VeChain (VET +5.44%) is a smart contract blockchain offering software solutions for businesses. It is best known for its enterprise supply chain product that traces shipped goods. This gives VeChain real-world uses across a variety of industries, including the food and beverage, fashion, and automotive sectors. It quickly established partnerships with several major businesses, and its native crypto token, VET, is among the 40 largest by market cap. In this VeChain guide, we'll go over how this blockchain works.

What makes VeChain unique?

While many blockchains are all-purpose platforms that do just about anything you can program into them, VeChain is much more specialized. The basic idea is that it provides both a unique ID and a sensor to track a physical product. It then records information as the product passes through the supply chain.

Here's a few examples of how this technology can be used by businesses:

- A luxury fashion designer can install VeChain chips in its handbags so that buyers can verify if bags are real or fake.

- A grocery store can track food products with VeChain. If there's a disease outbreak related to a specific product, the store can use tracking data to determine which products it needs to recall.

- Auto manufacturers can store data related to specific cars on VeChain. Future buyers will then be able to look up information related to the car and confirm that nothing has been tampered with such as the mileage.

- In addition to supply chain solutions, VeChain has continued to diversify and modernize its ecosystem capabilities, including adding support in 2022 for a fiat-backed stablecoin (VeUSD) to support DeFi and Web3 projects.

VeChain is also unique in that it has two native tokens. Most blockchains have one -- for example, Ethereum (ETH +6.81%) uses ETH tokens as its native cryptocurrency, and Cardano (ADA +4.32%) uses ADA tokens.

The primary token on VeChain is VET, which is used for storing and transferring value. It also has VeThor Token (VTHO +2.18%), which is used for transaction fees. VeChain separated the two so that the token used for transaction fees would have a stable price.

Where VeChain came from

Sunny Lu, the former CIO at Louis Vuitton China, founded VeChain in 2015. He is also the CEO of the VeChain Foundation, which launched in 2017.

VeChain started out as a crypto token built on the Ethereum blockchain. VeChain raised funds in an initial coin offering (ICO) in 2017. In February 2018, VeChain rebranded as VeChainThor (VET), its own blockchain. In June 2018, Ethereum VEN tokens were exchanged 1:100 for VET tokens, and the VeChainThor blockchain network officially began operation.

How VeChain works

The VeChain ToolChain product tracks goods using a combination of its blockchain and smart tags, which can use near-field communication (NFC), radio frequency identification (RFID), or QR codes. The sensors send information to the blockchain network during a product's entire lifecycle.

Since this information is saved to the blockchain, it can't be deleted or changed. The business and the consumer can review the product's information on VeChain.

Both VeChain's crypto tokens play an important role in how it works. The function of VET is to serve as a value-transfer medium, or, in other words, smart money that enables rapid value circulation within the ecosystem. VTHO, meanwhile, represents the underlying cost of using the VeChainThor blockchain.

To validate transactions, VeChain uses a different consensus algorithm than most cryptocurrencies. The most popular consensus algorithms are proof of work, first used by Bitcoin (BTC +5.23%), and proof of stake, which is more efficient.

VeChain uses proof of authority. A fixed number of known validators, called Authority Masternodes, are responsible for confirming transactions. Any party who wants to be an Authority Masternode must disclose their identity, go through a know-your-customer (KYC) procedure, and complete any other minimum requirements set by the VeChain Foundation.

Partnerships

Even before its mainnet launch, VeChain had already established partnerships with several well-known businesses, and it has continued to build relationships. Here are some of the bigger names that are working with VeChain:

- Accounting giant PricewaterhouseCoopers has partnered with VeChain to offer blockchain solutions to clients.

- Walmart (NYSE:WMT) China started working with VeChain in 2019 to track its packaged meat, vegetables, and seafood.

- Multiple brands under LVMH Moet Hennessy Louis Vuitton (LVMHF -1.56%) are working with VeChain to use blockchain technology as an anti-counterfeiting measure.

- BMW (BAMXF +2.59%) began a partnership with VeChain through the BMW Startup Garage Program to store vehicle data on the blockchain.

- French automaker Groupe Renault (RNSDF -9.98%) has partnered with VeChain to create a digital car maintenance book.

