You typically need earned income to contribute to an IRA. But for married couples, there's an exception: You can contribute to a spousal IRA for a nonworking spouse, up to the maximum annual limit.

A spousal IRA isn't a joint account, but using one can be an effective way for couples to double their tax-advantaged savings. It's also a good way to give a nonworking spouse the security of knowing they have their own retirement money tucked away.

What is a spousal IRA?

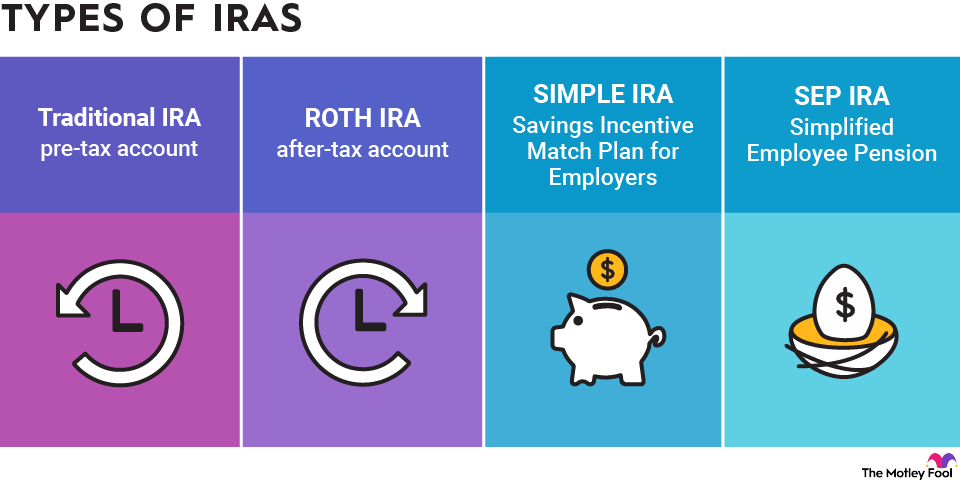

A spousal IRA is a Roth IRA or traditional IRA funded on behalf of your spouse, even if your spouse doesn't have taxable income. There's no special account type known as a spousal IRA.

The IRA contribution limit for 2025 is the lesser of:

- $7,000 per year, with an additional $1,000 allowed if you're over 50

- Your earned income for the year

In 2026, contribution limits increase to the lesser of:

- $7,500 per year, with an additional $1,100 allowed if you're over 50

- Your earned income for the year

For married couples, the earned income requirement can be fulfilled entirely by one spouse. As long as one spouse earns enough to cover both spouses' contributions, that person can contribute to their own account as well as to an account in the nonworking spouse's name.

For example, let's say you earn $75,000 in 2026 and your spouse is a stay-at-home parent. If you're both under 50, you can contribute $7,500 to an IRA in your own name and an additional $7,500 to an IRA in your spouse's name. But if you had only $10,000 of income for the tax year, that's the most you can contribute to both of your IRAs combined.

How do you open an IRA for your spouse?

Keep in mind that a spousal IRA isn't a joint account. In fact, there is no such thing as a joint IRA in the tax code -- the I stands for individual.

On a related note, you can't open an IRA for your spouse. They'll need to open their own IRA through a brokerage. If your spouse already has an IRA, they can keep their existing account. As long as you file a joint tax return, it doesn't matter whether the funds come from your income, their income, or a combination of the two.

Six spousal IRA rules to know

The regular IRA rules apply to spousal IRAs. After all, this is a plain old Roth or traditional IRA that you're funding on their behalf. Here are the most important rules to be aware of:

- Your spouse controls their IRA. Because your spouse owns their IRA, they get to decide what to invest in, even if you funded the account. With an IRA, the owner can invest in the individual stocks and bonds, mutual funds, and ETFs of their choice.

- You have to file a joint tax return. A spousal IRA isn't an option for married couples who file separately.

- You can contribute to Roth IRAs only if your joint income is within certain limits. The Roth IRA income limits for married couples who want to make the maximum contribution are $236,000 in 2025 and $242,000 in 2026. If you're a higher earner, a backdoor Roth IRA may be an option.

- You can contribute to traditional IRAs for you and your spouse regardless of your income. However, depending on your income, you may not be able to deduct the contribution on your taxes if the earning spouse is covered by a retirement plan at work.

- You can fund a spousal IRA no matter how old you are. As long as one of you is earning income, a working spouse can continue funding an IRA for a nonworking spouse, regardless of your ages.

- Your spouse doesn't have to name you as the beneficiary of their IRA or get your consent to name someone else. Whether the account was funded by the owner or their spouse has zero impact. Leaving the IRA to one's spouse confers a key advantage, though. Under the rules for inherited IRAs, if your spouse transfers their IRA to you when they die, you can roll it over into your own retirement account. The IRS will treat the money as if you were the original owner.

Why choose a spousal Roth IRA?

As a couple, you can effectively double your IRA savings rate, thereby doubling your tax benefits. Plus, funding a spousal IRA is a great way to help your spouse stay on track for retirement while they're out of the workforce, whether they're staying home to care for your children, are unemployed, or are simply choosing not to work.

Funding your spouse's IRA, even for a short period while they're not working, can make a big difference to your long-term retirement savings. Consider what would happen if your spouse stayed at home for five years, then worked for another 25 years and contributed the 2026 maximum of $7,500 in monthly increments of $625.

If you hadn't funded a spousal IRA, they'd have over $598,000, assuming 8% annual returns. But had you funded a spousal IRA with $7,500 during each of those five nonworking years, their account would have more than $937,000.

As long as you can afford to fund two IRAs on a single income, there's no reason not to fund a spousal IRA.