Learning These 50 Terms Will Help You Become Financially Literate

Learning These 50 Terms Will Help You Become Financially Literate

How well do you know the language of money?

Money is something that affects all of us every day of our lives. Unfortunately, few of us receive a thorough education in personal finance, and even fewer have the time to take a course in it now. But by learning some key personal finance terms, you can quickly gain a better understanding of how loans, investments, and savings vehicles work and how your financial decisions impact you. Here’s a list of 50 financial terms that everyone should know.

Previous

Next

1. 401(k)

A 401(k) is a common type of retirement savings account. It’s typically offered through your employer, though self-employed individuals can also set up a 401(k) for themselves. Most 401(k)s are tax-deferred, which means your contributions reduce your taxable income this year, but then you pay taxes on your distributions in retirement. Roth 401(k)s are becoming increasingly common. Contributions to these accounts don’t reduce your taxable income this year, but afterwards, they grow tax-free.

You can contribute up to $19,000 to a 401(k) in 2019 or $25,000 if you’re 50 or older. Your employer may also match some of your contributions, which can relieve some of the burden of saving for retirement on your own.

Previous

Next

2. 529 plan

A 529 plan is a tax-advantaged investment account that enables you to save money for education for yourself or a designated beneficiary. Money you contribute to these accounts is after-tax, so you cannot deduct it on your federal taxes, but you will not pay any taxes on your distributions as long as they are used for qualified educational expenses. If you use the money for a non-qualified expense, you’ll pay income tax plus a 10% penalty on your distributions. Some states enable you to deduct 529 plan contributions on your state taxes. Check with your state tax authority to see if this is possible.

Almost every state offers at least one type of 529 plan. Each has its own rules and benefits. Do your research before opening one, so you understand exactly what you’re getting.

Previous

Next

3. Adjusted gross income (AGI)

You may see the term “adjusted gross income (AGI)” popping up around tax time. That’s because it plays a key role in determining which tax credits and deductions you qualify for, and by extension, how much you pay in taxes.

Your AGI is all of your income minus certain deductions, like half of your self-employment taxes, contributions to tax-deferred retirement accounts, qualifying student loan interest, health savings account contributions, and more. If you use a tax-filing software, it will calculate your AGI for you, so you don’t have to do this on your own.

Previous

Next

4. Annual percentage rate (APR)

Annual percentage rate (APR) comes up when you take out a loan or open a credit card. Simply put, it’s the cost of borrowing the money. It’s similar to an interest rate, but there’s a key difference. An interest rate only tells you the cost of borrowing the principal amount, while the APR includes the extra expenses, like origination fees and closing costs, that you pay upfront when taking out a loan.

Imagine you borrowed $100,000 with a 5% interest rate. To figure out how much you’d pay in monthly interest, you’d simply multiply the $100,000 by the 5% to get the annual interest expense of $5,000 and then divide this by 12 to get the monthly interest expense of $416.67. Note that this is not your full monthly payment, but the amount you’d pay in interest.

APR is calculated in the same way, except it factors in the upfront expenses. So if you had $2,000 worth of upfront fees, your total balance would rise to $102,000. Multiply this by 5% and divide by 12 and you’d get $425. Because APR includes all the upfront costs, it’s considered a more accurate way to compare the cost of two loans. Lenders are legally required to share the APR with you. You can find this in the loan agreement.

ALSO READ: Mortgage Interest Rates vs. APRs: What's the Difference?

Previous

Next

5. Annual percentage yield (APY)

Savings accounts and investments often list their annual percentage yield (APY) to draw people in. APY is similar to APR, except that it accounts for how often interest is applied to your balance. Your APR tells you the amount you’d pay in interest if interest were applied once per year, but this isn’t usually the case. Credit cards, for example, often apply interest daily. You divide the APR by 365 to get the daily rate. Every day you carry a balance, the credit card charges you a small percentage in interest, and then the next day, you pay that same percentage in interest, but on your new, larger balance.

APY takes the frequency of applied interest into account to give you the most accurate estimate of how much your balance will accrue in interest. You can calculate APY by the following formula: 100[(1 + r/n)n - 1], where r is the APR expressed as a decimal and n is the number of times the interest is applied to your balance each month. So if you have a 5% APR and interest is applied monthly, your APY would be 5.12%.

