Do IRA distributions count as income for Social Security purposes? The short answer is: sometimes.

The question of whether IRA distributions are considered income depends on the reasons why you're asking. I know that sounds very vague, so bear with me.

The ability to collect Social Security benefits before reaching full retirement age depends on your earned income. And the taxable nature of your Social Security income depends on a different income metric. IRA distributions affect each of these Social Security income-related topics differently.

Taxes on retirement income

Taxes on retirement income

Retirement income taxation is a fairly complicated topic. Certain types of retirement income are treated differently by the IRS and state governments. And if you don't already know, Social Security can be rather complicated when it comes to various tax rules.

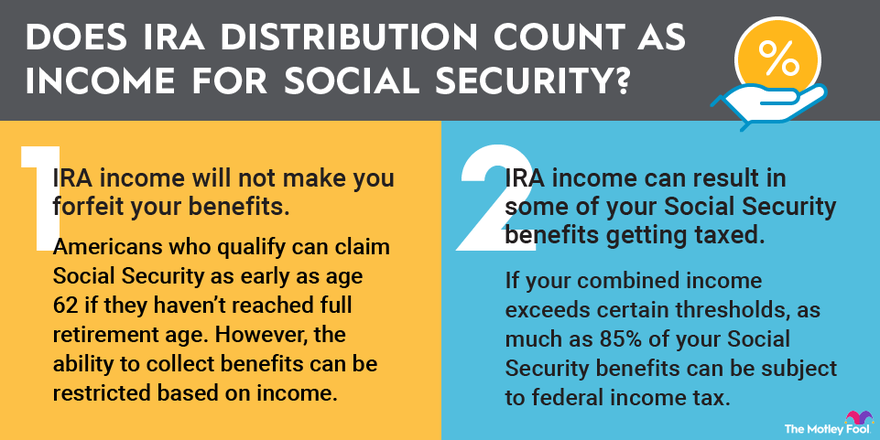

One area where there is a lot to unpack is how distributions from an individual retirement account, or IRA, can affect your Social Security benefits. There are two situations to consider:

- If your IRA income affects your ability to collect Social Security.

- If your IRA income affects the taxes you pay on Social Security.

Income-based SS restrictions

Situation 1: IRA income will not make you forfeit your benefits

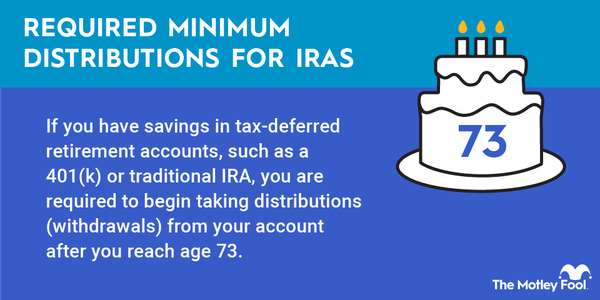

Americans who qualify can claim Social Security as early as age 62 if they haven't reached their full retirement age. However, the ability to collect benefits can be restricted based on income.

This concept is known as the Social Security earnings test. In simple terms, the idea is that some or all of your Social Security benefits can be withheld if you earn more than a certain amount.

If you will reach your full retirement age (67 for people born in 1960 or later) after 2025, you can earn as much as $23,400 with no effect on your benefits. Beyond that threshold, $1 will be withheld for every $2 in additional earnings.

There are more details to know about the earnings test. However, for our purposes, the important point is that IRA distributions do not count as earned income. The Social Security earnings test only considers money you earn from a job or that you get from a business you own or actively participate in.

Income-based SS taxes

Situation 2: IRA income can result in some of your Social Security benefits getting taxed

Depending on your income, some of your Social Security benefits can be subject to federal income tax. To determine this, the IRS uses a figure known as your combined income.

Your combined income is equal to:

- Your adjusted gross income (AGI)

- Any nontaxable interest income, such as from municipal bonds

- Half of your Social Security benefits.

Adjusted Gross Income (AGI)

So, if your AGI is $25,000, you have $5,000 in nontaxable interest, and you have $30,000 in Social Security benefits, your combined income for the year is $45,000.

If your combined income exceeds certain thresholds, as much as 85% of your Social Security benefits can be taxable. The general idea is that if Social Security is your primary source of income, you won't likely have to pay tax on it, but retirees who get significant income from other sources can be taxed.

When it comes to IRA distributions, here's how it works:

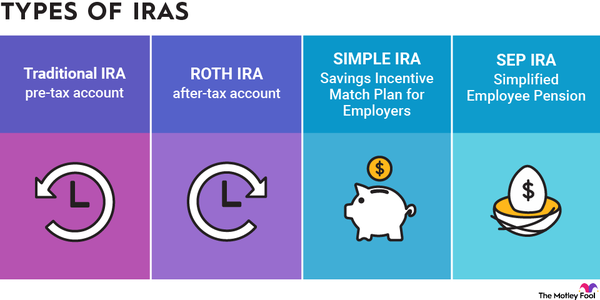

- Roth IRA distributions are not included in your combined income, so they have no impact on whether your Social Security is taxable.

- Traditional IRA distributions are generally included in your AGI, so they are included in your combined income.

This means traditional IRA distributions can make some of your Social Security benefits taxable.

Related investing topics

So, do IRA distributions count as income for Social Security?

As mentioned, traditional IRA distributions can be considered taxable income and will be included in your adjusted gross income for the current tax year.

However, they are not considered to be earned income.

This means that while traditional IRA distributions can result in your Social Security benefits being taxed, they won't have any effect on your ability to take Social Security while the earnings test still applies to you.

FAQ

IRA distributions FAQ

Do withdrawals from my IRA affect Social Security benefits?

If you withdraw money from a traditional IRA, it won't affect your ability to claim and collect Social Security benefits. However, a traditional IRA distribution is considered taxable income, so it can result in some of your Social Security benefits being subject to income tax.

Is withdrawal from an IRA considered earned income?

IRA withdrawals can be considered taxable income, but they are not considered earned income. Earned income is money you receive from a job, as an independent contractor for work you perform, or from a business you actively participate in.

What income counts toward Social Security earnings limit?

The Social Security earnings test considers only earned income, which includes salary, wages, tips, bonuses or other compensation from a job, money paid to you as an independent contractor for work you perform, or money you earn from a business you actively participate in.

Do IRA withdrawals count as income for Medicare?

Yes, traditional IRA withdrawals typically count as income for the purpose of calculating Medicare premiums. If your income is greater than a certain level, your Medicare Part B or Part D premiums can be higher.

What income does not count against Social Security?

Roth IRA distributions have no effect on Social Security benefits, including the earnings test or taxation of benefits. Any unearned income, such as interest or dividends, doesn't affect your ability to collect Social Security, but it can make more of your benefits taxable.