A rollover IRA refers to money that is transferred from one retirement account -- usually an employer-sponsored plan -- to an individual retirement account, or IRA.

Rolling over a workplace retirement account into an IRA can be a savvy financial move. It can open up more investing options and reduce pesky fees that cut into your returns.

If you're leaving your job or have already left, you can perform an IRA rollover. You can use a rollover IRA to consolidate the retirement accounts you have accumulated from prior employers.

Rolling over a retirement account allows you to maintain the tax-deferred status of your savings while taking greater control of your investments.

What is a rollover IRA?

A rollover IRA is the account that results when someone transfers funds from another retirement account into an IRA.

A rollover isn't just a transfer of assets from one account to another. The difference between an IRA rollover and a transfer of assets is that, when you perform an IRA rollover, you're changing the type of account where you keep your savings. That's important because an IRA has slightly different rules from a 401(k) or another workplace retirement plan.

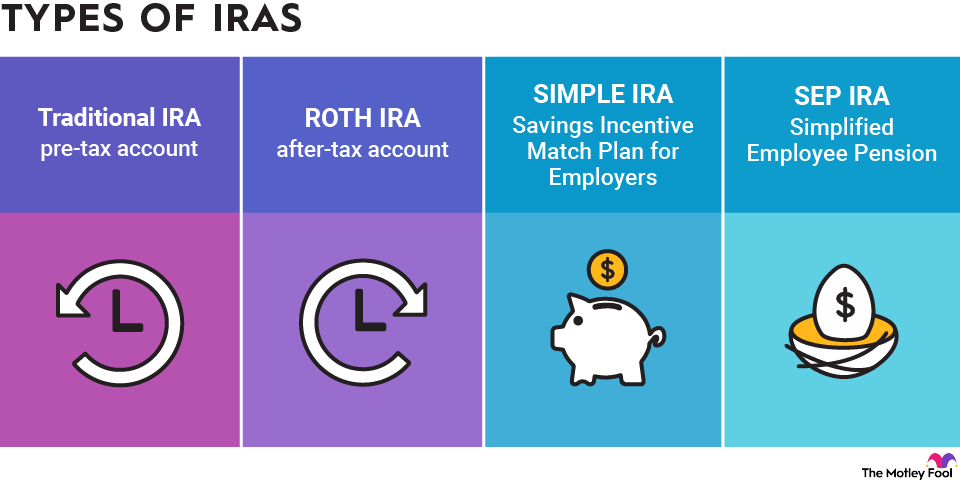

Rolling over a retirement account into an IRA doesn't require any special type of IRA. It's no different from an IRA you open and contribute to directly. In fact, you can roll over your workplace retirement account into a preexisting IRA that you already use for regular annual contributions. Typically, you'll roll over pretax account funds into a traditional IRA, whereas Roth accounts typically roll over into a Roth IRA.

IRA rollover chart

The IRS provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row).

Can I Roll Over This Type of Account... | ...Into a Roth IRA? | ...Into a Traditional IRA? | ...Into a SIMPLE IRA? | ...Into a SEP IRA? |

|---|---|---|---|---|

Roth IRA | Yes | No | No | No |

Traditional IRA | Yes | Yes | Yes, after two years | Yes |

SIMPLE IRA | Yes, after two years | Yes, after two years | Yes | Yes, after two years |

SEP IRA | Yes | Yes | Yes, after two years | Yes |

Governmental 457(b) | Yes | Yes | Yes, after two years | Yes |

Qualified plan (pre-tax) | Yes | Yes | Yes, after two years | Yes |

403(b) (pre-tax) | Yes | Yes | Yes, after two years | Yes |

Designated Roth account (401(k), 403(b), or 457(b)) | Yes | No | No | No |

You'll notice that tax-deferred accounts can roll over into Roth accounts, but not vice versa. Note, however, that when you move pretax savings into a Roth account, you'll owe income tax on the entire amount. Furthermore, that rollover is irreversible under the current tax law. It was once possible to recharacterize Roth IRA contributions as traditional IRA contributions within the same year; however, this option was eliminated by the Tax Cuts and Jobs Act.

How do you do an IRA rollover?

Performing an IRA rollover isn't complicated. There are five simple steps you can take to transfer an IRA from one institution to another:

- Determine which type of IRA account(s) you need: If your workplace plan holds pretax retirement savings, you'll likely want a traditional IRA. If your workplace plan is a Roth account, then you must use a Roth IRA for the rollover.

- Open an IRA, if you don't already have one: You can use an existing IRA for your rollover, or, if you don't already have one, you can open an IRA at your financial institution of choice.

- Request a "direct rollover" from your plan administrator: Your plan administrator will provide a form for you to fill out to process the rollover. With a direct rollover, your funds will be transferred directly to your IRA.

- Gather the necessary information from your IRA provider: You'll need to provide details on how the plan administrator should transfer your assets to your IRA. You can obtain this information from the financial institution where you hold your IRA.

- Submit the form to your plan administrator and wait: Once the administrator processes your request, it should take a few days to transfer assets to your IRA.

Indirect IRA rollovers

You can also do an indirect rollover, but it has limited appeal if the direct rollover option is available to you. With an indirect rollover, the plan administrator will liquidate your holdings and send you a check in your name. The administrator will also withhold 20% of your funds for taxes and send it to the IRS as a safeguard. You'll be responsible for depositing those funds, plus the 20% withholding, into your IRA to complete the rollover. Only when the IRA receives the full rollover amount will the agency return the safeguarded 20% to you.

For example, if you take an indirect rollover of $10,000 from a 401(k), you'd receive a check for $8,000, and the government would receive a payment of $2,000. You'd have to take that $8,000 -- plus $2,000 of new money -- and deposit it into your rollover IRA to complete the rollover.