Banks like to advertise APY when trying to market savings accounts or other investments because it makes people think they’ll get a larger return. When offering loans, however, they prefer to advertise APR because it makes the interest rate seem lower, even though it doesn’t provide the most accurate estimate of how much you’ll pay. Both numbers can be useful, but it’s important not to try to compare them to each other. When shopping for loans or savings accounts, always compare APR to APR and APY to APY.

Previous

Next

6. Annuity

Annuities are an agreement between you and an insurance company. You agree to pay a certain amount, either monthly or as a lump sum, and in return, it promises to pay you money with interest in the future. Immediate annuities start paying you back within a year after purchase while deferred annuities pay you back at a later date specified in your contract. They may pay you for a set number of years or for the rest of your life. Fixed annuities offer guaranteed payouts, while variable annuity payouts depend on what you invest in. You could get a larger return if you invest wisely, or a smaller one if you don’t.

Some people like the idea of guaranteed income in retirement, but annuities have some key drawbacks you should be aware of. Payment terms are usually fixed and it can be difficult or impossible to get your money out of them if you need a lump-sum distribution to cover a large expense. Annuities may also charge high fees, which can eat into your profits. Always read through the terms of an annuity before signing up for one, and ask for help from a financial advisor if you don’t understand something.

Previous

Next

7. Asset allocation

Asset allocation refers to how you invest your money. Your asset allocation strategy will depend on several factors, including your risk tolerance and how much money you have to invest. You always want your money to be diversified among different types of investments, like stocks, bonds, mutual funds, and more, as well as diversified among sectors. If you invest all of your savings in tech and a crisis rocks the industry, you could lose a lot of your money.

Your asset allocation will likely change as you age. Most people’s portfolios get more conservative as they age to reduce the likelihood that they will lose their nest egg on the eve of their retirement. On the other hand, younger investors with decades until retirement may invest more aggressively to chase larger returns.

Previous

Next

8. Beneficiary

A beneficiary is a person that you designate to receive benefits from your investment accounts or insurance policies. Usually, this refers to the people who will receive money from your retirement accounts or your life insurance policy after you die. You designate these beneficiaries when you open the investment account or take out the life insurance policy, and you can change them at any time. It’s important to keep these up to date to ensure the right people get your money after your passing.

ALSO READ: 3 Metrics That Define the Average Social Security Beneficiary

Previous

Next

9. Bond

You probably know that bonds are investments, but you may not understand how they work. Bonds are debt obligations, and they may be issued by federal, state, or municipal governments or corporations. When you buy a bond, you’re giving the institution a loan, which it promises to pay back with interest by the bond’s maturity date when everything is paid back and the organization’s obligation to you is over.

Bonds aren’t known for generating as large of returns as stocks. Since 1926, stocks have returned an average of 10% per year, compared to just 5% to 6% for long-term government bonds, according to Morningstar. But bonds are also seen as a more stable investment because you will get your money back unless the organization defaults on their loan. That doesn’t mean they’re without risk, though. Defaults do happen and even if the organization doesn’t default, you can still lose money if you sell it before the maturity date and bond interest rates have risen during that time. Prospective buyers may refuse to buy your bond with a lower interest rate unless you give them a discount, and this can reduce your profits.

Previous

Next

10. Capital gain

Capital gain is the profit you make when you sell an investment for more than you originally purchased it for. If you bought a share of stock for $100 and a year later it’s worth $200, you would have a $100 capital gain if you sold it.

If you owned the asset for less than one year before selling it, it’s considered a short-term capital gain and you’re taxed on it at your income tax rate. But if you hold onto the asset for more than one year before selling it, it becomes subject to long-term capital gains tax. You’ll pay either 0%, 15%, or 20% tax on these capital gains, depending on your income, but in all cases, you’ll pay less than you would if your capital gains were taxed at your income tax rate.

Previous

Next

11. Capital loss

A capital loss is the opposite of a capital gain. If you purchase an asset when prices are high and then sell when it’s low, the difference between your original purchase price and your selling price is a capital loss. You can use capital losses as a tax deduction, as long as you have paperwork to prove your loss.

