What do you call an economy that has emerged from a downturn and is showing signs of strength but is still not making a lot of people happy? The new word for it, credited to a podcaster in mid-2022, is "vibecession," a combination of "vibe" and "recession." Read on to find out more about vibecessions, their causes, their characteristics, and how to profit from them.

What Is a vibecession?

The U.S. economy was steadily improving in 2022. Much of the fear about the COVID-19 pandemic had been eased by the introduction of new vaccines. Although inflation had hit levels not seen in more than a generation, it was easing, and real wages for most employees were rising for the first time in years, if not decades. Unemployment was extremely low, and other economic indicators were strong.

And yet.

Consumer sentiment had plunged below levels seen during the pandemic when unemployment briefly reached record levels and huge numbers of the nation's businesses were pushed into lockdown. The University of Michigan's Consumer Sentiment Index, which was at 101 in February 2020 -- one month before the pandemic's effects began to be felt -- fell to 50 by June 2022.

Enter the "vibecession," coined by economics educator Kyla Scanlon. A vibecession, Scanlon said, is caused when economic indicators appear to show a strong economy, but the prosperity isn't shared by most people. The economy isn't in a recession, but people feel like they're living in the middle of an economic downturn.

What causes a vibecession?

Recent high energy prices, shrinkflation at the grocery store, and astronomical housing prices have affected almost every American in one way or another. So while gross domestic product (GDP), wages, and other economic indicators may be showing signs of improvement, a large number of people have felt left out of an apparent economic recovery -- bad vibes, in other words.

Clearly, though, more than bad vibes can affect people's views of the economy. Inflation, for example, has been a persistent issue for most Americans. And even the statistics that give us a rough idea of how the economy is performing can be extremely misleading.

Take, for example, the GDP, which is the sum of all final goods and services produced in the United States. Using GDP, the country would be most productive if we had more terminal cancer patients in the middle of expensive divorces.

Likewise, unemployment figures can provide only partial views of the economy. During the Great Recession, the government reported that as much as 10.2% of the labor force was unemployed in October 2009. When discouraged workers and people who were limited to working part-time jobs were considered, however, the unemployment rate rose to 17.1% of the labor force.

Finally, politics have always played a role in the economy. Herbert Hoover, Jimmy Carter, and George H.W. Bush lost reelection bids to challengers who were able to exploit economic downturns to their advantage. In an era of extreme political polarization, it's likely that politicians will attempt to sway voters based on a vibecession caused by a real or imaginary downturn.

Related investing topics

Leaning into vibecessions

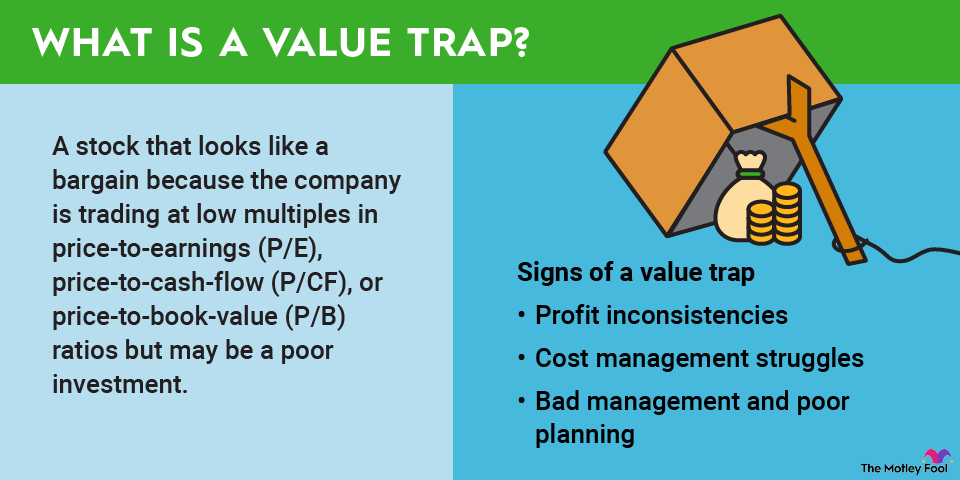

Famed investor Warren Buffett argued that fear is one of an investor's best friends because it offers the opportunity for bargains. Although Buffett's value investment approach is hardly contrarian, his basic thesis is to look at individual investments rather than the economic climate.

For example, financial services giant Visa (V +0.93%) launched its initial public offering (IPO) in March 2008, only two days after the investment bank Bear Stearns was sold for $2 per share -- the first domino to fall in the worst economic downturn since the Great Depression. While many investors fretted over the possibility of a financial meltdown and stayed on the sidelines, Visa stock was offered at $44; a little more than 15 years later, it's worth almost $260 per share.

Living in the middle of a vibecession may not be the best feeling in the world, but smart and patient investors will use the glum environment to search the horizon for potential bargains that pay off over the long term.