Can I make passive income with VeChain?

You can make passive income with VeChain through crypto staking, although rewards rates are on the low side compared to other cryptocurrencies.

The traditional way to stake VeChain is through one of the blockchain wallets it offers: Sync for desktop advanced users and VeChainThor mobile wallet for all users. All you need to do is transfer your VET tokens to either wallet. Once you do, you'll start earning VTHO automatically.

Although reward rates are low for the casual investor, VeChain offers several tiers of rewards. If you have enough VET tokens to identify your VeChain wallet as an economic node, you can earn additional rewards.

Another option is to stake VeChain through a crypto exchange. Crypto.com and Binance.US both support VeChain staking. Unlike when you stake through a wallet, these exchanges pay you in VET tokens, not VTHO.

Related investing topics

Unique risks

Cryptocurrency projects typically aim for decentralization, but that's not the case with VeChain. It's built more like a large corporation with a centralized design, and it has a relatively small group of transaction validators due to its proof-of-authority system.

This isn't necessarily a bad thing. It just means that the VeChain Foundation is in full control of the project, and, if you're going to invest in VeChain, you'll need to trust in the foundation behind it.

As previously mentioned, VeChain is aimed at businesses, which has its benefits and drawbacks. The downside is that there's less incentive for individuals to hold VET tokens. They don't need it since they aren't the target market for its services, and the staking rewards are lackluster.

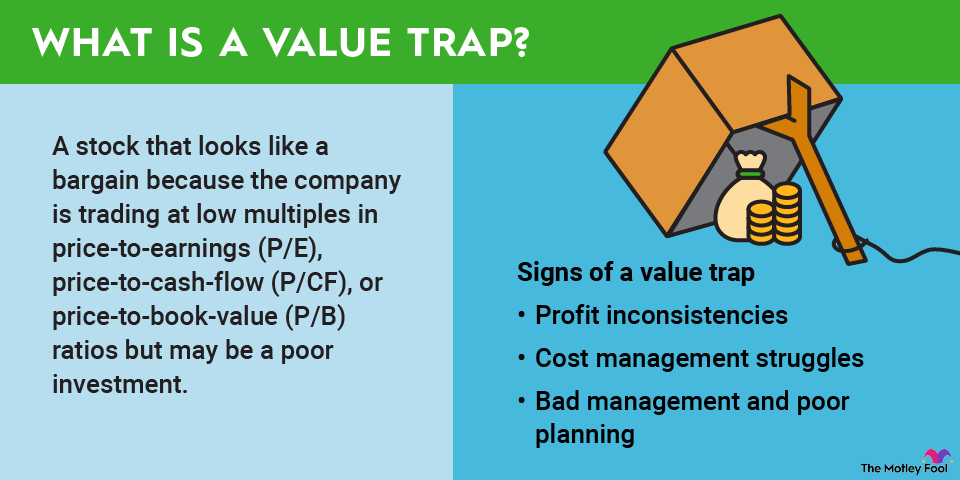

Is VeChain a good investment?

VeChain has some key things going for it as an investment. It has real-world utility and it's currently in use through partnerships with dozens of companies. That's a welcome departure from blockchain projects with poorly defined objectives and only theoretical utility.

There's a strong group behind VeChain that has done an excellent job of pushing it forward. Equally important, VeChain and its team haven't gone through any scandals or been involved in shady business.

On the other hand, VeChain is lacking in terms of brand awareness. While some of the biggest cryptocurrencies have become household names, VeChain isn't as well-known or widely talked about.

It's easy to see the potential of VeChain, and it's one of the better cryptocurrency investments. Keep in mind that, just like other cryptocurrencies, the value of VeChain is highly volatile, so be prepared for the ups and downs if you decide to invest.

How to buy VeChain

To buy VeChain, register for an account with a crypto exchange that offers it. Availability can be hit or miss, but here are a few popular crypto exchanges that support VeChain trading:

- Crypto.com

- Binance.US

- Binance (not available for U.S. residents)

VeChain doesn't get as much attention as the most popular cryptocurrencies, and it's somewhat undervalued when you consider its real-world applications. Those looking for an alternative to the usual crypto investments should consider VeChain.