Your capital losses offset your capital gains. So if you have $1,000 in capital gains one year and $500 in capital losses, you’d subtract the $500 in losses from the $1,000 in gains, and you’d only pay capital gains tax on the difference. You’re limited to $3,000 in net capital loss deductions per year, but if your net losses for a single year were, say, $5,000, you could deduct $3,000 from your income this year and deduct the remaining $2,000 the following year. There’s no limit to how many years you can stretch out your capital losses.

Previous

Next

12. Certificate of deposit (CD)

Banks offer certificates of deposit (CDs), which are similar to savings accounts, but they offer higher interest rates to help your money grow faster. Some CDs offer rates upwards of 3% APY while the average savings account only offers 0.09% APY. The catch is, you must agree to not touch the money in the CD for a specified period of time. This could be anywhere from a few weeks to several years. The longer the term length, the higher the interest rate you’ll get.

You can take money out of your CD before the maturity date, but if you do so, you’ll be charged a penalty which is usually equivalent to several months’ worth of interest, depending on how early you took the money out. For this reason, CDs aren’t a good choice if you believe you’ll need to access your funds before the maturity date.

Previous

Next

13. Collateral

If you take out a loan, you’ll often be required to offer something up as collateral -- that is, something the bank can confiscate and resell to get its money back if you default on the loan. For a home or auto loan, the collateral is the car or home you’re taking the loan out for.

Some loans, like personal loans, don’t require any collateral, but they usually charge higher interest rates. If you default on the loan, it has no way to recoup its money, so the higher interest rates are necessary to incentivize lenders to take a bigger risk.

Previous

Next

14. Commission

When you invest your money, your brokerage firm will likely charge a commission on every transaction. It’s how they make their money. Every time you buy or sell an asset, it takes a small cut for its role in facilitating the purchase or sale. Commission schedules vary depending on the brokerage. Some may charge extra if you cancel or modify your order after submitting it.

Commissions are usually a percentage of the transaction, and you can find out how much you’ll pay in commissions by checking your broker’s fee schedule. You may think that you should choose the brokerage that charges the lowest commissions, but it could be worth paying slightly higher commissions if your brokerage offers high-quality educational resources that enable you to make smarter investments.

Previous

Next

15. Compound interest

Bank accounts, like savings accounts and CDs, earn compound interest. This means that at first, you only earn interest on the principal amount you contribute, but over time, you’ll begin to earn interest on your interest as well. This can help your balance grow more quickly. Loans may also charge compound interest, and this can make it more difficult for you to pay back.

Precisely how fast your balance will grow depends on how much your balance is initially and how often the interest compounds. If your interest compounds annually, that means that interest is only added once per year. If it compounds monthly, interest is added to your balance every month. The greater the number of compounding periods, the greater the interest you’ll receive if you’re talking about a savings account or CD, or pay if you’re talking about a loan.

Previous

Next

16. Credit

Credit is an agreement between you and a lender, usually a bank or credit union, in which the lender agrees to provide you a lump sum of money now, and in return, you agree to pay back the balance with interest. Credit cards are similar, but instead of getting a lump sum, you have a credit limit that you can spend up to each month, and you won’t pay any interest as long as you pay your balance in full each month.

ALSO READ: This Is the No. 1 Reason Americans Open Credit Cards

Previous

Next

17. Credit report

Everyone has three credit reports -- one for each of the three credit bureaus: Equifax, Experian, and TransUnion. Your credit report is essentially your financial report card. It lists all of the credit accounts in your name, along with payment history, bankruptcy, and collection information. Lenders pull your credit reports when deciding whether or not to lend to you, and some employers or landlords look at them as well to assess your financial responsibility.

You can view your credit reports for free once a year through AnnualCreditReport.com. It’s important that you do this to ensure that all the information listed there is accurate and that there aren’t any accounts you don’t recognize. This could indicate a clerical error or possible identity theft, and it could hurt your ability to get a loan when you need it.