If you deposited only the $8,000 into your brokerage account, you'd owe taxes on the $2,000 sent to the IRS. Sound complicated? That's why it's best to opt for a direct rollover whenever possible.

Rules and limits of IRA rollovers

There are several key rules to be aware of when performing an IRA rollover.

The 60-day rule

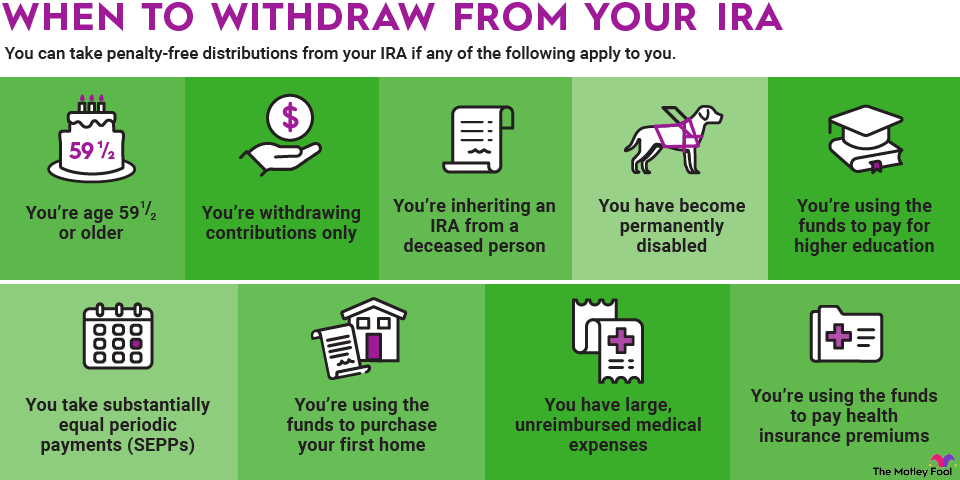

If you make an indirect rollover, you'll have 60 days to deposit the funds, plus the amount withheld for taxes, into your rollover IRA. If you don't complete the rollover within 60 days, the distribution will be treated as a regular withdrawal. That means you'll have to pay taxes on the entire amount and could be subject to an early withdrawal penalty of 10%.

You can use an indirect rollover to withdraw funds for 60 days and then replace them in the same account. This allows you to borrow funds for a very short time, but do this with caution. You could face stiff penalties if you don't return the money within 60 days.

One IRA rollover per year

If you're rolling over funds from a traditional IRA, SIMPLE IRA, or SEP-IRA to another one of those types of accounts, you're eligible to do that only once per rolling 12 months. Importantly, the one-IRA-rollover-per-year rule doesn't apply to rollovers from a tax-deferred IRA account to a Roth account, which is actually a conversion. It also doesn't apply to rollovers to or from employer-sponsored retirement plans.

If you don't follow this rule, every rollover after your first could be subject to the 10% early withdrawal penalty, and you'll have to pay taxes on the distribution. You could also face a penalty for contributing too much to your IRA if you put funds back into your brokerage account that aren't eligible for a rollover.

The same-property rule

When you execute a rollover, you have to contribute the same property that you withdrew from your original brokerage account. If, for example, you received a check for an indirect rollover, bought some stock with the distribution proceeds, and then tried to transfer that stock to another retirement account, you'd violate the same-property rule.

If you violate the same-property rule, the distribution will be treated as a normal withdrawal, which you'll have to pay taxes on, and you could owe a 10% early withdrawal penalty on it as well.

Distributions ineligible for rollover

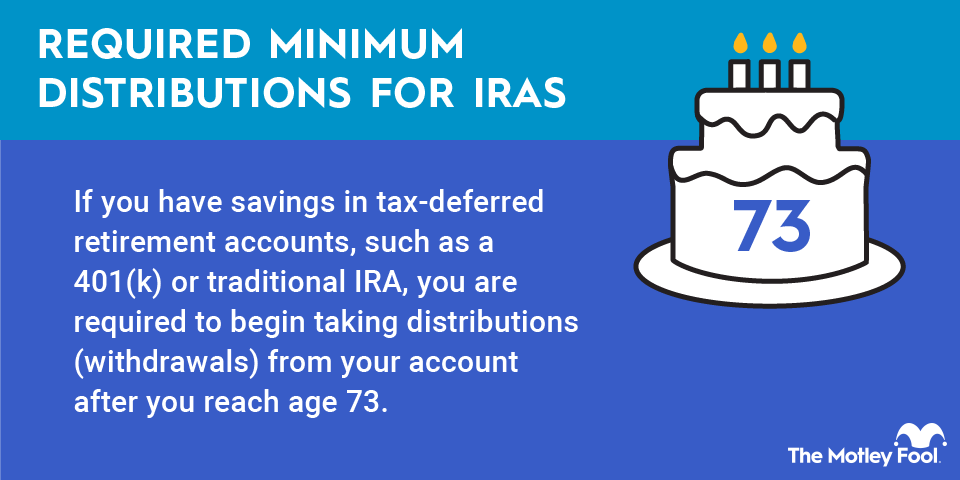

Some distributions from your workplace retirement plan are ineligible to be rolled over into an IRA. For example, required minimum distributions are ineligible, as are loans and hardship withdrawals.

Limits

There is no limit on the amount you can roll over into an IRA. A rollover will not affect your annual IRA contribution limit either.

There's also no limit to the number of rollover IRAs you can have. However, it's probably easier to manage fewer accounts. You can use the same IRA to roll over funds from multiple accounts. You can also make regular contributions to that IRA, so you don't really need more than one.

Related retirement topics

Know the rules

Rollover IRAs are common, but there are quite a few rules to follow. If you stick to the basics, you shouldn't have any problems getting your money where you need it to go.