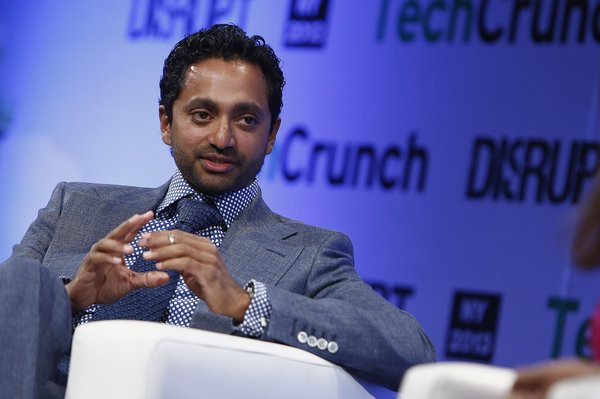

David Tepper is a billionaire hedge fund manager and owner of two professional sports teams. He's one of the richest people in the world. In mid-2023, Forbes estimated his net worth at $18.5 billion, ranking him the 89th-richest person in the world.

Tepper has been one of the most successful investors of his generation. His hedge fund, Appaloosa Management, has made billions of dollars over the years, earning returns of more than 25% annually. A big driver of his outsized returns is his expertise in distressed debt investing. Although it's not an easy strategy to master and can yield very volatile returns, it can be extraordinarily profitable.

Here's a look at David Tepper, his investment strategy, and some of the top stocks he currently owns.

Who is David Tepper?

Who is David Tepper?

David Tepper is living proof that anyone can get rich by investing. Born the middle child of middle-class parents (his father was an accountant, and his mother was an elementary school teacher) in Pittsburgh, Tepper worked to pay for his own education, first earning a bachelor's degree at the University of Pittsburgh and then earning the equivalent of an MBA at Carnegie Mellon University. Although his father did give him his first two investments, both companies went bankrupt.

Accountant

Tepper's first job out of graduate school was working for a steel company that eventually had to merge to avoid bankruptcy. He learned a lot about financing during that time; his employer, Republic Steel, did more finance deals in his two years at the company than it had over its 100-year history.

The experience led Tepper to take a job at a mutual fund focused on distressed companies. From there, he joined Goldman Sachs (GS 1.79%), first as a credit analyst and later as a junk bond trader. After twice getting passed over for a promotion to partner, Tepper quit and eventually started Appaloosa Management.

Tepper's Appaloosa has made billions of dollars over the years, driven mainly by bold bets on distressed situations. For example, his fund generated a 61% return in 2001 by investing in distressed bonds after the dot-com crash of the early 2000s. Meanwhile, Tepper's fund made an astounding $7 billion during the Great Recession by opportunistically buying distressed financial stocks and bonds.

David Tepper's personal stats

David Tepper's personal stats

- Age: 65 years.

- Source of wealth: Hedge fund management.

- Marital status: Married.

- Residence: Palm Beach, Florida.

- Children: Three.

- Education: University of Pittsburgh (BA); Carnegie Mellon University (MSIA).

David Tepper's investment approach

David Tepper's investment approach

Tepper focuses on distressed situations and deep-value stocks. Appaloosa Management typically targets the debt of companies in financial distress. Appaloosa has made successful bets on the bonds of financially troubled companies like Enron, WorldCom, Marconi, and Williams (WMB -0.48%).

Enron

His aggressive style leads his firm to make outsized wagers that can yield massive paydays. For example, during the 2007-09 financial crisis, he bet big on bank stocks and commercial mortgage-backed securities. His fund made more than $7 billion on these investments, including $4 billion for Tepper. Observers have called Tepper's trades during the financial crisis some of the best ever made.

While Tepper specializes in distressed debt situations, they don't come along all the time. His overall investment strategy is to be opportunistic, often taking a contrarian view.

David Tepper's investments

David Tepper's investments

We can see Tepper's contrarian approach in Appaloosa's current equity portfolio. The fund's top holding included several technology stocks, a sector that took a beating during the bear market of 2022.

As of mid-2023, Appaloosa's top five equity holdings were:

| Company | Market Cap | Description |

|---|---|---|

| Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) | $1.6 trillion | A technology holding company that includes Google, YouTube, and other companies. |

| Amazon (NASDAQ:AMZN) | $1.3 trillion | A leading e-commerce company. |

| Uber Technologies (NYSE:UBER) | $84 billion | A leading ride-hailing and food and package delivery company. |

| Constellation Energy (NYSE:CEG) | $30 billion | A leading producer of carbon-free energy, including hydro, wind, solar, and nuclear energy. |

| Meta Platforms (NASDAQ:META) | $695 billion | A technology holding company that includes Facebook, Instagram, and WhatsApp. |

In addition to investing in stocks, Tepper also invests in debt. His opportunistic and contrarian approach to distressed situations was on full display in 2023. Tepper's fund reportedly bought bonds and preferred stock in the bankrupt parent of Silicon Valley Bank after its collapse in early 2023.

More from David Tepper

More from David Tepper

Tepper is in the process of converting his hedge fund into a family office by returning capital to outside investors. Appaloosa's assets under management were about $13 billion in mid-2023, down from $20 billion at the peak. Most of the fund's remaining money belongs to Tepper and his family. He's not as publicly active as he was when managing one of the world's top-performing hedge funds. However, he still occasionally appears on CNBC and recently made headlines in the Financial Times for his bet on the distressed debt of the failed Silicon Valley Bank.

Assets Under Management (AUM)

Tepper is also occasionally in the headlines as the owner of two major professional sports franchises. He owns the NFL's Carolina Panthers and Charlotte FC in Major League Soccer. He's also a well-known philanthropist who has given away millions of dollars over the years. He made the largest-ever gift to alma mater Carnegie Mellon, which named its business school after him.

The return of capital to clients and giving back to others is part of Tepper's personal philosophy: "Learn it, earn it, return it." His approach of taking the time to learn lessons, turning those learnings into earnings, and then returning some of those rewards to others has enriched him and others over the years.

David Tepper shows anyone can make it big

David Tepper shows anyone can make it big

David Tepper is a billionaire hedge fund manager. He's a contrarian investor who makes bold bets on distressed financial situations that have paid off spectacularly for him and the investors in his fund. Tepper's early experience working for a distressed company enabled him to spot similar opportunities in the market. His temperament gave him the confidence to pounce when those opportunities arose. Although his investment style isn't for everyone, his life story shows that anyone can make a lot of money in the market if they can recognize opportunities for outsize gains and take the bold step of putting capital behind a contrarian idea. Meanwhile, his "learn it, earn it, return it" philosophy is one that many investors could find rewarding.

David Tepper FAQs

What is David Tepper's net worth?

In mid-2023, Forbes estimated that David Tepper's net worth was about $18.5 billion, making him the 89th-richest person in the world. He owns hedge fund firm Appaloosa Management, the Carolina Panthers football team, and the soccer club Charlotte FC.

How did David Tepper get so rich?

David Tepper is a self-made billionaire. He made most of his money by founding and managing Appaloosa Management, a global hedge fund. He got rich by investing in distressed situations. His fund made an estimated $7 billion during the 2007-09 financial crisis, including $4 billion for himself, betting on financial stocks and other financial instruments.

What stocks does David Tepper own?

Although David Tepper is primarily a distressed debt investor, he holds several stocks. His top five holdings as of mid-2023 are Alphabet, Amazon, Uber Technologies, Constellation Energy, and Meta Platforms.