Previous

Next

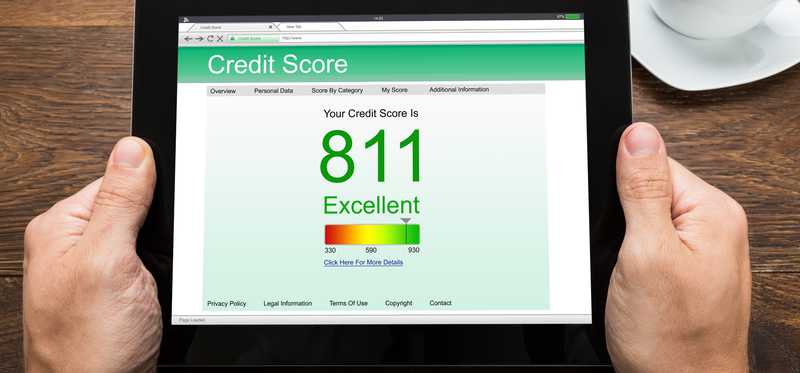

18. Credit score

Your credit score is a three-digit number that provides lenders with a quick assessment of your financial responsibility. There are several credit scoring models out there, and each scoring model has three scores -- one for each of your credit reports -- that are often similar, but may not be identical if the information in your credit reports is not the same.

The most popular credit scoring model is the FICO® Score. It evaluates you based on your payment history, credit utilization, length of credit history, credit mix, and the number of credit inquiries on your report and gives you a score between 300 and 850 with a higher score indicating a greater degree of financial responsibility.

VantageScore is another popular credit scoring model. It looks at the same factors as the FICO® Score but weighs them slightly differently. It too scores you from 300 to 850. Generally, a score in the high 600s or above is considered to be good.

Previous

Next

19. Debt-to-income ratio

Your debt-to-income ratio is another factor that lenders consider when deciding whether or not to work with you. As the name implies, it’s the ratio between your monthly debt payments and your income. A high debt-to-income ratio raises red flags to lenders. They may not want to lend to you for fear that another debt payment may strain your finances, leaving you unable to pay the company back.

Ideally, you should keep your debt-to-income ratio below 35% and lower if you can. The lower your debt-to-income ratio is, the more likely you are to qualify for favorable interest rates because lenders are more confident that you can pay back your debt obligations.

Previous

Next

20. Dividend

When you purchase a stock, mutual fund, or exchange-traded fund (ETF), you may occasionally receive dividends. This is where the company gives you a cash payout. The amount you receive depends on how many shares of stock you own and what the company’s board of directors has approved. It’s deposited as cash into your brokerage account.

Most U.S. companies that pay dividends to shareholders do so quarterly, but some may pay them semi-annually or monthly. You can determine which stocks offer the best dividends by looking up their dividend yield. This is the annual dividend divided by the stock price and multiplied by 100 to get a percentage. However, you shouldn’t base your decision on the dividend yield alone. If you choose an unstable company, it could go under and then you’ll lose money.

Previous

Next

21. Equity

Equity has multiple meanings depending on what you’re talking about. In the context of personal finance, you’ve probably heard of home equity. This is the value of your home minus any loans or liens against it. It’s how much of your home that you own outright.

You may also hear equity brought up when discussing stocks and investments. This is known as shareholders’ equity, and it represents how much money would go to the shareholders if all the company’s assets were liquidated and all of its debts were paid off. Shareholders’ equity may be positive or negative. Positive shareholders’ equity indicates that the company has enough money to cover its debts while a negative shareholders’ equity means it does not, and this can be cause for concern for investors.

Previous

Next

22. Exchange-traded fund

Exchange-traded funds (ETFs) are funds which typically contain a number of different stocks, bonds, and other investments. This offers instant diversification to investors who may not otherwise be able to or want to invest in individual stocks and bonds themselves.

They’re similar to mutual funds, except that ETFs can be traded like stocks throughout the day, and they usually require a smaller initial investment. While most mutual funds employ pricey managers to buy and sell stocks within the fund, ETFs are more likely to track a market index, resulting in lower fees and fewer capital gains because there’s less buying and selling going on.

Previous

Next

23. FDIC-insured

The Federal Deposit Insurance Corporation (FDIC) is a government corporation that guarantees the safety of your deposits in member banks up to $250,000 per account ownership category in the event of bank failure. This means that if your bank is FDIC-insured and it goes under, the government will pay you back what you had in your accounts, up to a maximum of $250,000 per type of account you had.

The majority of banks are FDIC-insured, but it’s always best to check this before you place your money there to ensure you’re not putting it at risk. If you keep your money in a credit union, it will not be FDIC-insured, as the FDIC only works with banks. However, the National Credit Union Administration (NCUA) provides many of the same protections to credit union members.

