Examples of common adjustments

There are several adjustments to income that can reduce your AGI in a given tax year:

- Contributions to a qualified tax-deferred retirement plan, such as a traditional IRA.

- Contributions to a health savings account, or HSA.

- Educator expenses, up to the annual maximum.

- Student loan interest, up to the maximum allowed.

- Half of the self-employment tax you paid.

- Self-employed health insurance premiums.

- Alimony payments.

- Moving expenses for members of the U.S. military.

- Employee business expenses, but only for select groups such as armed force reservists.

There are a few others, but these are the most common adjustments to income.

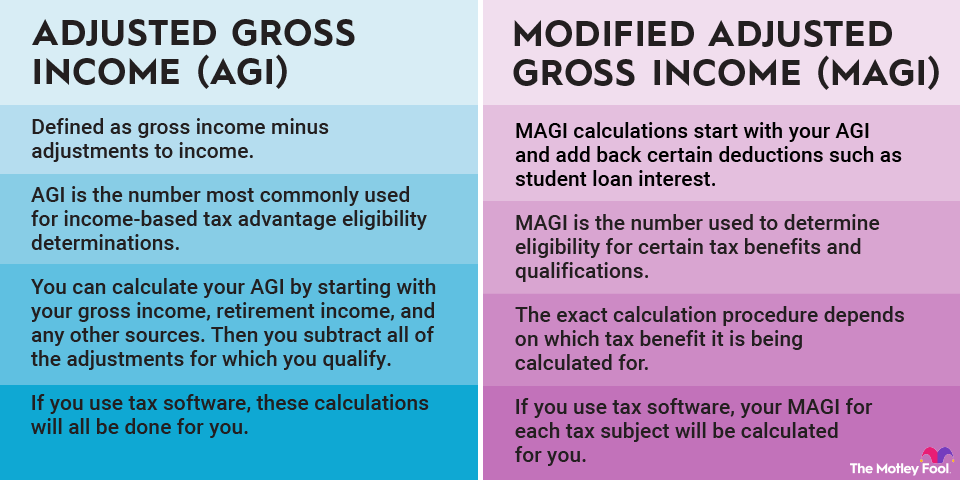

How to calculate adjusted gross income (AGI)

The short answer is that you can calculate your adjusted gross income by starting with your gross income, including income from a job, self-employment or freelance income, retirement income such as Social Security payments and 401(k) withdrawals, unemployment compensation, investment income (such as from stock sales or dividends) and any other sources. Then you subtract all of the adjustments for which you qualify.

As an example, let's say that your gross income is $100,000. You have the following adjustments:

- $5,000 in qualified retirement plan contributions

- $1,000 in student loan interest

- $2,000 in contributions to an HSA

By taking your $100,000 gross income and subtracting the $8,000 in adjustments you qualify for, you have an AGI of $92,000.

Note that this is different from taxable income. Before the tax brackets are applied to your income, you'll subtract your other deductions, such as the standard deduction.

Finally, it's also worth mentioning that if you use tax software, such as TurboTax or TaxAct, these calculations will all be done for you. But it's still important to understand which deductions can reduce your AGI each year since these can be extremely valuable when qualifying you for other tax advantages.

Adjusted gross income vs. modified adjusted gross income

There's a slightly different version of adjusted gross income known as modified adjusted gross income, or MAGI, which is technically the income number used for certain tax benefits. In a nutshell, MAGI calculations start with your AGI and add back certain deductions, such as student loan interest.