond principles for compliance.

- Social bonds raise money for food security, sustainable food systems, socioeconomic opportunities, affordable housing and infrastructure, and access to essential services. ICMA also has social bond principles guidelines for voluntary compliance.

- Climate bonds are similar to green bonds, but they raise money for investments that will reduce greenhouse gas emissions or reduce dependence on carbon-intensive sources of energy.

- Sustainability bonds are issued to raise funds for a combination of green and social projects. Some green or social bonds are reissued as sustainability bonds.

- Sustainability-linked bonds (SLBs) require issuers to make specific commitments on ESG objectives. Although they sound similar to sustainability bonds, they have unique governance principles. If a stated ESG target is not achieved by an SLB, issuers have to pay a penalty in a coupon step-up.

JPMorgan Chase (JPM 0.29%) and BNP Paribas (BNP -1.09%) are two of the major ESG bond underwriters.

In terms of bond offerings, major companies such as Walmart (WMT 0.24%) and Apple have offered sustainability bonds to further climate-conscious objectives. For example, an Apple bond included using funds to generate 1.2 gigawatts of clean power.

In 2020 and 2021, Bank of America (BAC 0.36%) issued two sustainability bonds to advance racial and gender equality, economic opportunity, and environmental sustainability. They also regularly offer green bonds focused on renewable energy and environmental impact and social bonds focused on addressing issues of low- to moderate-income neighborhoods.

Investors can contact their current investment service provider or advisor to purchase ESG bonds. Remember to keep the big picture in mind: Invest for the long term and, ideally, hold bonds to maturity for greatest returns.

Should you invest in ESG bonds?

ESG bonds offer some major advantages, including lower prices, lower risk, stable returns, ESG transparency, and the ability to hand-pick bonds related to personally important issues. But that doesn’t mean ESG bonds are without a few key disadvantages. Like all bonds, they are susceptible to market fluctuations. And they often have lower interest rates than conventional bonds. ESG also reporting needs to be standardized.

Green bonds, social bonds, sustainable bonds, sustainably linked bonds, and climate bonds all provide defined targets and scope for investment objectives. Investors who are ready to allocate funds to ESG bonds as a part of a diversified portfolio can purchase ESG bonds from traditional financial institutions and wealth management companies.

Related investing topics

What is ESG investing?

ESG investing is a strategy that looks at a company’s environmental (E), social (S), and governance (G) risks as a part of investment decisions. ESG investing may also be called sustainable investing.

Why is sustainable investing important? Proponents say corporations must do more than seek profits. They have the added responsibility of creating positive outcomes for people, communities, and the planet. And, some studies show that doing so contributes to profit-making. As an example, companies with strong ESG records showed greater resilience than their counterparts in the market downturns of 2008 and 2018.

Investors are supporting ESG-forward companies and ESG funds, both for the returns and for the positive impact. According to a Morgan Stanley 2021 survey, 79% of all investors and 99% of millennial investors are interested in sustainable investing or ESG investing.

What are ESG risks?

Poor governance, unsafe or unfair labor policies, data security issues, fossil-fuel dependence, water scarcity threats, or carbon-intensive business practices are all examples of ESG risks that can threaten a company’s long-term profitability.

On the other hand, companies actively engaged in creating transparent governance policies, ethical labor practices, alternative energy production, or reduction of waste and emissions are managing those long-term risks to support future stability and growth.

Investors can gauge a company’s ESG risks through the widely used ESG rating systems from MSCI USA (MSCI 2.33%) or Sustainalytics. These ESG rating frameworks help investors evaluate and compare a company’s environmental, social, and governance vulnerabilities. For climate-specific information, MSCI ESG research also includes a company’s projected contribution to climate change.

Examples of companies with high ESG ratings include technology companies Microsoft (MSFT 2.58%), Apple (AAPL 0.07%), and Samsung Electronics (SSUN 1.39%). Software companies such as Adobe (ADBE 1.19%) and Intuit (INTU 1.04%) also score highly.

Across sectors, retailers such as Best Buy (BBY 0.74%) and Tractor Supply Company (TSCO 2.8%), and companies such as Vestas Wind Systems (VWDRY 2.82%), Enphase Energy (ENPH 5.42%), and Consolidated Edison (ED -0.75%) are ESG leaders because of their focus on renewables.

As a subset of ESG, investors can also choose to invest in conscious capitalism companies such as Costco (COST 1.04%) and Starbucks (SBUX 1.14%), which prioritize an ethical approach to making money.

ESG Bonds FAQs

ESG bonds vs. green bonds: What's the difference?

Green bonds are a subset of ESG bonds. ESG bonds refer to any bond with set environmental, social, or governance objectives. This can include everything from affordable housing to improved infrastructure, reduction of racial or gender inequity, or renewable energy.

Green bonds specifically focus on issues related to the climate and environment. Investors choose green bonds to support climate-forward policies and changes. Common green bond themes include renewable energy, alternative energy solutions, reduction of greenhouse gas emissions, or reduction of reliance on carbon sources of energy.

Who issues ESG bonds?

ESG bonds are issued by corporations, municipalities, and governments. In the U.S., JPMorgan Chase and BNP Paribas are the largest underwriters of bonds. Familiar names such as Bank of America, Apple, and Walmart all issue ESG bonds.

The European Union, HM Treasury, and Deutsche Bank AG are among the world's top green bond issuers. Other major green bond issuers include Citigroup (NYSE:C) and Novartis (NYSE:NVS), as well as government-backed banks worldwide.

Where can I buy ESG bonds?

Investors can buy ESG bonds wherever they purchase other fixed income securities. This includes financial institutions such as investment banks, online trading companies or brokerages, and wealth management companies.