Previous

Next

24. Flexible spending account (FSA)

Your employer may offer a flexible spending account (FSA) to help you cover your out-of-pocket medical expenses. You can choose how much you’d like to contribute to an FSA up to $2,700 in 2019, and any contributions reduce your taxable income for the year. If you use the money for qualified medical expenses, you won’t pay taxes on it at all.

The catch is, you must use all the money in your FSA by the end of the year or it expires. If you still have money left over, your employer may give you one of two options to salvage some of it. It may give you an extra 2.5 months to use up any remaining funds, or it may enable you to carry $500 over into the next year. Companies can offer either option, but not both. For this reason, it’s best not to contribute more to an FSA than you believe you’ll use in a single year.

Previous

Next

25. Health savings account (HSA)

Health savings accounts (HSAs) are similar to flexible spending accounts (FSA), but ironically, it’s the HSA that’s more flexible. Qualifying individuals can contribute up to $3,500 to an HSA in 2019 and families can contribute up to $7,000. Your contributions reduce your taxable income this year and distributions for qualified medical expenses are tax-free. If you have money left over at the end of the year, it just rolls over to the next year. The only downside is that you can’t open one unless you have a high-deductible health insurance plan. This is defined as one with a deductible of $1,300 or more for an individual or $2,700 or more for a family.

You can withdraw money from your HSA for non-medical expenses, but you’ll pay income tax on these distributions, plus a 10% early withdrawal penalty if you’re under 65. The 10% penalty disappears at 65, at which point your HSA becomes similar to a traditional IRA, except you still get tax-free medical distributions and you don’t have to take required minimum distributions (RMDs) when you reach age 70 ½.

Previous

Next

26. Index fund

An index fund is a type of mutual fund -- a collection of stocks and bonds -- that passively tracks a market index, which is a list of stocks and bonds. They’re a popular choice with many investors because they offer instant diversification, they typically provide solid returns, and because they’re passively managed, their expense ratios (annual fees) are much lower than actively managed mutual funds.

Index funds contain the same investments weighted in roughly the same way as a market index so that it can effectively mimic the performance of that index. When the index does well, so does the index fund. They’re a favorite of Warren Buffett who recommends index funds as one of the best assets for retirement savings.

Previous

Next

27. Individual retirement account (IRA)

An individual retirement account (IRA) is a popular type of retirement account that you can open on your own. There are two types: traditional and Roth. Traditional IRAs are tax-deferred, which means that your contributions reduce your taxable income this year, but then you must pay taxes on your distributions in retirement. Roth IRAs work the other way. You don’t get a tax break this year, but then your contributions are allowed to grow tax-free.

IRAs are popular because they offer virtually unlimited investment choices, including stocks, bonds, mutual funds, ETFs, annuities, and more. They also typically have lower fees than 401(k)s, though this depends to some degree on what you invest in and which company you invest with. The downside to IRAs is that you can only contribute up to $6,000 in 2019 or $7,000 if you’re 50 or older. Most people won’t hit that ceiling, but if you do and you’re not eligible for a 401(k) through your employer, you’ll have to put the rest of your money in a taxable brokerage account instead.

Previous

Next

28. Inflation

Inflation is the rise in the cost of goods or services over time. It’s especially important in the context of retirement planning because it affects how much you need to save. While you may be able to get by on $30,000 per year today, chances are you’ll need more than that in the future, even if your spending habits don’t change because inflation will drive up living costs.

The inflation rate varies from year to year, but 3% per year is a good estimate for retirement planning. This is the average annual inflation rate based on historical data. However, if you want to be conservative, consider upping the inflation rate to 4% per year when calculating how much you need for retirement. A retirement calculator can help you with this.

Previous

Next

29. Itemized deductions

When you file taxes, you have a choice between claiming the standard deduction for your tax filing status or itemizing your deductions. This means totaling up all the individual tax deductions you qualify for. Both methods reduce your taxable income, helping you save money. Itemizing deductions makes sense if you believe the value of your itemized deductions will be greater than your standard deduction.

Common itemized deductions include home mortgage interest, charitable contributions, medical expenses that exceed 10% of your adjusted gross income (AGI), and business expenses if you’re self-employed.

Previous

Next

30. Medicaid

Medicaid, not to be confused with Medicare, is a joint federal and state program that provides healthcare coverage to low-income households. Each states have its own eligibility requirements, but generally, you qualify if you’re below 100% to 200% of the federal poverty line and are elderly, disabled, pregnant, a child, or a parent of dependent children. Income eligibility is based on your modified adjusted gross income (MAGI). This is your adjusted gross income with some tax deductions added back in.

Previous

Next

31. Medicare

Medicare is a government program that provides health insurance to adults 65 and older. It’s broken down into four parts: A, B, C, and D. Part A covers hospital stays and some home healthcare services. Part B covers doctor visits, preventative services, and outpatient care. Part C plans cover the same things as Parts A and B, but they’re offered through private health insurers rather than the federal government. Part D covers prescription drugs.

While Medicare does cover a lot, it covers little in full. You’ll still have deductibles, premiums, and coinsurance like you do with any other health insurance policy, and there are some services, like dental care, long-term care, and hearing aids, that Medicare doesn’t cover at all. Some Medicare recipients purchase supplemental health insurance policies, known as Medigap policies, to help cover those expenses that Medicare does not cover. Medigap policies are available through private health insurers and these plans charge their own premiums, deductibles, and copays.

Previous

Next

32. Modified adjusted gross income (MAGI)

The government uses your modified adjusted gross income (MAGI) to determine which tax deductions and credits you qualify for. It also determines your eligibility for government programs like Medicaid.

To calculate yours, you start with your adjusted gross income (AGI) and add certain deductions back in, like student loan interest, half of self-employment taxes, and rental property losses. Many of the tax deductions you add back in are rare and you may not have them. In most cases, your AGI and MAGI will be similar and they could even be identical. Your tax filing software should calculate all of this for you so you don’t have to.

ALSO READ: 5 Little-Known Tax Deductions and Credits You Don't Want to Miss

Previous

Next

33. Money market account

A money market account is similar to a savings account, but they typically offer higher interest rates because banks are able to invest this money in things like certificates of deposit (CDs) and government securities. Money market accounts are a better choice than CDs if you want easy access to your cash. There are limits to how many withdrawals or transfers you can make per month, but there’s no penalty for accessing your funds.

Money market accounts typically require a higher initial deposit than savings accounts, and some may ask for as much as $1,000 to open the account. The bank may also have account minimums, and if your balance falls below this, it may charge you a fee.

Previous

Next

34. Mutual fund

When you purchase a mutual fund, you’re essentially pooling your money with other investors to purchase a collection of stocks, bonds, and other investments. It enables you to instantly diversify your portfolio, which could be difficult to do if you had to buy shares of stocks and bonds individually.

Mutual funds may be active or passively managed. Actively managed funds have portfolio managers that decide when to buy or sell investments in the fund. Passively managed funds, like index funds, track a market index like the S&P 500, so there’s less work for portfolio managers.

All mutual funds charge expense ratios -- an annual fee -- to all shareholders. This is listed in your prospectus as a percentage. Actively managed mutual funds typically have higher expense ratios than passively managed funds because the portfolio managers have to do more work to run actively managed funds.

Previous

Next

35. Prime rate

The prime rate is the interest rate that banks charge customers with the best credit. Credit card issuers also use the prime rate as a basis for determining credit card interest rates. The Wall Street Journal publishes the prime rate after surveying the 30 largest banks in the U.S. to determine the consensus prime rate.

The prime rate can change over time and this will affect you if you have credit card debt or a loan with a variable interest rate. When the prime rate rises, so will your loan or credit card interest rate. And if the prime rate decreases, your variable interest rates will as well.

Previous

Next

36. Principal

When you take out a loan, the principal is the initial amount that you’re borrowing. So if you buy a home for $200,000 and you put 20% down, your principal balance would be $160,000. The amount of interest you’ll pay over the lifetime of the loan depends on your interest rate and the principal balance. If you have a larger loan, it will take longer to pay off and you’ll pay more in interest over the lifetime of the loan.

Principal can also refer to the money you contribute to a savings account or other interest-earning account. You subtract the principal from the total value of the account to determine how much you’ve earned in interest.

ALSO READ: High Debt Is Ruining Retirements Everywhere. 4 Ways to Fix It

Previous

Next

37. Prospectus

A prospectus is a document that gives details about a particular investment product, like a stock, bond, mutual fund, or exchange-traded fund (ETF). The Securities and Exchange Commission (SEC) requires all of these investment products to have a prospectus that’s available to potential investors so they can make an informed decision.

You’ll find information about the investment’s fees, background on the company, recent performance, dividend policies, and more. It’s a good idea to read through the prospectus for any investments you’re considering so you can decide whether it’s the right fit for your portfolio.

Previous

Next

38. Rate of return

A rate of return is the net gain or loss on an investment over a specified period of time. You calculate it by subtracting the initial cost from the final cost and then dividing by the initial cost and multiplying by 100 to get a percentage. So if you purchased a stock for $100 and a year later it’s worth $110, your rate of return for that year would be 10%.

Rate of return is a useful measure for assessing whether an investment is performing as expected, and it plays a factor when planning for your retirement. Most retirement calculators will ask you to estimate a rate of return on your investments to determine how much your current savings will grow between now and your retirement age. You can never know for sure how your investments will perform, but you can use 7% to 8% as a baseline, or 5% to 6% if you want to be more conservative.

Previous

Next

39. Required minimum distributions (RMDs)

When you reach 70 ½, the government requires you to begin taking required minimum distributions (RMDs) from all of your retirement accounts except Roth IRAs. It’s the government’s way of ensuring it gets its tax cut of your savings.

You can calculate your RMDs using this table. Divide the total balance of each of your retirement accounts by the distribution period next to your age to determine the minimum amount you must withdraw this year. If you fail to take out at least this much, you’ll pay a 50% penalty on the amount you should have withdrawn.

Previous

Next

40. Roth retirement accounts

Unlike tax-deferred retirement accounts, contributions to Roth retirement accounts don’t reduce your taxable income for the current year. But because you pay taxes in the year that you earned the money, it’s allowed to grow tax-free afterward and you won’t pay any taxes on these distributions in retirement as long as you’re over 59 ½ and the money has been in your account for at least five years.

Roth retirement accounts are a smart choice for young workers just starting out in their career and anyone who believes they’re in a lower income tax bracket today than they will be in retirement. By paying taxes on the money today, these individuals will lose a smaller percentage of their earnings than they would if they waited to pay taxes in retirement.

Previous

Next

41. Rule of 72

The Rule of 72 is a method for estimating how long it will take for an investment to double in value based on its interest rate. You divide 72 by the interest rate to come up with the number of years it will take for your money to double. So if the interest rate is 8%, you’d divide 72 by eight and you’d get nine years. This is a rough estimate, and in reality, you may get only slightly useful results, but it’s a nice shortcut to give you an idea of how your money could grow if you invest it.

Previous

Next

42. Simple interest

Simple interest is calculated as a percentage of the principal balance. You multiply the principal by the interest rate by the length of the loan to determine how much you’ll pay in interest. So if you borrowed $5,000 with a 6% interest rate for five years, you’d pay $1,500 in interest. Some loans, like car loans, use simple interest, but compound interest is more common in the finance world.

Previous

Next

43. Social Security

Social Security is a government program designed to provide a continuous source of income to adults 62 and older and the disabled. Your retirement benefit is calculated based on your average monthly income during your 35 highest-earning years. If you didn’t work for at least 35 years, your calculation will be weighed down by several zeros. And if you worked for less than 10 years, you won’t qualify for Social Security retirement benefits.

The age you start Social Security will also affect the size of your monthly checks. The Social Security Administration considers full retirement age to be 66 or 67, depending on the year you were born. You can start taking benefits before this, but then you’ll get less per check to make up for the extra months you’re receiving benefits. If you start at 62, you’ll only receive 70% or 75% of your scheduled benefit per check, depending on your full retirement age. You can also delay Social Security and your checks will increase until you get the maximum benefit at 70, which is 124% or 132% of your scheduled benefit per check.

Previous

Next

44. Standard deduction

Each tax filing status has a standard deduction. If you claim the standard deduction instead of itemizing your deductions, your taxable income is automatically reduced by this amount. The standard deduction in 2019 is $12,200 for single adults and married couples filing separately, $24,400 for married couples filing jointly and qualifying widow(er)s, and $18,350 for heads of households. Unmarried adults can add an additional $1,600 if they’re over 65 or blind, or $3,200 if they’ re over 65 and blind. Married couples can claim an additional $1,300 per spouse who is over 65 or blind, or $2,600 if both blind and over 65.

The standard deduction offers the better deal for most people, but if you believe the tax deductions you qualify for are worth more than the standard deduction for your filing status, you may be better off itemizing your tax deductions instead.

ALSO READ: Should I Itemize My Tax Deductions or Take the Standard Deduction?

Previous

Next

45. Stock

A stock represents part ownership in a company. How much of the company you own depends on how many shares you own and how many shares there are in total. They’re the most popular class of investments because they tend to offer large returns, though they can be volatile in the short term. If a company is performing poorly, its stock value could plummet, but when the company does well, stock values will rise.

There are two main types of stock: common and preferred. Preferred stocks typically give a fixed dividend that is larger than the dividend given to common stockholders, and preferred stockholders are repaid before common stockholders if the company goes under. However, preferred stockholders cannot vote on company matters like common stockholders.

Previous

Next

46. Tax credit

A tax credit reduces your tax liability dollar for dollar. So if you owe $3,000 in taxes and you qualify for a $1,000 tax credit, your tax bill will be $2,000. There are two types of tax credits: refundable and nonrefundable. Nonrefundable tax credits can reduce your tax bill to zero, but no further. Refundable tax credits can reduce your tax bill below zero. If this happens, the government will give you the excess as part of your tax refund.

There are a number of tax credits aimed at low-income families, parents, and individuals paying for higher education. Each has its own requirements that you must meet in order to claim the credit, and the value and eligibility requirements for this credit may change from year to year, so it’s important to stay up to date on them if you intend to claim them.

Previous

Next

47. Tax deduction

A tax deduction also helps reduce your tax bill, but in a different way. Instead of directly reducing your tax bill, it reduces your taxable income. If you made $50,000 this year and you qualified for $15,000 in tax deductions, you would only owe taxes on the remaining $35,000. It’s possible that you could end up in a lower tax bracket if you qualify for enough deductions, and this can reduce the percentage of your income that you lose to the government.

Common tax deductions include medical expenses that exceed 10% of your adjusted gross income (AGI), half of self-employment taxes, business expenses if you’re self-employed, charitable contributions, and mortgage interest.

Previous

Next

48. Tax withholding

If you work for an employer, you should have filled out a Form W-4 when you took the job indicating how much money you wanted withheld from your paychecks for taxes. You determine this by choosing your number of allowances. If you’re a single adult, you’re probably only claiming one or two allowances, but as your family grows and more people are dependent on your income, you can claim more allowances for them. This means the government will take less money from each paycheck, but your tax refund may be smaller because the amount you paid in throughout the year was closer to your actual tax liability.

If you’re not sure how many allowances you’re claiming now, ask your employer, and if you’re not sure how many you should be claiming, use the IRS’s tax withholding calculator. If you want to change your tax withholding, you must fill out a new Form W-4 and submit it to your employer.

Previous

Next

49. Tax-deferred retirement account

Contributions to tax-deferred retirement accounts reduce your taxable income in the year you make the contribution, but then you must pay taxes on your distributions in retirement. Tax-deferred retirement accounts are the way to go if you believe you’re in a higher income tax bracket now than you will be in retirement. By waiting to pay taxes, you’ll lose a smaller percentage of your income to the government.

Previous

Next

50. Taxable income

Your taxable income is the amount of your income that is subject to tax, which is not the same as how much you made this year. You can reduce your taxable income by taking advantage of tax credits and deductions. What’s left over after these are applied is your taxable income. This will determine which income tax bracket you fall into, and your tax bracket determines what percentage of your income goes to the government. You could pay anywhere from 10% to 37% in taxes, depending on where your taxable income falls.

Previous

Next

How many did you know?

This is not a comprehensive list of every personal finance term you should know, but it should help you understand the basics of banking, investing, and taxes. Use this information to guide your financial decision-making, and keep educating yourself. There’s always more to learn, and the more you know, the better you can manage your money.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.